US Stock Market Weekly Update February 17- February 21, 2020

Last week we wrote in our weekly US stock market update “The attention of the global financial markets and the US stock market remains on the current outbreak of coronavirus disease and latest news and developments, still the US stock market proved to be resilient as earnings season provides optimistic outlook about growth prospects, mainly about revenue and earnings.”. The main theme for the week ending on February 21, 2020 was again the focus on the coronavirus latest developments. The momentum now appears to favor a risk averse mood, as was clearly shown by the surge in gold (GLD) prices, closing at $1645.90 and the US 10-yr bond (SPTL) yield at 1.4710, on Friday, February 21, 2020. The CBOE Volatility Index (VIX) has moved higher this week, closing at 17.08+1.52 (+9.77%), while last Friday, February 14, it was at 13.68. Increased volatility in the stock market and financial markets is a high-probability event at least for now.

Economic and financial news during the previous week

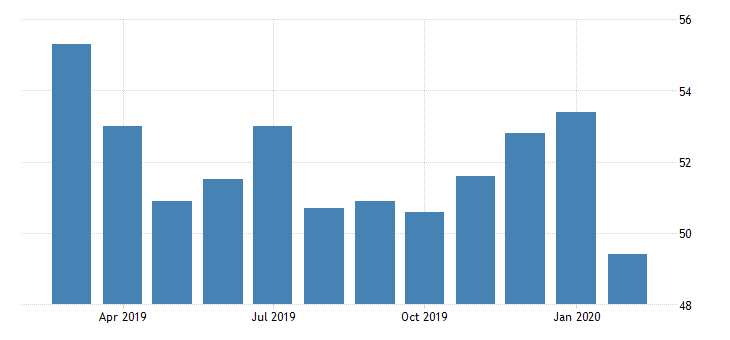

“On February 18, 2020 the USD NAHB Housing Market Index came in at 74, slightly below the forecast of 75, showing some weakness in the US housing market. However, on February 19, 2020 both the monthly USD Building Permits and USD Housing starts were better than expected. On February 20, 2020 the USD Philadelphia Fed Business Outlook beat the estimate, with a figure of 36.7, much higher than the forecast of 11.0, showing optimism for the business sector. On Friday, February 21, 2020 the USD Markit US Manufacturing PMI showed weakness with a figure of 50.8, less than the forecast of 51.5. A big negative surprise was that the USD Markit US Services PMI came in at 49.4, less than the forecast of 53.5. A figure below the level of 50.0 shows contraction in the service sector.

“The IHS Markit US Services PMI dropped to 49.4 in February 2020 from 53.4 in the previous month and well below market expectations of 53, a preliminary estimate showed. The latest reading signaled the first decline in business activity since February 2016 as new business declined the most since the series began in October 2009. New export orders also dropped amid the concerns about the impact of the coronavirus outbreak. The level of outstanding business fell and the pace of job creation softened. On the price front, input cost inflation eased to a five-month low, while output charges rose only fractionally. On a more positive note, business confidence reached its strongest level since last June.” Source: Trading Economics

Source: Trading Economics

For the week of February 17 – February 21, 2020 the major US stock market indexes closed as follows on Friday, February 21, 2020:

• Dow Jones Industrial Average (DJI): Close 28992.41, -1.38% for the week, +1.59% Year-to-date

• S&P 500 Index (SPY): Close 3337.75, -1.25% for the week, +3.31% Year-to-date

• NASDAQ (QQQ): Close 9576.59, -1.59% for the week, + 6.73%, Year-to-date

• Russell 2000 (IWM): Close 1678.61, -0.53% for the week, +0.61% Year-to-date

The Russell 2000 had the smallest losses among all other major US stock market indices, although it has yet the lowest year-to-date performance.

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Brickell Biotech Inc (BBI), Close 3.15, 5-day change +194.39%

2. Stamps.Com Inc (STMP), Close 174.47, 5-day change +103.37%

3. Schrodinger Inc (SDGR), Close 50.00, 5-day change +87.97%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Glory Star New Media Group Holdings Ltd. (GSMG), Close 2.02, 5-day change -80.35%

2. Pulse Biosciences CS (PLSE), Close 7.02, 5-day change -42.36%

3. Mednax Inc (MD), Close 19.99, 5-day change -26.05%

Economic events for the week February 24- February 28, 2020:

Important economic data being released this week for the US economy will the consumer confidence, new home sales to monitor the state of the US housing market and personal income and spending.

Disclosure: I have no position in any stock mentioned