Use Altria's High Dividend For Retirement Portfolios

The stock price of Altria (MO) is down over 27% this year. This has clearly been a painful year for equity holders of this once-stable company. But continuing declines in smoking rates in the United States has sparked fears that there is no way Altria can continue its earnings growth over the long run.

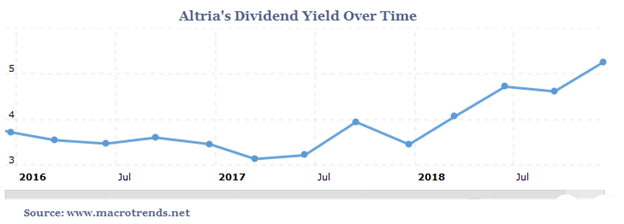

The big drop in Altria’s stock price is the bad news, at least for current holders of the stock. But there is a lot of good news for those looking to invest in solid dividend-paying stocks: First and foremost, Altria’s current dividend yield is 5.9%.

It isn’t easy to find a 5.9% dividend yield from a company with a long history of never cutting its dividend. Also, Altria increased its dividend this year by 14% compared to 2017. For those looking for dividend income over the long-run, Altria could be the perfect fit.

How Altria Can Continue To Grow

The decline in U.S. smoking is definitely bad news for this company. But Altria understands they need to diversify and they have been making moves. They recently bought a $1.8 billion stake in Canadian marijuana company Cronos. Altria knows that the tide has turned for legalized marijuana both here in the U.S. and Canada, and they want to get on board early.

Altria is also in talks to take a stake in e-cigarette maker Juul Labs. Although cigarette smoking is way down in the U.S. over the past decade, e-cigarette use has accelerated, especially among younger people. Altria knows that and has been involved in the e-cigarette market for a while now.

Altria’s Dividend And Retirement Portfolios

For those looking to live off of income in retirement and not touch their principal, a stable of solid dividend payers is a must. Although interest rates have increased quite a bit this year, bond yields are still not high enough to generate the needed income in retirement for most people.

This is why investing in the best dividend payers for the long-run is so important. I want to show just how big the impact of a stock like Altria can be on retirement portfolios.

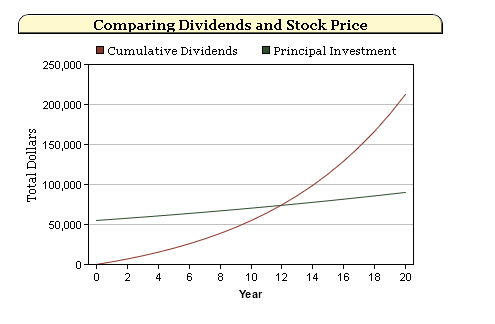

The first thing I want to show is just how valuable dividends can be over time. If we buy 1,000 shares of Altria today, its dividends grow by an average of 5% per year, and the stock price only moves at the rate of inflation, we see the following:

Over time the returns due to dividend payments swamp the increase in principal. In fact, over 20 years the average annual return under this scenario would be 8.9%. Of that return, 92% is due solely to dividends!

What this means is that in retirement, the change in the price of the stock barely matters to the investor any longer. It’s the dividend checks that make all the difference. Even better is the fact that the investor is living off of income and doesn’t have to dip into his investment principal.

If we are more pessimistic and we reduce the dividend growth to only 2% per year, the average annual return is still 7.6% per year and about 89% of that is due to dividends.

Dividend Champions For Retirement Portfolios

We have discussed before how it is wise to place your higher yielding investments into a qualified retirement account, such as an IRA or 401(k). Altria fits this strategy well. Given the stability of dividends over time, at least from dividend champions such as Altria, the returns over time are less volatile as well. This, in turn, increases the probability of never running out of money in retirement. We can measure this by running a Monte Carlo analysis on a financial plan.

I did this for a 55-year-old couple that is 60/40 in stocks and bonds. All of their investments are in an IRA and they currently have $500,000 saved and will spend $50,000 per year in retirement at age 65. When I first ran their plan they had only a 60% chance of never running out of money in retirement. When I moved the equity portion of their investments into a basket of dividend champions that had characteristics similar to Altria, I found that their Monte Carlo probability of never running out of money increased to 77%.

The reduced return volatility of solid dividend payers over time really has an impact on the chances of retirement success. This, in turn, will reduce stress in retirement as the movement in the stock price becomes less and less important over time.

When looking to create a basket of solid dividend payers for retirement, make sure they have a long history of not cutting their dividends, even in recessions. Once you compile your basket of great dividend-paying stocks, over time you will find that the dividends are what matters, not the price volatility.