USell: Renewed Growth Model Provides A Probable 100% Return Opportunity

Note from TM editors: This article discusses a microcap and/or penny stock. Such stocks are easily manipulated; please do your own due diligence.

- uSell (USEL) is a growing online re-commerce marketplace that sports superior features over websites like Ebay (EBAY) and Gazelle

- uSell appears to be on the verge of major expansion

- uSell’s Q3 filing revealed positive prospects and a cleaned up balance sheet; ample cash and no debt

- New partnerships with well established companies like Staples (SPLS) and Tracfone should translate to substantial shareholder value

- Continuous and significant insider buying validates the bull thesis

I invest primarily in undervalued small caps and there are always a handful of indicators I explicitly scout for in the selection process. For example, the balance sheet should be clean, meaning no debt and ample cash. Also, the company needs to be in a durable high-growth condition with access to a very large addressable market, so the upside potential is unmistakably there. The insiders need to back up their statements with their own money too, like buying stock in the open market, no selling whatsoever, and owning a sizable portion in their own company. There are a few other factors involved in the process, but it all eventually comes down to a final risk vs. reward assessment. With this strategy, I have significantly outperformed the main indices over the past few years. I think uSell is a classic example of an undervalued and overlooked small cap stock that exactly matches my criteria. This article presents the bull case.

Business overview

uSell is a player in the online expertise called re-commerce. Its online marketplace helps individuals turn unused items, like smartphones and textbooks, into cash. uSell ensures that customers get the highest payouts with the least amount of hassle by facilitating risk-free transactions with professional buyers. uSell doesn’t hold products in inventory, it’s a software-based platform just connects buyers and sellers. uSell generates revenue by charging a commission for each transaction. Here’s a simple step by step of how such a transaction takes place:

- Consumers interested in selling items to find cash offers for their items based on the make, model, and condition of each item.

- The seller can then compare offers for those items from a marketplace of professional buyers.

- The seller can also review satisfaction ratings and customer reviews of each buyer.

- The seller complete his or her transaction on its website with the buyer of his or her choice.

- The seller then ships the device.

- Both can track the progress of their order online from initiation to final payment for their device.

This all takes place is a completely hassle free environment. You do not need to upload photos or a description. You also do not need to monitor the auction process or answer messages from potential buyers. uSell will send you a postage-paid shipping kit so you do not have to buy packaging and postage. This is from a customer experience viewpoint clearly preferable over Ebay’s way of dealing with buyers and sellers. That’s not me saying this, but a multitude of review sites. According to resellerratings.com, uSell scores a 9.6 out of 10 based on 1727 reviews, whereas Ebay is awarded an abysmal low 1.25 based on 257 reviews.

What about price? A good customer experience is one thing, but price is another. On average, uSell manages to make sure sellers get a higher price than on Gazelle, another competitor in the re-commerce space. That should not be a surprise, given the fact that uSell does not hold inventory and thus has no inventory related bills to pay. Keep in mind that uSell prices are net prices. Prices on sites like Ebay may appear higher, but if you subtract necessary costs like packaging, the price drops considerably. This angers many customers, which could explain the abundance of negative reviews on Ebay.

On the verge of major expansion

In the few years since its existence, the company has grown from 0 revenue to $6 million annual revenue based on most recent quarters, while they are operating in a highly competitive business. This is impressive, and even though the reported growth so far this year is somewhat lagging due to a recent transition in business model, I think the 50% plunge in share price is way overdone, providing an excellent entry point (think risk vs. reward here). Regarding the business model: Beginning in February 2014 uSell phased in a major change. Under the new model, the upfront lead fees to buyers were eliminated and replaced by fees when buyers actually pay sellers for received devices. This means revenue is recognized only upon actual payment. This is a more transparent and straightforward way of bookkeeping. It also aligns the company’s incentives with sellers and reduces risk for buyers. Management is perfecting a highly scalable revenue platform that ensures uSell will re-enter the rapid growth state by re-investing all cash in marketing and sales. uSell is not reporting a profit right now,but it could switch to profitability any day now. uSell is in fact already generating profit on every transaction, and high margin on every transaction. But the decision to re-invest all cash is a strategic one, similar to what Amazon (AMZN) has pulled off. At first glance, it may come across as a bit illogical to postpone profitability but if this strategy works out, shareholders will be richly rewarded in the longer term.

