Varonis: A Cybersecurity Stock Set To Rally

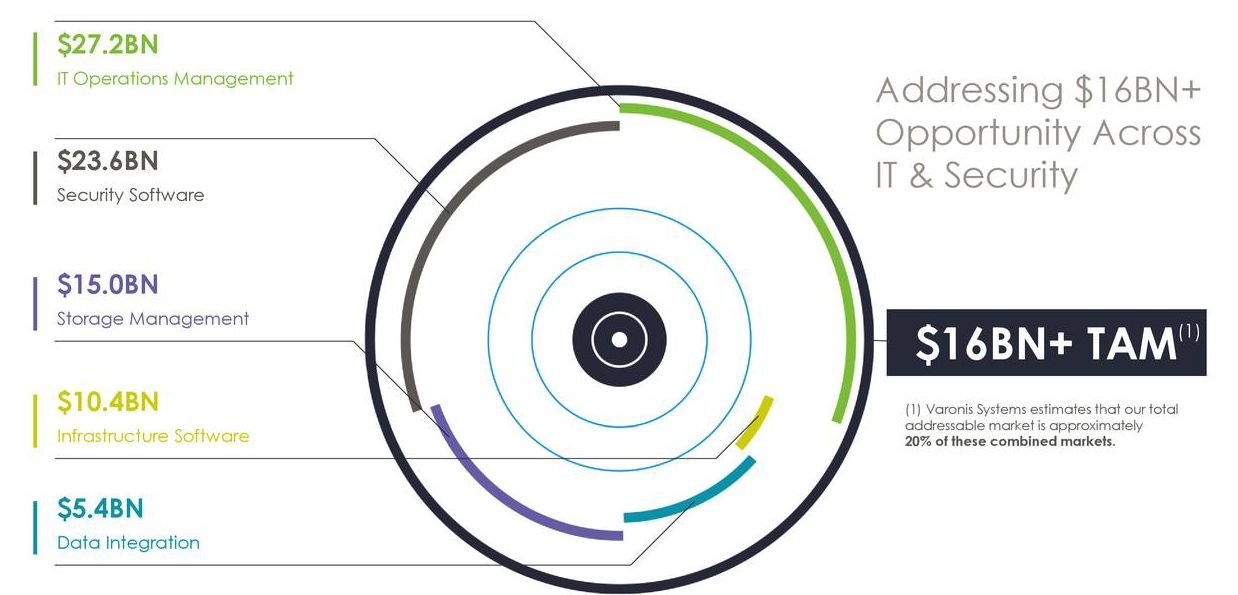

Varonis Systems (VRNS) is an interesting name in data security and analytics. The company offers an interesting business model, with durable products that anyone can use. From a broader standpoint, the company's products are in a high demand niche. There is an increased demand for data protection & analytics solutions. In fact, the market is estimated to be $14-$20 billion.

We watched the name fall after reporting an earnings beat on the top and bottom lines, but offering somewhat murky guidance on a strategic shift toward a subscription model. Shares were under $53 at the time we pegged this trade, down 18%.

We looked to play this for a rebound, with $50 support.

Our first play

Target entry: $49-$52

Target exit: $59-$66

Stop loss: $45.50

Time frame: ~4-8 weeks

Options play: Sell either $50 or $45 puts to acquire shares at defined price or to collect premium

Remaining upside?

