US Stock Market Weekly Review June 29- July 3

A higher close for the US stock market for the week ending on July 3, 2020, with the best quarter for Dow Jones since 1987 during a shortened trading week for the celebration of the 4th of July, and solid economic data was the key economic news for the past week. A strong job momentum and a big positive surprise for pending home sales supported the optimism for an economic recovery. Nasdaq made a new record hit and vaccine hopes by Pfizer supported the risk-on investment sentiment.

The US pending home sales for May 2020 came in at +44.3% beating the estimate of +18.9% and improving significantly compared to the previous figure of -21.8%. The Conference Board (CB) Consumer Confidence figure beat the forecast of 91.8 with an actual figure of 98.1. This is particularly important as it is a leading economic indicator predicting future consumer spending which is crucial for the total economic activity and growth. The Markit Manufacturing PMI Final reading also beat the forecast of 49.6 with a reading of 49.8 showing improved performance for the manufacturing sector, while the ISM Manufacturing PMI with a figure of 52.6 showed an expansion in the manufacturing economy, beating the forecast of 49.5. The positive economic data was supported by a strong jobs report. The Non-Farm Payrolls figure was better than expected with a figure of 4800K compared to the estimate of 3000k, and the unemployment fell to 11.1%, better than the forecast of 12.3%. However, the weekly numbers for the initial jobless claims and continuing jobless claims were worse than the expectations.

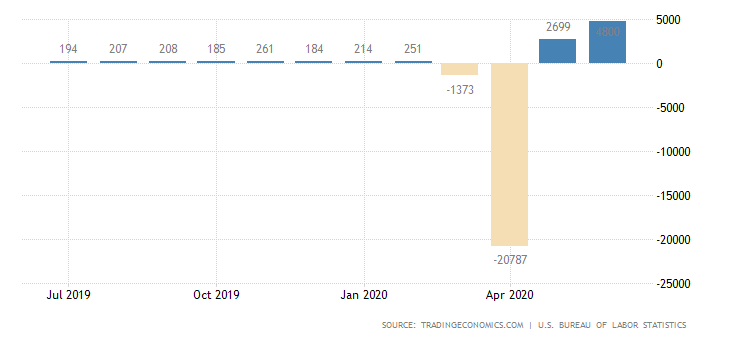

United States Non-Farm Payrolls

“The US economy added 4.8 million jobs in June, the most on record and beating expectations of 3 million. It follows an upwardly revised 2.7 million rise in May reflecting a partial resumption of economic activity that had been curtailed due to the coronavirus pandemic in April and March when employment fell by a total of 22.2 million in the 2 months combined. However, the job market still has a long way for a full recovery. Many economists believe the numbers do not capture the full scale of job losses as many are being still classified as employed but are absent from work. Besides, several states are scaling back or pausing reopening efforts to respond to the second wave of coronavirus infections and more people may lose their jobs.”

- Source: Trading Economics

A second consecutive month with big gains for the labor market is a positive fundamental factor supporting the economic recovery, despite sustained risks and uncertainties such as the fears for a coronavirus resurgence both locally and globally.

For the week of June 29– July 3, 2020, the major US stock market indexes closed as follows on Thursday, July 2, 2020:

• Dow Jones Industrial Average: Close, 25827.36 +0.32% for the week, -9.50% Year-to-date

• S&P 500 Index: Close 3130.01, +1.50% for the week, -3.12% Year-to-date

• NASDAQ: Close 10207.63, +1.90% for the week, +13.76%, Year-to-date

• Russell 2000: Close 1431.86, +1.31% for the week, -8.92% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Workhorse Grp (NASDAQ:WKHS), Close 20.91, 5-day change +144.28%

2. Diamondpeak Holdings Corp Wt6 (NASDAQ:DPHCW), Close 2.34, 5-day change +96.62%

3. Prgx Global Inc (NASDAQ:PRGX), Close 4.77, 5-day change +33.24%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. Travelcenters Of America Llc (NASDAQ:TA), Close 13.56, 5-day change -38.36%

2. Liquidia Technologies Inc (NASDAQ:LQDA), Close 7.79, 5-day change -31.91%

3. Chiasma Inc (NASDAQ:CHMA), Close 4.51, 5-day change -31.35%

Economic events for the week July 6- July 10, 2020:

Important economic data for the week will be the ISM Non-Manufacturing PMI reading, and the Continuing and Initial Jobless Claims.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

PFE WKHS DPHCW PRGX

Disclosure: I have no position in any stock mentioned