US Stock Market Weekly Update October 28-November 1, 2019

U.S. stocks closed to fresh record highs after the October jobs report showed that the economy added more jobs than expected, with a figure of 128K for the October change in non-farm payrolls, beating the expectations of 85K. Unemployment remained unchanged at 3.6%. The ISM Manufacturing reading for October was 48.3, less than expected at 48.9, and well below the threshold level of 50.0 which is considered a neutral level. In fact, the ISM Manufacturing reading showed contraction in the manufacturing activity for a second consecutive month. The Consumer Confidence Index reading for October 2019 was weaker than expected at 125.9, the forecast being 128.0.

The US Gross Domestic Product Annualized for the third quarter was better than expected, with a figure of 1.9% beating the forecast of 1.6%. Still the most important news for the week was the Fed’s interest rate cut by 25 basis points and a current lower bound-upper bound range of 1.5%-1.75%, the third consecutive interest rate cut in the past few months.

“The Federal Reserve cut rates as expected and signaled a pause in its easing cycle. At the same time, Powell highlighted that the central bank would need to see a significant move up in inflation before they could consider raising rates.”, Source: Investing.com.

For the week of October 28 – November 1, 2019 the major US stock market indices closed as follows:

- Dow Jones Industrial Average: Close 27,347.36, +1.44% for the week

- S&P 500 Index: Close 3,066.91, +1.47% for the week

- NASDAQ: Close 8,386.40, +1.74% for the week

- Russell 2000: Close 1589,33, +1.96% for the week

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

- Foamix Pharma Ord (NASDAQ:FOMX), Close 3.86, 5-day change +37.86%

- Cirrus Logic Inc (NASDAQ:CRUS), Close 72.43, 5-day change +29.13%

- Bridgebio Pharma Inc (NASDAQ:BBIO), Close 24.15, 5-day change +29.01%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

- Tetraphase Pharmaceuticals, Inc (NASDAQ:TTPH), Close 3.29, 5-day change -36.12%

- Nacco Industries (NYSE:NC), Close 47.38, 5-day change -25.86%

- Freightcar America (NASDAQ:RAIL), Close 3.19, 5-day change -24.76%

Stock Market Commentary

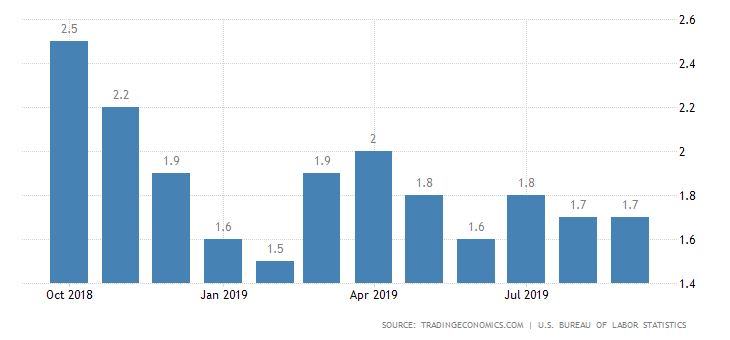

United States Inflation Rate

“The US annual inflation rate was unchanged at 1.7 percent in September 2019, slightly below market consensus of 1.8 percent, as a pick up in food inflation was offset by a further decline in energy prices. “, Source: Trading Economics

From the above chart we note that there is still enough room and time for the inflation to reach the 2% target rate set by the Fed. As we approach the 2020 US Elections we can expect even more pressure by the US president to the Fed to lower furthermore the interest rates. This is positive for the stocks and their valuation, and for the companies lowering their borrowing costs. But we cannot rule out a profit taking and a sell-off after these record highs for S&P 500 and Nasdaq.

----

Additional Sources:

https://www.dailyfx.com/economic-calendar

Disclosure: I have no position in any stock mentioned