Value And Momentum And Investment Anomalies

The predictive abilities of value and momentum strategies are among the strongest and most pervasive empirical findings in the asset pricing literature (here is a deep dive).

For example, the study “Value and Momentum Everywhere” by Clifford Asness, Tobias Moskowitz, and Lasse Pedersen, published in the June 2013 issue of The Journal of Finance, examined these two factors across eight different markets and asset classes (individual stocks in the U.S., the U.K., continental Europe, and Japan, as well as country equity index futures, government bonds, currencies, and commodity futures) and found:

- There are significant return premia to value and momentum in every asset class. The value premium was persistent in every stock market, with the strongest performance in Japan. The momentum premium was also positive in every market, especially in Europe, though statistically insignificant in Japan (see here for more details).

- Value strategies are positively correlated with other value strategies across otherwise unrelated markets, and momentum strategies are positively correlated with other momentum strategies globally. This persistence assuages data mining concerns (see here for more details).

- Value and momentum are negatively correlated with each other within and across asset classes. Their negative correlation and high positive expected returns imply that combining strategies result in improved Sharpe ratios.

Is There Value and Momentum in Anomalies?

Deniz Anginer, Sugata Ray, H. Nejat Seyhun, and Luqi Xu contribute to the literature on value and momentum with their February 2020 study “Value and Momentum in Anomalies.” They examined the performance of value and momentum across the following capital asset pricing model (CAPM) anomalies. Specifically, they investigated whether the time variation in the predictive ability of anomalies is random or serially correlated over time.

- Net stock issues: Net stock issuance and stock returns are negatively correlated. It’s been shown that smart managers issue shares when sentiment-driven traders push prices to overvalued levels.

- Composite equity issues: Issuers underperform non-issuers, with “composite equity issuance” defined as the growth in the firm’s total market value of equity minus the stock’s rate of return. It’s computed by subtracting the 12-month cumulative stock return from the 12-month growth in equity market capitalization.

- Accruals: Firms with high accruals earn abnormally lower average returns than firms with low accruals. Investors overestimate the persistence of the accrual component of earnings when forming earnings expectations.

- Net operating assets: The difference on a firm’s balance sheet between all operating assets and all operating liabilities, scaled by total assets, is a strong negative predictor of long-run stock returns. Investors tend to focus on accounting profitability, neglecting information about cash profitability, in which case net operating assets (equivalently measured as the cumulative difference between operating income and free cash flow) capture such a bias.

- Asset growth: Companies with high growth rates in their total assets earn lower subsequent returns. Investors overreact to changes in future business prospects implied by asset expansions.

- Post-earnings announcement drift: If earnings surprises are positive (negative), future stock prices drift upward (downward) — stock prices drift in the same direction as the earnings surprise.

- Investment-to-assets: Higher past investment predicts abnormally lower future returns.

- O-score: This is an accounting measure of the likelihood of bankruptcy. Firms with higher O-scores have lower returns.

- Momentum: High (low) recent (in the past year) past returns forecast high (low) future returns over the next several months.

- Gross profitability premium: More-profitable firms have higher returns than less-profitable firms.

- Return on assets: More-profitable firms have higher expected returns than less-profitable firms.

- Size: Smaller firms have higher expected returns than larger ones.

- Value (book-to-market): High book-to-market (value) firms have higher expected returns than low book-to-market (growth) firms.

The authors began by first defining “anomaly momentum” as the future abnormal returns to anomaly-identified stocks that exhibit better (or more positive) returns than other anomalies. They then defined “anomaly value” as the future abnormal returns to anomaly-identified stocks that exhibit higher recent book-to-market ratios. Their sample includes U.S. stocks over the period January 1975 through December 2014.

The following is a summary of their findings:

- There is significant persistence in the relative rankings of anomalies with respect to their past one-month returns, as well as their past year’s historical adjusted book-to-market ratio — 77 (85)% of the anomalies exhibit a relative (absolute) momentum.

