US Stock Market Weekly Update April 6- April 9, 2020

It was a trading shortened week with impressive gains for all major US stock indexes as stocks recorded one of their best weekly gains on record. Is the worst for the stock market already priced in for now? Time will tell as we enter the first-quarter earnings season for 2020. The small-cap stocks witnessed a significant bounce for the week as the Russell 2000 index rose more than 14%.

The Federal Reserve announced another large stimulus program, estimated at $2.3 trillion, providing loans to smaller businesses and municipalities to support the US economy. Still, over 10% of workers have lost their jobs and the weekly US initial jobless claims reported were worse than expected. Has the Fed even more solutions to support the economy or has it taken all the financial decisions at such a short time of period, shifting its tone from conservative to a more aggressive yet effective central bank policy?

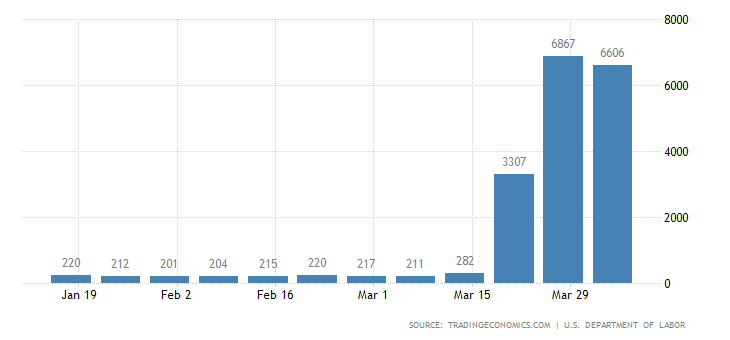

The United States Initial Jobless Claims

“The number of Americans filing for unemployment benefits eased to 6.606 million in the week ended April 4th from the previous week's record high of 6.867 million, but well above expectations of 5.25 million. The latest increase brought the total reported in the last three weeks to near 17 million, as the coronavirus crisis deepened. The 4-week moving average, which removes week-to-week volatility, also jumped to an all-time high of 4.266 million, while continuing jobless claims hit 7.455 million in the week ended March 28th, also the highest on record. The last week's number may be underestimated as many states are struggling to process high volumes of claims. The $2.2 trillion package approved by the White House and Congress which increased payments for the unemployed to up to $600 per week for up to four months likely contributed to the rise in the claims.”

Source: https://tradingeconomics.com/united-states/jobless-claims

It is the third consecutive week with abnormal figures for the US initial jobless claims, and this trend is to be closely monitored in the next weeks for any improvement. The peak of this trend will be important for the US economy and the stock market, and the degree of the anticipated recession.

For the week of April 6– April 9, 2020, the major US stock market indexes closed as follows on Thursday, April 9, 2020:

• Dow Jones Industrial Average: Close 23719.37, +10.77% for the week, -16.89% Year-to-date

• S&P 500 Index: Close 2789.82, +10.40% for the week, -13.65% Year-to-date

• NASDAQ: Close 8153.58, +8.90% for the week, - 9.13%, Year-to-date

• Russell 2000: Close 1246.73, +14.82% for the week, -25.28% Year-to-date

Weekly Stock Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Neurobo Pharmaceuticals Inc. (Nasdaq: NRBO) Close 28.46, 5-day change +102.24%

2. Macerich Company (NYSE: MAC), Close 9.42, 5-day change 87.65%

3. Western Midstream Partners LP (NYSE: WES), Close 5.62, 5-day change +83.06%

Weekly Stock Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Sigma Labs Inc (Nasdaq: SGLB), Close 2.05, 5-day change -31.44%

2. BP Prudhoe Bay Royalty Trust (NYSE: BPT), Close 4.00, 5-day change -31.27%

3. Huize Holding Limited ADR (Nasdaq: HUIZ), Close 5.45, 5-day change -22.03%

Economic events for the week April 13- April 17, 2020:

Important economic data for this week will be the earnings season as several companies will release the first-quarter corporate results as well as the retail sales, building permits, and the leading economic index. The retail sales figure and the building permits will shed light on the impact of the lockdown on the US economy. As retail sales contribute about 70% to the total US GDP, the latest reading can move the stock market, regardless of the missing of beating the expectations.

Sources:

https://quotes.wsj.com/index/US/COMP

https://www.barchart.com

https://www.dailyfx.com/economic-calendar

https://stockcharts.com/

Disclosure: I have no position in any stock mentioned