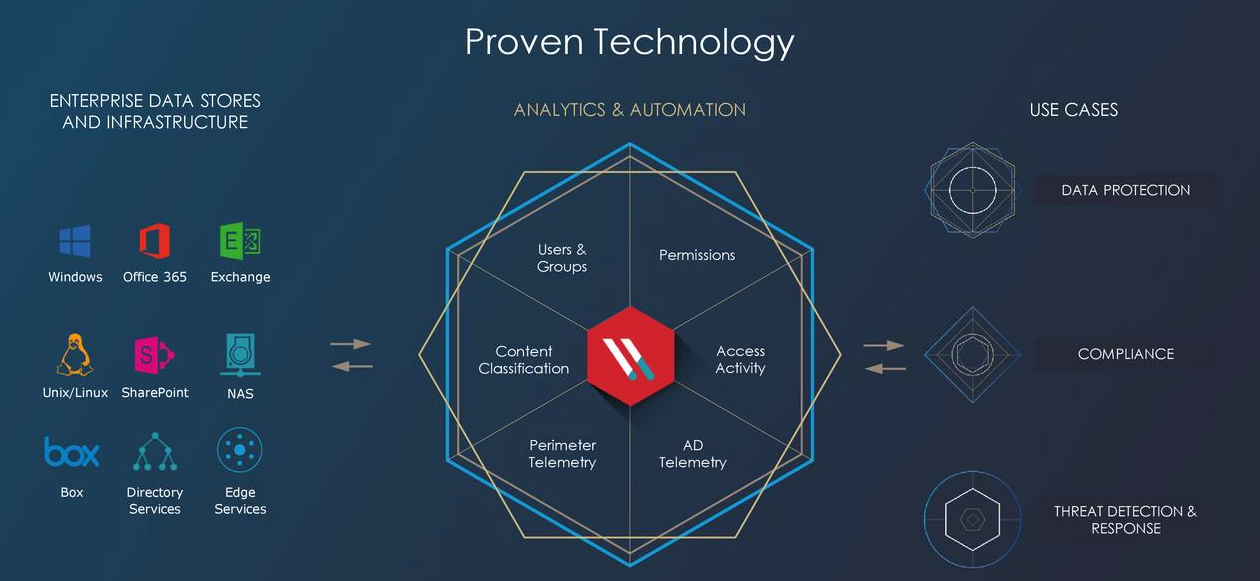

While the initial bounce has come, we see remaining upside to the top end of our target range, implying a remaining 13-15% upside in shares. This valuation target is conservative in our opinion given the breadth of the addressable market as well as performance of the name. The company is a sole leader in the industry and it has achieved consistent business growth in line with management expectations. It is constantly innovating and making smart investments in cloud expansion by offering clients products integration with office 365 and Azure, what makes a strong value proposition. Once the company scales its business with landing larger customers together with gradual margin improvement, it has a realistic chance to achieve the strategic goal of $1 billion in revenues, as well as solid cash generation.

If you look specifically at what the company offers, it has a single integrated solution, therefore it faces no direct competition as other companies don’t offer the same breadth of functionalities.

Source: Investor Relations

The closest competitors are private companies Veritas Technologies and Quest Software that offer similar standalone solutions. As the company expands its penetration into the cloud, it may face increased competition from larger cloud-focused companies. The addressable market is estimated at $16 billion, with our reasonable range of $13-$20 billion.

Source: November Investor Presentation

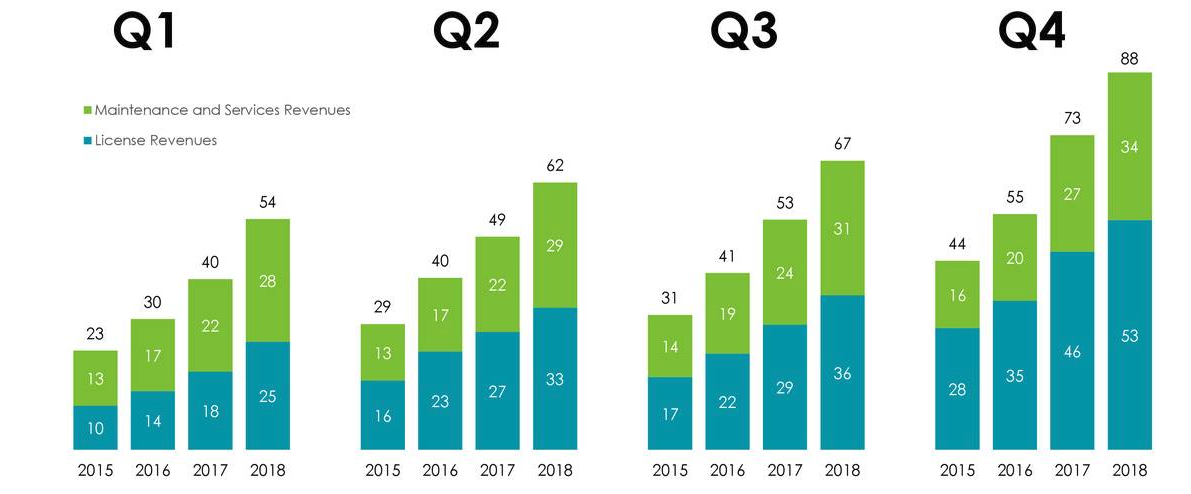

Recent performance was solid.

Here are the highlights for Q4 2018:

Revenues:

- Total revenues were $87.5 million, up 20% compared with the fourth quarter of 2017.

- License revenues were $53.3 million, up 16% compared with the fourth quarter of 2017.

- Subscription revenues as a percentage of license revenues was approximately 6%, compared with less than 2% in the fourth quarter of 2017.

- Maintenance and services revenues were $34.2 million, up 27% compared with the fourth quarter of 2017.

Source: Q4 earnings slide

Operating Income:

- GAAP operating income was $4.5 million for the quarter, compared to $7.7 million in the fourth quarter of 2017.

- Non-GAAP operating income was $15.5 million for the quarter, compared to $13.4 million in the fourth quarter of 2017.

Net Income:

- GAAP net income was $6.5 million, compared to $6.8 million in the fourth quarter of 2017.

- GAAP net income per diluted share was $0.20, compared to $0.22 in the fourth quarter of 2017, based on 32.5 million and 31.1 million diluted shares outstanding, respectively.

- Non-GAAP net income was $17.5 million, compared to $12.5 million in the fourth quarter of 2017.

- Non-GAAP net income per diluted share was $0.54, compared to $0.40 in the fourth quarter of 2017, based on 32.5 million and 31.1 million diluted shares outstanding, respectively.

