UNH Stock Forecast: A Defensive Company For Uncertain Times

Highlights

- United Health benefited by the pandemic as most people continue to pay for insurance and new clients have been added

- United Health is a huge company, with a great balance sheet, but in a market with low growth rates

- In a scenario where central banks raise interest rates due to inflation, United Health shares will not be as affected as technology companies

- United Health stock forecasts are good, as the company pays steady quarterly dividends and is trading at a fair valuation.

Overview of the Market

The worldwide health insurance market has always been resilient and tends to remain so for quite some time. This is because, in crises, such as Covid, people do not stop paying for the health plan, and when the economy is good, people continue to pay for the plan and more people sign up. However, it is not a market that has large growth rates like e-commerce or retail. For these reasons, the shares of companies in this sector are considered more defensive and optimal for moments of uncertainty, that is, for UNH stock we have a very positive forecast.

The market had an average year-on-year growth of 6.6% from 2017 to 2019, and for the next years, it is projected to grow in an annual CAGR of 5.5% from 2021 to 2028 reaching a total market size of USD 3,038.6 billion in 2028.

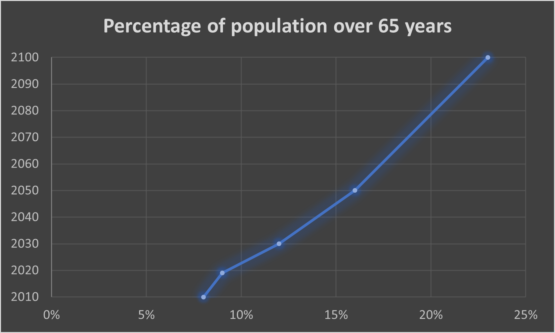

This growth is explained by different reasons. Most importantly, because the world population is getting older, and older people use more health care services, therefore insurance gets more expensive. In 2019, 9% of the population was older than 65, and it is estimated that by 2050 16% of the population will be over 65. This increasing number will contribute to the future growth of the company.

Competition

Most of United Health’s revenue comes from the US, which is a very competitive market. The US market has 10 big health insurance companies, but the top 4 companies have more than 40% of the market share. United Health has approximately 14.4% and used to have around 16%.

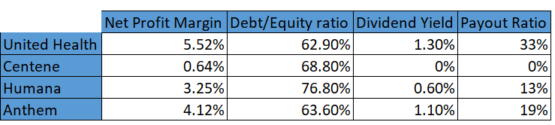

When comparing the efficiency between United Health and its competitors, we can see that UNH is much more efficient and profitable in terms of margins than its competitors. We can observe a higher Net profit margin for United Health as well as a higher Dividend Yield. When comparing the net profit margin of the top 4 companies of market share, we can see a big advantage of UNH. Also, United Health has a much smaller debt/equity ratio than its competitors. And, United Health has paid a steady dividend in the last decade. The dividend yield for the stock has low volatility and paid between 1.2% and 1.8% since 2012.

Solid Balance Sheet

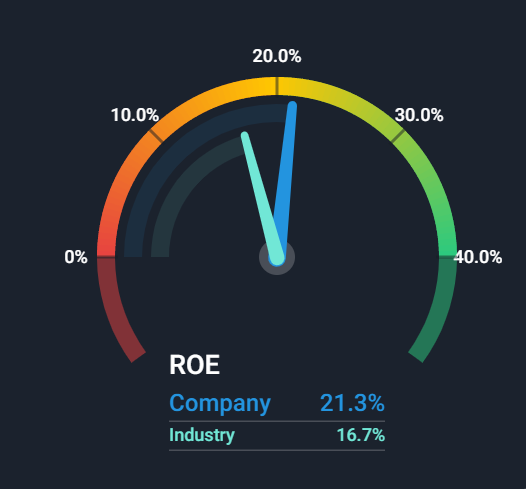

In the last few years, United Health has been able to reduce significantly its debt/equity ratio. UNH has reduced its debt/equity ratio from 84.1 to 62.9 in the last 5 years. Also, the interest the company pays for creditors is covered more than 13 times by the company EBIT, showing a mature and secure company. The company’s ROE beats the market in most time horizon and will likely remain at high levels. The actual ROE of the company beats the market average by almost 5%.

The revenue of the company has grown in an annual CAGR from 2010 until 2020 of 10.56%. There were 3 years that the company grow at a double-digit rate. In 2014 the company’s revenue increased by almost 17%, in 2015 grew by 15%, and in 2017 by more than 11% year-over-year.

Impacts of inflation on Company operation

All over the world, inflation has risen again and is bothering central banks, and this inflation is reflecting directly on the health insurance market and other markets all around the world.

Since United Health is the leader of the market and has almost 15% of the market share, the company has a greater ability to readjust prices than other insurance health companies. Even though United Health lost a little of its market share in the last years, the company for being the market leader has an easier life because they have a higher margin and a lot of cash to use if the company needs to hold out for a while without being able to readjust prices.

This is important because, in this scenario in which the CPI (the USA inflation index) is reaching higher rates, United Health manages to hold out longer without readjusting the price or even reducing its margins for a certain period, since the margins are much higher than those of its competitors. For this reason, UNH stock has a better forecast for the future than its competitors in the insurance health market.