Let’s look at the most recent revenue number and projections.

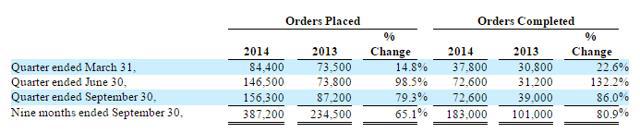

For the third quarter of 2014, revenues reached $1.4 million. On an operational level the company saw a 79% increase in orders placed through the system to 156k. The completed orders increased 86% to a total of 72k. So the completed orders rose even more than the orders placed. That’s interesting. That must mean that uSell’s marketplace has gained more trust from customers. The SEC filing stresses that the value of the orders increased as well, even though the total completed orders remained flat.

uSell also increased prices offered to sellers, leading to higher conversion rates and throughput, during the nine months ended September 30, 2014, compared to the nine months ended September, 2013.

So I project the upcoming quarters to be even better. What sure helped is that uSell experienced, according to this press release, a record inflow of orders partially thanks to Apple’s new iPhone 6. With a good level of stickiness of new customers flocking in, revenue could be ramped up significantly. The books of Q4 and beyond should reflect to what degree exactly. Overall, management emphasizes that the short term marketing & sales investment has provided a substantial strategic value that will be recognized throughout the fourth quarter and into next year.

Further unlocking the rapid growth potential, uSell announced it has introduced an enhanced service model called “managed by uSell” According to management, this new service greatly increases the ability to control its customer experience and dramatically improves the scalability of the uSell platform. In order to launch the Managed by uSell service, uSell has partnered with a 3rd party logistics company to inspect and process devices before passing them along to the buyers offering the highest prices for each device. This ensures that buyers get exactly the devices that they bid for, while sellers are provided a fair appraisal and quick payment. It remains to be seen how this exactly pans out, but if it’s true what management is saying, revenue could be ramped up even more thanks to this innovation. It’s the culmination of a 3-year-long research & development investment. I think management made a good point when they stated:

"The new technology that we have developed is aimed to reduce risk all around. This includes risk to sellers, risk to buyers, and risk to uSell. These reductions in risk will apply upward price pressure to our marketplace, which will in turn increase conversion rates,throughput, and customer satisfaction."

Another option for uSell to boost revenue is to include more household items in the market place. They exercised that option last year with textbooks and gift cards. The primary focus is still on smartphones, but if they feel the need to expand, they could incorporate other options fairly easy and quickly. Again I draw the comparison with Amazon, they sold only textbooks during the first 4 years of its existence.

Overall, uSell appears to be on the verge of major expansion.

The people leading uSell

Let’s check out the people leading uSell. Dan Brauser is the ‘Zuckerberg’ of uSell. Fairly young guy, very ambitious, and quite vocal about transforming uSell into a multi-billion dollar company. Here’s a list of his feats:

- 1995: Sold Kertz Security Systems to Wayne Huizenga for $28million.

- 1998: After a series of rollups in the security business, sold company to Ameritech for $660 million (now known as ADT).

- 2001: Sold Naviant, an internet company he built to Equifax for$135 million.

- 2004: Sold Seisint, a data fusion company that he co-founded in 1999, to Reed Elsiver (Lexis/Nexis) for $780 million.

- 2009: Sold 5 to 1 (an internet company) to Yahoo for $28million.

- 2010: Sold Interclick (an internet ad network) that he founded in 2007 to Yahoo for $280 million.

Can we add uSell to this list in the future? I don’t know, but his past successes sure inspires a lot of confidence. Next on the team is Christian Croft; Chief Product Officer & Co-founder. Nik Raman is the other Co-founder. He is the COO. Vijay Ganapathy is the Chief Technology Officer. The company recently made new key hires to strengthen its human capital. In total about 18 very high-skilled people work at uSell.

Management is well motivated to make uSell a success story. Their fixed pay is limited, while the options kick in only when the share price is considerably higher. Digging up the insider trading pattern reveals the next:

This is an insider trading pattern I love to see; only buying, no selling. Especially if you consider how low the market cap is today.

uSell’s financial condition

As said, uSell is a growing company and they are making dollars on every transaction, as shown by cost of revenue / revenue. This stands at almost 90%:

You can also see that the operating loss can be attributed mostly to sales and marketing expenses.