For the entire year ending December 31, 2018

Revenues:

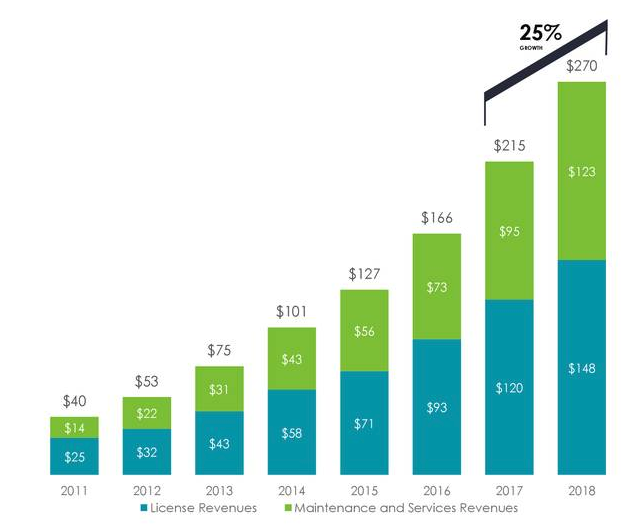

- Total revenues were $270.3 million, up 25% compared with 2017.

- License revenues were $147.6 million, up 23% compared with 2017.

- Maintenance and services revenues were $122.7 million, up 29% compared with 2017

Source: Q4 earnings slide

Operating Income (Loss):

- GAAP operating loss was ($29.1) million, compared to ($13.4) million in 2017.

- Non-GAAP operating income was $9.8 million, compared to $7.6 million in 2017.

Net Income (Loss):

- GAAP net loss was ($28.6) million, compared to ($13.8) million in 2017.

- GAAP net loss per basic and diluted share was ($0.98), compared to ($0.50) in 2017, based on 29.0 million and 27.5 million basic and diluted shares outstanding, respectively.

- Non-GAAP net income was $10.4 million, compared to $7.1 million in 2017.

- Non-GAAP net income per diluted share was $0.32, compared to $0.23 in 2017, based on 32.3 million and 30.9 million diluted shares outstanding, respectively.

Outlook is spooking the Street

The stock is cratering due to a murky outlook as the company shifts to a subscription model. The impact of the transition from a perpetual license to a subscription model should lead to longer-term growth but the move is being questioned. This is also going to cost the company significant expenditures, hitting 2019 earnings, but setting the company up for growth in the long run.

For the first quarter of 2019, the company expects revenues in the range of $58.5 million to $60.0 million, representing 9% to 12% year-over-year growth. The company anticipates first quarter 2019 non-GAAP operating loss in the range of ($11.0) million to ($10.0) million and non-GAAP net loss per basic and diluted share in the range of ($0.38) to ($0.36), based on a tax provision of $400,000 to $600,000 and 29.8 million basic and diluted shares outstanding.

For the full year 2019, the Company expects revenues in the range of $297.0 million to $305.0 million, representing 10% to 13% year-over-year growth. The Company anticipates full year 2019 non-GAAP operating income of $3.5 million to $8.5 million and non-GAAP net income per diluted share in the range of$ 0.04 to $0.16.

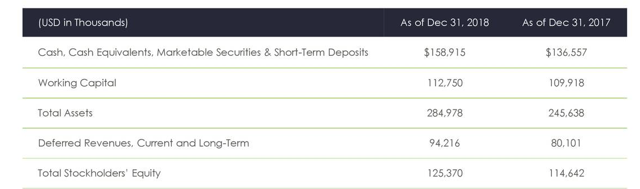

It is this latter figure that is causing a valuation change. However, in the world of tech and security it is about the long-game. The balance sheet is solid. As of December 31, 2018, the company had $158.9 million in cash and cash equivalents, marketable securities and short-term deposits, compared with $136.6 million as of December 31, 2017.

Source: Investor presentation

We think it is key to point out the balance sheet is debt free.

Our view

When considering the growth path of the company, 2018 was another strong year for Varonis, as total revenues increased 25%. To extend the benefits of the full platform products the company offers they want to up the adoption of their products more quickly. To do so they are transitioning from perpetual licenses to a subscription-based model. This is quite similar to what many others have done, much like Office 365 etc. This may allow Varonis to capture more of the $13-$20 billion total addressable market and increase customer lifetime value. It is a critical step on our path toward building a billion dollar revenue generating business and increasing shareholder value in our opinion. The move is NOT based on nothing. The company piloted a subscription model in 2018 and is now ready to implement the move.

We believed a near 20% decline was a bit much when you consider the long-term growth profile. Yes it hurts to see earnings decline, but revenues are increasing. This increase will pay off once expenses are reigned in after implementation of the full model is in place.

Although we are recommending this as trade that will likely materialize in a few weeks, we also like through the lens of a longer-term investing standpoint into 2020 and beyond as that is when we anticipate the real earnings growth to commence once the transition is complete and in full force. As the initial rally is underway, we think our broader readership should consider catching the remaining upside.

Disclosure: BAD BEAT Investing is long VRNS