US Stock Market Weekly Review June 22- June 26

The US stock market for the week ending on June 19, 2020, had weekly losses for all major stock indexes. There was a stock market selloff on Friday, June 26, 2020, with fears due to new coronavirus cases surge in several states, a key factor that we mentioned in our previous weekly market update. Tech stocks outperformed this week, while bank stocks were under severe selling pressure on news that the Fed will restrict the dividends and share repurchases of big banks after the recent stress tests released.

Economic news

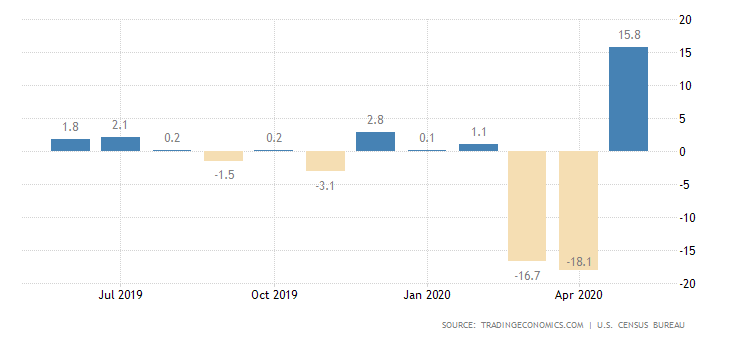

The economic news released has been mixed, with labor market data showing weekly jobless claims declining by less than expected, but continuing claims falling more than anticipated. The Markit Manufacturing Purchasing Managers’ Index showed an improvement for manufacturing data as the figure came in at 49.6 beating the estimate of 48. The May durable goods orders beat expectations with a figure of +15.8% much better than the forecast of +10.9%. New home sales came in well above consensus with a figure of +16.6% compared to the forecast of +2.9%. The extremely low-interest rates in the US market are a positive factor for the housing market, a particularly important economic indicator to monitor for economic recovery. The GDP Growth Rate QoQ Final (Q1) came in at -5%, the same as the forecast. The Michigan Consumer Sentiment Final came in at 78.1, worse than the forecast of 79.

United States Durable Goods Orders

“New orders for the US manufactured durable goods rose 15.8 percent month-over-month in May of 2020, rebounding from an upwardly revised 18.1 percent slump in April and above market expectations of a 10.9 percent increase. It is the biggest gain in durable goods orders since July of 2014. Demand for transportation equipment surged 80.7 percent, boosted by a 27.5 percent increase in motor vehicles and parts. Excluding transportation, new orders advanced 4 percent, and excluding defense new orders surged 15.5 percent. Core capital goods orders, which exclude aircraft and military hardware, went up 2.3 percent.” Source: Trading Economics

Durable Goods Orders measure the total value of new orders placed with manufacturers for delivery of hard goods with a duration of at least three years. To the extent that this big jump is not reversed the following month but proves to be positive, even at a lower reported figure, this news is considered positive for the US economy.

For the week of June 22– June 26, 2020, the major US stock market indexes closed as follows on Friday, June 26, 2020:

• Dow Jones Industrial Average: Close 25015.55, -3.31% for the week, -12.34% Year-to-date

• S&P 500 Index: Close 3009.05, -2.86% for the week, -6.86% Year-to-date

• NASDAQ: Close 9757.22, -1.90% for the week, +8.74%, Year-to-date

• Russell 2000: Close 1378.78, -2.81% for the week, -17.36% Year-to-date

Weekly Stocks Gainers

These are the top 3 gainers, stocks with 5 days of consecutive price advances:

1. Workhorse Grp (NASDAQ:WKHS), Close 9.90, 5-day change +102.87%

2. Altimmune Inc (NASDAQ:ALT), Close 10.60, 5-day change +43.24%

3. Otelco Cl A (NASDAQ:OTEL), Close 11.24, 5-day change +41.74%

Weekly Stocks Losers

These are the top 3 losers, stocks with 5 days of consecutive price declines:

1. 9F Inc ADR (NASDAQ:JFU), Close 3.85, 5-day change -54.22%

2. Carver Bancorp (NASDAQ:CARV), Close 5.64, 5-day change -53.77%

3. Optimumbank Hlds (NASDAQ:OPHC), Close 2.20, 5-day change -40.41%

Economic events for the week June 29- July 3, 2020:

Important economic data for this week will be the pending home sales, consumer confidence, and the June jobs report.

Sources:

https://www.wsj.com/market-data/stocks/us/indexes

https://www.barchart.com

https://www.fxstreet.com/economic-calendar

Disclosure: I have no position in any stock mentioned