Unusual, But Not Unprecedented

Since its inception, the S&P 500® Equal Weight Index has outperformed the S&P 500 by 1.4% annually. Year-over-year performance margins, however, are anything but steady. Exhibit 1 shows that the S&P 500 Equal Weight Index and its cap-weight counterpart have gone through many performance cycles over the past 30 years.

(Click on image to enlarge)

Mega caps experienced record performance during the past year, especially in the Information Technology sector, which is up a remarkable 46% over the past 12 months (Apple, Microsoft, Alphabet, Amazon, and Facebook account for 18% of the S&P 500’s weight).

As a result, the performance of the S&P 500 Equal Weight Index, which has a small-cap bias, suffered, lagging the S&P 500 by 6.2% over the past 12 months. Exhibit 2 demonstrates that larger-cap stocks dominated within most sectors of the S&P 500, particularly in Information Technology. Of the 11 equal weight sectors, 9 underperformed their cap-weighted counterparts. Intra-sector weighting in Information Technology and its underweight to the sector were responsible for more than half of Equal Weight’s shortfall.

(Click on image to enlarge)

It is important to understand the historical context of Equal Weight’s recent underperformance. We can look to its history to put the current 6.2% loss in perspective. In August 2000, for example, the S&P 500 Equal Weight Index had underperformed by 5.9% over the trailing 12-month period. Exhibit 3 shows that this underperformance reversed itself in two months, followed by peak outperformance of 29.2% six months later in February 2001.

(Click on image to enlarge)

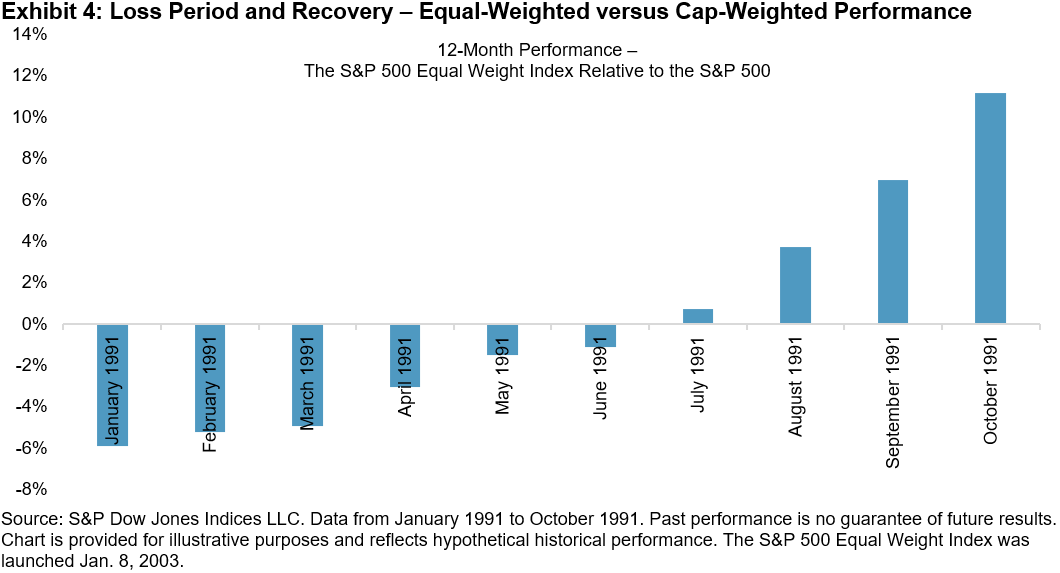

A similar occurrence took place in January 1991, when the Equal Weight underperformed by 5.9% over the trailing 12-month period. Exhibit 4 illustrates that, again, this underperformance reversed itself in the subsequent months with outperformance of 11.2% in October 1991.

(Click on image to enlarge)

We obviously can’t know in advance what the future relative returns of the S&P 500 Equal Weight Index will be. What history teaches us, however, is that Equal Weight’s recent underperformance is unusual, but not unprecedented.

Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information ...

more