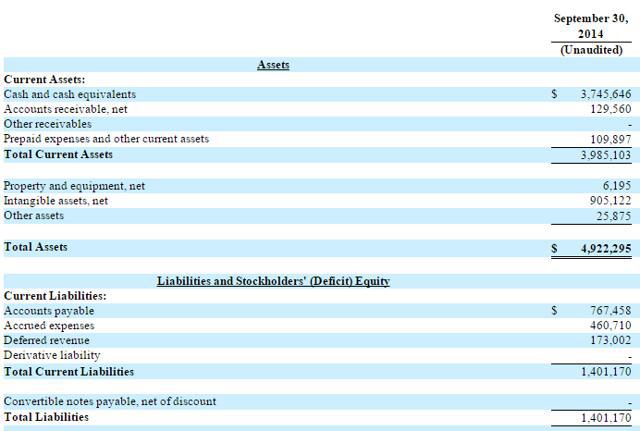

Regarding the balance sheet, the working capital and stockholders equity improved dramatically in the course of 2014. The balance sheet is currently free of debt, free of goodwill and they have about $3.7 million in cash per end of September 2014, thanks to an equity offering they closed late August.

A sound balance sheet limits downside risk which I regard as an important aspect in small cap investing. It’s also helpful from a strategic perspective; the $3.7 million in net cash provides management the financial capabilities to expand business.

As so many early-stage innovations, uSell makes a net loss. As per same SEC filing, net loss accumulated to almost $6 million over the last 9 months. Again, the sales & marketing expenses caused this loss. The good news is that the general expenses dropped, while revenue went up. uSell’s operational infrastructure has become leaner and more efficient. Based on the last 3 annual statements, the company burns about 200k per month, so the cash available is good enough for 1,5 years of continuity. But I expect revenue to ramp up significantly, and if management (strategically) decides to tone back the sales & marketing expenses, uSell should report profitability, certainly given the extremely high level of margins.

Share structure

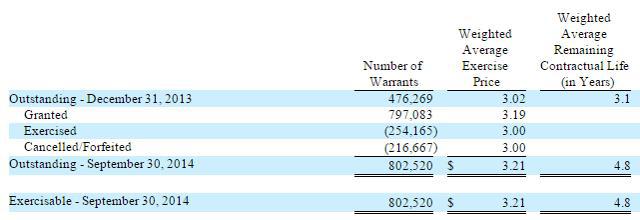

According to the latest SEC filing uSell had per end of September803k warrants outstanding with an average strike price of $3.21. The SEC filing of end of June revealed an average strike price of$3.04 while the most recent offering disclosed that the company has added warrants with a strike price of $3.20.

So warrant conversion can only kick in when the share price rises more than 40%. Remember than conversion leads to a cash influx,although it does (temporarily) cap the share price. There are no convertible notes outstanding. Total shares outstanding sum up to approximately 6.7 million (includes the recent offering).

uSell has a pretty clean share structure, which is quite unusual for early stage OTC stocks.

The competitive landscape

The online resale space is very competitive. Ebay and Amazon are clearly the biggest players. Gazelle and EcoATM fill up the space. But this is hardly a surprise. The addressable market is gigantic. In my view, people will eventually use the platform that is the most user-friendly, trustworthy, fast and economical. Based on this mix, uSell appears to be in a good position. It also is somewhat different from the rest. The company specializes in the ‘sell it now ‘ niche, whereas Ebay focuses more on the buyer. Go google ‘sell iPhone'. uSell appears on the top page. Again, uSell does not hold inventory, it's a pure software-based platform. Could competitors copy their model? It could be, but since uSell IP's is protected and with a serious time advantage in mind, I consider that risk to be fairly low. Applying logic convinces me that an easier route is simply buying uSell in its entirety. I don't invest in small caps just based on take-over speculation aspect, but it does add weight to the bull case.

Overview catalysts

A few short-term catalysts should unlock shareholder value, and drive shares higher. The most important one is profitability. I don't expect uSell to report a net profit this year, but I expect green headlines in the first half of 2015. Needless to say, a company that reports a profit for the first time almost always results in a significant higher share price.

