Upcoming Quiet Period Expiration Likely To Boost MuleSoft Stock Price

Quiet Period Event - Expect A Price Increase around April 11 Expiration Date

The IPO quiet period is a period of time post a company's IPO, in which its underwriters are unable to release reports or recommendations on the stock. Following the expiration, these reports are often positive, widely distributed, and lead to a temporary boost in stock price. Our firm has studied the event in detail and found positive returns between day (-5,+2) time frame surrounding the quiet period expiration (day 0).

Factors that expand the likelihood for a stock price increase around the quiet period expiration are: an influential team of underwriters and a successful market debut, among others. MuleSoft's team of underwriters include: Goldman Sachs, J.P. Morgan, BofA Merrill Lynch, Allen & Company, Barclays, Jefferies, Canaccord Genuity, Piper Jaffray, William Blair. Additionally, its stock price is up 43.1% from its IPO price (pre-market session 4.3).

The company went public on March 16. At the time we were bullish on the stock and recommended an investment. We view the upcoming quiet period expiration as a second buying opportunity.

Company Background

Founded by Ross Mason in 2006, MuleSoft (NYSE:MULE) provides iPaaS and other integration technologies that help business customers to more securely and easily manage and connect their data across various applications. Its platform enables integration between different technologies and applications, and the company currently serves more than 1,000 customers in 60 different countries. Clients using its Anypoint Platform include big names such as Unilever, Toyota Motor Corporation Australia, the State of Colorado, Spotify, ServiceNow (NYSE:NOW), Salesforce, Office Depot Europe B.V., McDonald's, Dixons Carphone, The Coca-Cola Company, Citrix, ATT (NYSE:T), Accenture and General Electric (NYSE:GE).

(Click on image to enlarge)

(Company Website)

Executive Management Overview

Gregory Schott has been the CEO of MuleSoft since 2009. His previous experience stems from positions at IBM, Westinghouse, The Boston Consulting Group, Digital Generation Systems, Agile Software and SpringSource. Schott holds a Master of Business Administration degree from Stanford University and earned a Bachelor of Science in Mechanical Engineering from North Carolina State University.

Since 2014, Matthew Langdon has served as CFO of MuleSoft. His previous experience stems from positions at Donaldson, Lufkin & Jenrette, Bass Brothers Enterprises, Siebel Systems and TIBCO. He was educated at the University of Michigan and received his MBA at Northwestern University.

IPO Performance

Its strong IPO performance highlights demand for MuleSoft. The company went public on March 16, offering 13M shares at $17 each, above the expected price range of $14 to $16. Share price increased 45.6% of the first day of trading. Since then the stock price has remained relatively flat, ranging between $21.80 to $25.92. Current stock price is $24.58 (pre-market session 4.4).

Financial Performance

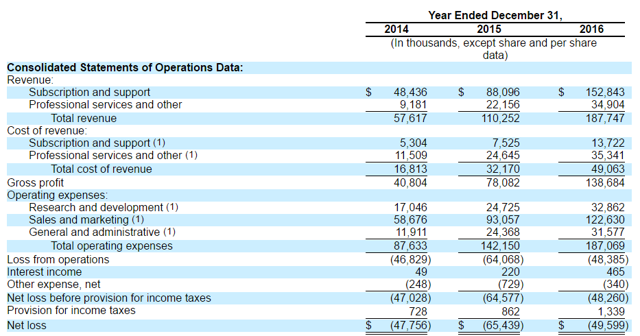

MuleSoft generates revenue from professional services as well as through its subscription service, and has increased revenue and margins at an impressive rate. The table below highlights results for the last three years.

(Click on image to enlarge)

(S-1/A)

Conclusion: Buy Ahead Of 4.11

We recommended an investment in MuleSoft ahead of its IPO and view now as another buying opportunity.

MuleSoft is a fast growing company and is well-positioned to take advantage of enterprises' growing need to securely and quickly integrate data across different applications and services.

We anticipate that the many underwriters will be eager to publish detailed positive reports and recommend the stock once restrictions are lifted.

Our firm expects a price increase in a short window of time surrounding the quiet period expiration on April 11.

We recommend aggressive investors consider making an investment to benefit from this expected price increase.

more