- Anomalies that have performed well in the past month continue to outperform those that have performed poorly by about 60 basis points (bps) per month. The performance is stronger for absolute momentum.

- Anomalies that exhibit a value orientation outperform anomalies that exhibit a growth orientation going forward by about 30 bps per month—77% of the anomalies exhibit a relative value effect.

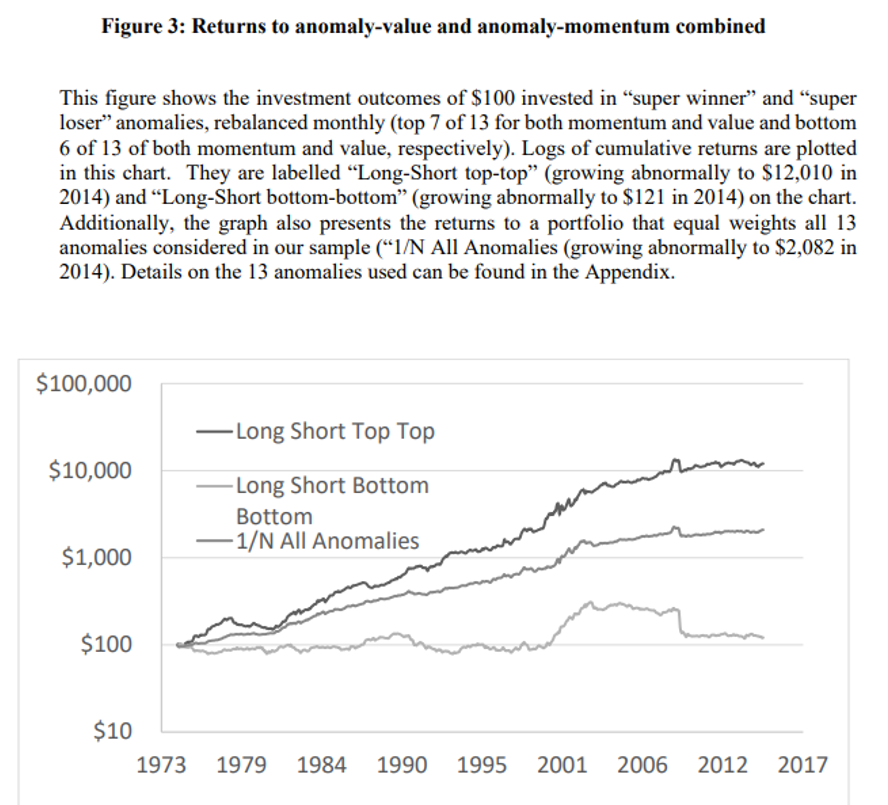

- Their strategy significantly outperforms a naive diversification strategy of equal weighting across anomalies.

- The performance of their strategy improves using absolute momentum (time series) and value rankings instead of relative rankings (cross-sectional).

- Combining momentum and value to construct the “super winner” portfolio, investing in the anomalies that are both “winning” in terms of past month’s performance and “winning” in terms of past year’s historical adjusted book-to-market ratio, results in an abnormal return of 1.08% per month. In contrast, the “super losing” portfolio (“losing” past performance as well as past adjusted book-to-market ratio) has an abnormal return of only 0.11% per month. Hence, investing in super winning portfolios generates an additional 0.97% per month.

- Their results are robust to a wide variety of specifications.

- The anomaly momentum/value is distinct from and cannot be explained by individual stock momentum/value or industry momentum/value.

The results are hypothetical results and are not an indicator of future results and do not represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Their findings led the authors to conclude:

“Our findings further corroborate the hypothesis that mispricing is an important source of anomaly profits.”

They added:

“We are the first to document that value works across anomalies and that anomaly-value and anomaly-momentum can be combined to create a powerful trading strategy.”

Finally, they suggested:

“that anomaly momentum can reduce tail risk when used to time investment decisions.”

Their study contributes to the body of evidence suggesting that investors can improve the efficiency of their portfolios by using investment vehicles that incorporate both value and momentum strategies.

Disclosure: Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. Past ...

more