Unpopular Opinion: Facebook Is Undervalued

Facebook (FB) stock made new historical highs above $240 per share on June 10, 2020. At current prices, the company has a market capitalization value of over $670 billion, and few investors would consider such a well-known name to be undervalued. However, the market could be putting too much attention on the short-term challenges, while underestimating the long-term growth opportunities that Facebook has to offer.

Considering the company's fundamental strengths and growth prospects in different areas such as advertising, shopping, digital payments, and virtual reality, the current valuation levels look quite attractive for long-term investors in Facebook.

Fundamental Quality

Facebook has reached a gargantuan scale. The company has 2.36 billion daily active people across its different platforms as of March of 2020, which represents a 12% increase versus the same quarter in the prior year.

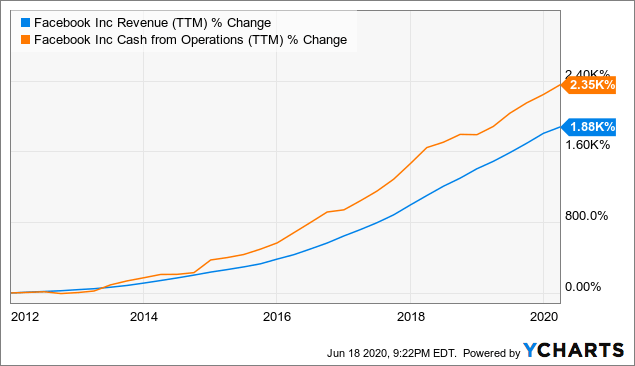

Financial performance in terms of both revenue growth and cash flow generation has been outstanding over time. The company reported a healthy increase of 18% in revenue last quarter, and while management did not provide any guidance due to the pandemic, it did note that revenue was stabilizing in April. The operating profit margin was 33% of revenue during the quarter, and Facebook ended the period with $60.3 billion in cash and investments on its balance sheet.

Data by YCharts

Going forward, the main Facebook platform is getting saturated, but the company still has plenty of room for growth with Instagram, and it is barely getting started with WhatsApp.

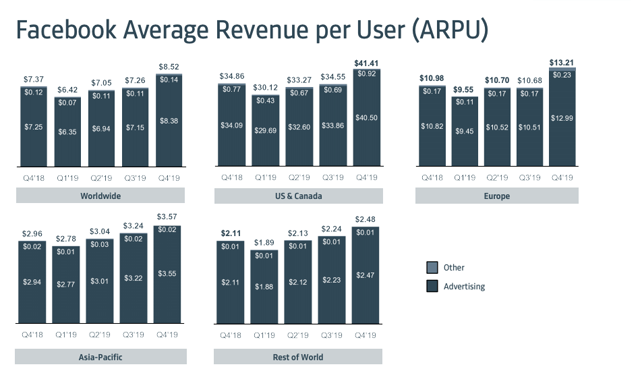

The average revenue per user is $41.41 in the U.S. and Canada, versus a much lower $8.52 on a global scale and a minuscule $2.48 in low-monetization regions. Just by bringing global monetization levels in different countries to levels more in line with those of the U.S., the company has plenty of room for sustained growth by increasing monetization.

Source: Facebook

Even more interesting, the company is aggressively venturing into new areas with enormous potential in the years ahead. Shopping could be a remarkably valuable opportunity for Facebook, and the alliance with Shopify (SHOP) in combination with a larger focus on online shopping for Instagram could open the doors to massive growth venues.

WhatsApp is currently launching digital payments in Brazil, and Facebook has partnered with PayPal (PYPL) to invest in Gojek, the Indonesian ride-hailing, food delivery, shopping, and digital payments app.

In essence, Facebook has an enormous user base and practically unlimited financial resources. The company could relatively easily combine its different communications platforms and build both an online shopping platform and a digital payments platform on top of that gargantuan user base.

Facebook is also one of the main players in Virtual Reality, an area that could be entering an explosive growth stage in the near term. The company has ambitious new projects in this area, and Virtual Reality, in combination with Artificial Intelligence, could blend very well with communications, data, shopping, and entertainment applications.

The competition will be tough across these different segments, and there is no such thing as guaranteed success in the tech business. Nevertheless, the point is that Facebook still has massive opportunities for long-term growth, both in its main advertising business and across different areas like shopping, digital payments, and virtual reality.

Attractive Valuation

Wall Street analysts are, on average, expecting Facebook to make $9.69 in earnings per share during 2021. Under this assumption, the stock is trading at a forward P/E ratio of 24.3 earnings for next year, a very reasonable valuation for a company with attractive opportunities and sky-high profitability.

Besides, it wouldn't surprise me at all to see Facebook outperforming earnings estimates in the years ahead, which would imply that the stock is much cheaper than what current valuation ratios are indicating.

It is important to keep in mind that earnings estimates are just projections that necessarily carry a large margin of error. This is particularly relevant for a company such as Facebook, which has plenty of optionality for new growth venues across different big and growing markets.

