Use These 3 Preferred Shares To Protect Yourself Against Future Dividend Cuts

The recent stock market crash that hit investors of index funds like SPY, opened up a new, attractive asset class for income-focused investors. Dividend cuts and suspensions have hit more than 25% of stocks in the typical high-yield sectors such as REITs, business development companies, and energy infrastructure stocks and a high number of stocks that comprise SPY and other popular indexes IWM, QQQ, XLRE, and others.

Investors who count on dividend income have been shocked by dividend cuts from companies that in the years before COVID-19 investors counted on for reliable dividend payments.

In these challenging times for investors, preferred stock shares offer a safe haven for income-focused investors.

Preferred stocks get the name because this share class has a preference for dividend payments over common stock shares. Put another way, if a company wants to pay common stock dividends, it has to pay the scheduled preferred share dividends. Here are the features of preferred stocks.

- A preferred issue will have a fixed dividend or coupon rate, based on a $25 par value for the shares. For example, a preferred with an 8% coupon, will pay $2.00 per year or $0.50 per share each quarter. The dividend rate will not change.

- Preferred shares trade on the stock exchanges, and the price you pay for shares may be higher or lower than the par value.

- Most preferred shares have cumulative dividends. This feature means that if a company stops paying dividends on its preferred when it restarts paying dividends, it must also pay any dividend payments that were missed. In the event of a suspension of all dividend payments, preferred shareholders will be made whole before any dividends are paid to common stock shareholders.

- Preferred shares do not have a maturity or expiration date. However, they are usually callable by the issuer. If a preferred is called in, investors will receive the $25 par value per share.

If you check and see that a company continues to pay common stock dividends for any amount, you can be assured that the preferred dividends will continue to be paid. Recently, hotel REIT RLJ Lodging Trust (RLJ) slashed its dividend from $0.33 per share down to just one cent. The one penny dividend is your indicator that the dividends on RLJ’s preferred shares are safe.

For some ideas on individual preferreds, here are the three largest holdings of the InfraCap REIT Preferred ETF (PFFR):

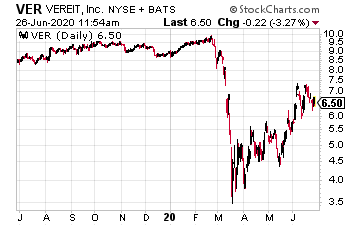

The VEREIT, Inc. Preferred F (VER.PF) has a 6.7% coupon rate and currently trades right at the $25 par value, giving a 6.7% current yield.

The underlying company, VEREIT, Inc., is a net lease REIT that owns a $15 billion portfolio of commercial real estate properties.

In May, VEREIT cut its common stock dividend by 44%. That cut does not apply to the preferred shares, and the fact that any common dividend continues assures the preferred share dividends are secure.

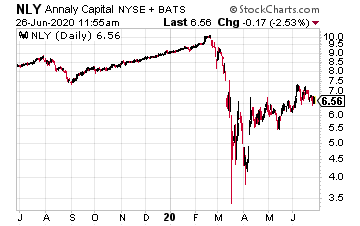

The Annaly Capital Management Preferred F (NLY.PF) has a 6.95% coupon rate and a current share price of $21.60.

Since the preferred is trading for less than par, the current yield is 8.0%. Annaly is a finance REIT that owns a leveraged $125 billion portfolio of mortgage-backed securities.

The effects of the pandemic cut profits from Annaly, and on June 10, the common shares dividend was reduced by 12%.

In contrast, preferred shareowners will continue to earn the regular coupon rate.

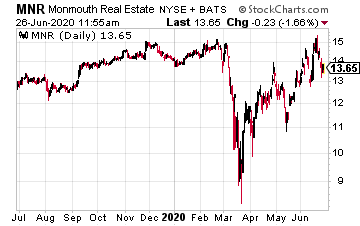

Monmouth Real Estate Investment Corp. Preferred C (MNR.PC) has a 6.125% coupon rate, and a current share price of $24.50, giving a current yield of 6.25%.

Monmouth is an industrial property REIT, a category of commercial real estate that has done well through the COVID-19 crisis.

Industrial properties are the warehouses that online retailers need to hold their inventory and ship products.

In this case, the Monmouth common shares yield less than 5%, while the preferreds pay well over 6%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more