The other catalyst is an uplisting to the NASDAQ. Management has stated that this is one of uSell's goals, and I expect an uplisting will take place in 2015. Such a move would generate more investor awareness and enables institutional investors to initiate a position. It ‘s hard to predict to what extent the share price will be impacted,but I regard an uplisting as a positive event, and expect a bump because of the simple fact that the pool of potential buyers enlarges dramatically (not everybody can or is allowed to trade on the OTCboard).

Then we have the partnerships with Staples and Tracfone, allowing uSell access to their existing customer bases, which can be very profitable because these existing customer bases don't have acquisition or marketing costs. TracFone has over 20 million subscribers and Staples has 30 million unique visitors per month going to their website, so the economic potential for both these partnerships is tremendous. I won't be surprised if uSell manages to land more partnerships in the near future.

Other catalysts are introductions of widely anticipated products like the next iPhone or Samsung Galaxy, investor conferences, more coverage (uSell is quite an unknown stock) and upbeat earnings calls (Q4 should be the first).

The upside

What's the stock worth? uSell is currently valued at $15 million. I conservatively project the annual revenue to grow in the 30% to 40% range. That makes an annual revenue of almost $10 million. The average price/sales multiple of such a high-growth stock should be at least 3, but let‘s apply the current running multiple of 2.3. That should catapult uSell's valuation to $23 million, equating to a 50% upside from current share price.

When using a blended approach of high growth and a higher multiple, the valuation could approach $30 million, equating to almost 100% upside. That‘s more than fair, Ebay‘s growth has stalled but it still sports a price/sales multiple of 4. I concur that the 50% discount in relative valuation to Ebay seems more or less justified. Ebay is a profitable company and has a far bigger moat. But uSell is in reality already making money on every transaction, is growing much faster and has a clean balance sheet, so I argue the discount should be far lower.

When uSell reports a net profit, a much higher multiple is even warranted. Since uSell is a software-based business, the company is capable of massive scaling, with minimal additional costs. Remember that the company operates in a growing multi-billion addressable market. As uSell grows, leverage amplifies what is applied to the bottom line. The NOL asset shields the company from future taxes. Durable quarter-to-quarter profitability could even lead to a >100% return.

Overall, I assess a 40% short-term surge to fair value as highly likely, a 100% return within 12 months as probable, and even higher returns as an interesting possibility.

Key risks

Although the upside is very alluring, there are risks to consider. Investors should bear in mind the next:

- uSell is operating in quite a competitive environment. Margins could erode if competitors step up the plate.

- This is an OTC stock. Beware of the risks associated with OTC stocks.

- Limit your order, the bid-ask spread could be more than 3%.

- If uSell won ‘t report profitability or even grow in 2015, shareholders could get burned.

Final risk vs. reward assessment

Normally I refrain from holding OTC stocks, but uSell is the little gem I’m willing to make an exception for. It sports all the features for a great risk vs. reward investment. Given the clean balance sheet, I hardly see any financial and/or dilution risk. The competition is fierce, but the addressable market is gigantic and still growing. With such a viable, renewed and scalable software-based platform, uSell should re-ignite its former rapid-growth state. I expect the share price to quickly readjust to its fair value in the $3.00 – $3.50 range. Eventually the growth adds up to the bottom line, and when that is bound to happen in 2015 the share price should surpass $5. An interesting kicker to the story is a downright take-over by a company like Ebay or Best Buy (BBY). Since the share price appears to have bottomed out on low volume, I think now is the time to initiate a long position.

Disclosure: Long uSell. Please do your due diligence before investing.

Hard to find current coverage on this stock. Have any updates on this or other stocks worth keeping an eye on?

Thank you for the extremely detailed report. I am certainly thinking about this much more than I would have otherwise.

Another insider buy two days ago: The CEO bought 3000 shares in the open market.

It's also encouraging to see an author add insights to an article. I know this site is still small and new but I'm encouraged by the level of commentary.

That's encouraging news!

I picked up some of this stock after reading John Ford's analysis and hint that it could be an acquisition target for ebay. The expected increase never materialized but I still have hopes for USEL. I agree that it is a gem and is under-priced.