The table below shows the average earnings estimate, the lowest estimate, and the highest earnings estimate for Facebook among the analysts following the stock. As we can see, there is a considerable degree of dispersion among those earnings estimates.

| Fiscal Period Ending | Avg. E | Low E | High E |

| Dec 2020 | 7.29 | 6.28 | 8.16 |

| Dec 2021 | 9.69 | 8.04 | 11.1 |

| Dec 2022 | 11.99 | 9.74 | 14.03 |

| Dec 2023 | 13.58 | 11.6 | 15.01 |

| Dec 2024 | 15.65 | 13.6 | 17.3 |

| Dec 2025 | 17.11 | 15.72 | 18.5 |

Data Source: Seeking Alpha

Now we can look at the projected P/E ratio based on the different earnings estimates. If the actual numbers come near the high estimate, then Facebook would be trading at P/E ratios of 21.2 and 16.7 for 2021 and 2022 respectively. This would be a huge bargain for such a strong business.

| Fiscal Period Ending | P/E Avg. | P/E Low E | P/E High E |

| Dec 2020 | 32.2 | 37.4 | 28.8 |

| Dec 2021 | 24.3 | 29.2 | 21.2 |

| Dec 2022 | 19.6 | 24.1 | 16.7 |

| Dec 2023 | 17.3 | 20.3 | 15.7 |

| Dec 2024 | 15.0 | 17.3 | 13.6 |

| Dec 2025 | 13.7 | 14.9 | 12.7 |

Data Source: Seeking Alpha

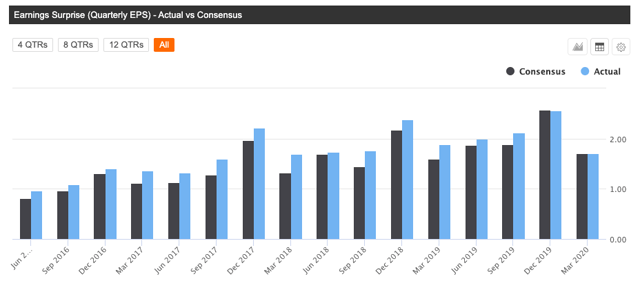

If history is any valid guide for the future, it is worth noting that the company has delivered earnings numbers above Wall Street expectations in 15 of the past 16 quarters. Past performance is obviously no guarantee of future outperformance, but winners keep on winning more often than not, and it is good to know that management likes to underpromise and overdeliver.

Data Source: Seeking Alpha

Valuation is an art as much as a science, and valuation ratios should always be interpreted in the context of other return drivers. A company that generates strong profitability and consistently beats earnings expectations deserves a higher price-to-earnings ratio than a business with below-average profitability and underperforming expectations.

However, it can be complicated to incorporate multiple factors into the analysis and quantify them in order to see the complete picture. In that spirit, the PowerFactors system is a quantitative system that ranks companies in a particular universe according to a combination of factors: financial quality, valuation, fundamental momentum, and relative strength.

Data from S&P Global via Portfolio123

The backtested performance numbers show that companies with high PowerFactors rankings tend to deliver superior returns over the long term, and the higher the ranking, the higher the expected returns.

Facebook has a PowerFactors ranking close to 99 as of the time of this writing. This means that the stock is in the top 1% of companies in the US stock markets based on quality, valuation, fundamental momentum, and relative strength together.

It is important to keep in mind that an algorithm such as PowerFactors is based on current data and current expectations about future data. Relying on hard data as opposed to opinions can be a sound approach for superior decision-making, however, this quantitative approach also has some limitations.

At the end of the day, future returns for investors in Facebook will depend on the cash flows that the company can produce in the years ahead. It is good to know that the valuation provides room for attractive returns if the company delivers, but the most important driver of future returns will be the company's ability to meet and ideally exceed expectations in the future.

It is very important to buy at a reasonable P/E ratio, but the future trajectory of E can be much more relevant for the evolution of P than the initial P/E ratio. This is especially important when holding a stock over long periods of time.

The Wall Of Worry

An old saying in the stock market is that bull markets climb a wall of worry. This is true not only for the broad market but also for individual stocks. When everyone else is bullish on Facebook, chances are that the stock is already too expensive and the best is already in the past. However, there are plenty of concerns surrounding Facebook nowadays.

An obvious consideration is the global recession produced by the COVID-19 pandemic. Advertising is a cyclical industry, and while Facebook delivered much better-than-feared numbers for the first quarter of 2020, we need to acknowledge that a long recession could inflict further damage to the company's revenue. Besides, Facebook has increased investments in security and R&D over recent years, which is putting pressure on profit margins.

If you are a long-term investor, however, this should not much of a reason for concern. Management is doing the right thing by investing in the platform and prioritizing the health of the business above short-term margins.

In any case, Facebook is still making an operating profit margin above 36% of revenue and a net profit margin of around 28.5%, so profitability is still stratospheric in spite of the recession and the increased spending.

The recession will hurt revenue growth in the short term, but this is only a temporary factor by its own nature. Over the long term, the pandemic will probably lead many businesses to acknowledge that they need to keep a strong online presence to protect their relationship with customers and to keep their commercial channels functioning in times of social distancing. Facebook and its different platforms will emerge from this crisis stronger than ever.

The regulatory uncertainty will probably become an even bigger issue around Facebook with the elections approaching in the coming months. However, regulatory pressure will not derail the company from its long-term growth opportunities.

The most likely scenario is that regulations will be focused on reasonable goals, such as policing privacy and illegal content. It can take time, money, and effort for Facebook to adapt to new regulations, but the company is strong enough to continue thriving while facing increased regulatory pressure.

In any case, regulatory risk is already incorporated into market expectations and into the stock price to a large degree. If anything, the short-term uncertainty surrounding Facebook stock seems to be creating a good entry price for long-term investors in the company.

Facebook stock is already attractively priced based on current expectations for growth, and there is a good chance that the company will do better than expected in the years ahead, making the stock a potential bargain for investors with a long-term horizon.

Disclosure: I am/we are long FB, PYPL.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship ...

more