VBI Vaccines: Hidden Vaccine Gem

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

One of the more interesting and under followed biotechs in the market just announced the official plans to start a major Phase III clinical trial for a drug that has an increasingly unmet need. The best part about VBI Vaccines (VBIV) is that the company already has the vaccine approved in multiple markets and has several other drug candidates in the pipeline.

Despite the generally positive prospects for vaccine approval, the stock traded near the lows until the start of 2017. The recent pullback to $4.74 leaves investors with an opportunity to buy the stock with a market cap of only $200 million and some compelling catalysts for a higher stock price.

Phase III Catalyst

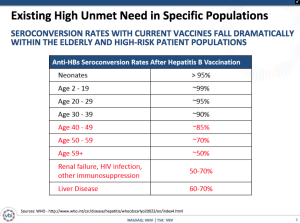

On July 11, VBI Vaccines announced the intent to run two concurrent Phase III trials in the U.S., Canada, and Europe to show that Sci-B-Vac is a third-generation hepatitis B vaccine that can safely meet the needs of patients that aren't met by the current Hepatitis B vaccines. Hepatitis B is currently seen as a managed disease by existing approved vaccines, but those vaccines are increasingly failing to meet the needs of high-risk people such as elderly and diabetics.

The reality is that not only are large populations not vaccinated, but also an increasingly significant population is encountering seroconversion rates that fall dramatically. People over 59 and ones with liver disease or renal failure are seeing rates down at only 50%.

The company is proposing two concurrent Phase III studies for approximately 4,800 adults over an expected duration of 15 months. The trials include PROTECT to prove the safety and immunogenicity of Sci-B-Vac with an ultimate objective of demonstrating superiority of the seroprotection rates and CONSTANT for a lot-to-lot consistency study with a secondary objective of evaluating the speed to seroprotection. The clinical trials will have the following details:

- PROTECT - double-blind, two-arm, randomized, controlled study on 1,600 adults. Patients will get either a three-dose course of Sci-B-Vac or a three-dose course of the control vaccine, Engerix-B.

- CONSTANT - double-blind, four-arm, randomized, controlled study of 3,200 adults age 18-45. Patients will be randomized in a 1:1:1:1 ratio of four three-dose courses: Lot A, B, and C will have Sci-B-Vac and the remaining lot will contain the control vaccine, Engerix-B.

The studies will take place at 40 sites throughout the U.S., Canada, and Europe. The size and scope of the Phase III trials are benefiting from previous study results along with over 300,000 patients already vaccinated in 15 countries where VBI Vaccines already has approval.

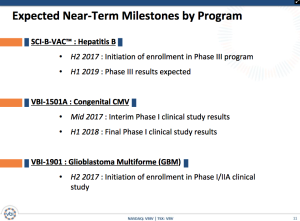

The company plans to start the Phase III trials in the 2H of the year allowing for completion of the studies around the end of 2018 with results by early 2019. Considering the company has already completed multiple trials in order to obtain approvals in other smaller countries, the risks here aren't as standard with most vaccines that are unproven.

Solid Pipeline

Besides having an approved vaccine with a predictable path to Phase III trials, VBI Vaccines offers a solid pipeline. The small biotech has two drugs in the process of starting Phase I trials.

These studies are in the beginning stages with initial positive indications. By the time the Sci-B-Vac results are finalized, the CMV and GBM drug candidates will have progressed through Phase I trials and potentially taken the step towards Phase II clinical trials providing the stock with some risk protection.

Ultimately though, the investment thesis over the next year is solely based on getting approval for the Sci-B-Vac Hepatitis B vaccine in both the U.S. and Europe. Canada is part of the study and the company points out as a cheaper alternative to the U.S., but the country won't matter to the stock price.

Typical Financial Position

The part that makes VBI Vaccines an appealing investment is the market cap at only $200 million while the company and other sources like Benzinga have listed the market opportunity at above $500 million. Other vaccine stocks like Dynavax Tech (DVAX) trade for a valuation of $450 million despite failing to get its Hepatitis-B vaccine Heplisav-B approved.

One reason for the higher valuation is the larger following for Dynavax. A popular investment site like StockTwits shows over 6,000 followers for Dynavax while VBI Vaccines only has close to 700. The vast difference in followers highlights the lack of visibility for VBI.

As with a small biotech, finances play a big role in the risk equation. VBI Vaccines ended Q1 with a cash balance of about $23.5 million. Based on the cash burn rate, the company probably ended Q2 with roughly $15 million.

Per the conference call to discuss the Phase III trials, the projection is that the 4,800 patients will cost around $8,000 to $10,000 per person. At the upper end, the budget is roughly $48 million for the 15 months of clinical trials and doesn't include other costs for the company.

VBI has already clearly stated the need to raise more funds after the December equity raise. The current stock price approaching $5 is definitely more preferable than raising funds back in the $3 range.

The risks remain standard for a small biotech. The company needs to raise additional funds and despite previous trial results on Sci-B-Vac, an approval by the U.S. Food and Drug Administration or the European Medicines Agency isn't guaranteed even with positive results.

A prime example of the risk is Dynavax that plunged from a high of $17.50 last year to a low of $3.20 this year on the negative outcome with the FDA. The stock has rebounded recently due to positive outcomes from another drug candidate showing the prime reason that VBI Vaccines is similarly attractive with the additional pipeline drugs.

Takeaway

The key investor takeaway is that VBI Vaccines has a major catalyst with the startup of Phase III trials for Sci-B-Vac. The recent inclusion in the Russell 2000 should garner the stock more attention after previously flying below the radar. The path to the Phase III trials provides the alert investor an opportunity to invest in a stock that didn't have the typical run-up following the normal process of releasing positive Phase II results.

As with any small biotech, an investment is only recommended for a small portion of a diversified portfolio.

Disclosure: No position.

Additional disclosure: Please consult your financial advisor before making any investment decisions.

I have been an investing veteran of #pharma companies for years. For the first time, I am truely amazed by the scale of the trials #VBI has been conducting. $VBIV

@[Grayson Brown](user:49500) and @[Samuel Kaufman](user:49499), you left very similar comments at the same time. Same person perhaps trying to pump up this stock? $VBIV

Cool. This is a very informative article which deserves a better publicity. I would like to see how their Phase III trials go. Probably a good time to buy and hold. Maybe? $VBIV