Impacts of inflation on valuation

Inflation will have another big impact on the American stock exchange, and it is already having a similar impact on other stock exchanges around the world: the rising of interest rates by the central bank. With the rising of interest rates, there are 4 main problems for stocks. The WACC used in the DCF models of the companies will grow, and by that mainly technology companies will be more affected. This happens, because companies that have most of their cash flow in the future will need to discount with a higher cost of capital reducing their valuation.

Therefore, United Health’s shares will not suffer as much as technology companies. This occurs because, as the company is already mature, cash flows are more in the present or in the near future and therefore there is not much discount when bringing it to present value.

There are 3 other reasons why rising interest affects the stock market: decrease in future profits, people reducing the risk in their portfolio and migrating to fixed income, and demand contraction in the real economy. Future profits will reduce because debt expenses will increase. Other than that, fixed income will be more attractive since now the USA 10 years treasury bond is 1.5% and the inflation more than 6%, and with higher interest rates and less inflation, people will allocate a bigger part of their portfolio in fixed income. Lastly, with higher interest rates, credit gets more expensive and the demand in the economy tends to reduce.

UNH won’t be as affected as other companies for these reasons above, because investors which are more risk-averse can still invest in United Health stock since its a mature company, with stable dividends and less volatility than the market. Other than that, even with contraction in the economy, people won’t stop paying for health insurance, and retail companies tend to be more affected. For the reason that health companies don’t lose too much revenue in a hawkish scenario, the future profits won’t be much affected.

Future and Growth Strands

Since health insurance isn’t a high-growth market, a strategy to grow for United Health could be by inorganic growth/ M&A. There is a transaction that is waiting for approval to happen that is an acquisition of Change Healthcare by UNH. This could boost the UNH stock forecast since it could be complementary to United Health’s core business. As projections for the coming quarters are generally conservative, the company is not counting on this acquisition to grow.

Even though Change Healthcare’s market cap is small (6.47 billion dollars) compared to United health’s (which is one of the biggest companies in the world), they have a lot to contribute to UNH. “Change Healthcare will join with OptumInsight to provide software and data analytics, technology-enabled services and research, advisory and revenue cycle management offerings to help make health care work better for everyone.”

Other than that, since the company that will probably be bought is small, there should be no regulatory problem regarding this M&A.

Regarding the financial health of the company, we can predict that the payout ratio will maintain around 28%, and by that, the company will have more than enough money to pay its debt and reinvest in the business. United Health has a very good track record of capital allocation and a great return for shareholders. The return over investment (ROI) of the company, since the third quarter of 2009, has been higher than 10%. When analyzing one of its biggest competitor’s ROI we can understand one of the reasons that cause UNH to trade in a higher multiple. Anthem, the second company in market cap in the health insurance market, has had an ROI between 5% and 10% in the last decade.

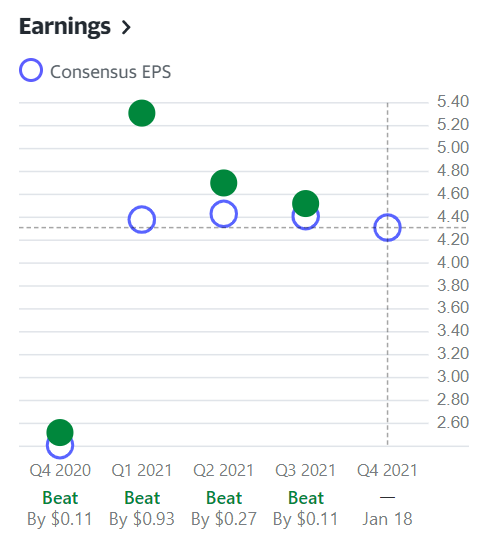

United Health managed to beat the market expectation in the last 4 quarters towards the earnings. For the next quarter, they are expected to have an Earning Per Share of 4.31.

Valuation

When looking into the company’s P/E, we can observe that the United Health stock is being traded at a higher price than the market, and higher than the average of the health insurance market. United Health is traded around 28x and the sector trades around 21x. It is fair to UNH stock trade in a higher multiple because the company has a better forecast.

As for the forward P/E, the difference between the company and the sector diminishes a lot. This is because the company has growth projections far above the market average. According to Guru Focus, UNH forward P/E is 21.28, and its biggest competitor (Anthem) is currently trading in a forward P/E of 15.24. It is normal for a company like UNH to be traded in higher multiples, due to its greater efficiency and profitability.

Conclusion:

I would recommend a buy for UNH stock since its projections are good. Investing in UNH is adding a mature company with reliable growing dividends, and their revenue and earnings are also growing. It is a defensive company, that can protect your portfolio in case the FED raises the interest rates, which also can provide great compound returns. So, it should be a good option for your portfolio for the long term.

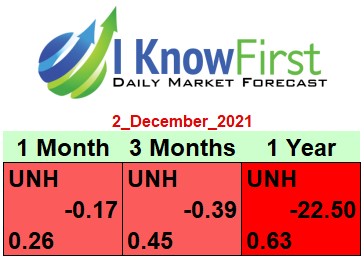

The I Know First algorithm is issuing negative signals for the stock price. For the 1 month and 3 months the signal is very weak, close to zero, and for 1 year is still a weak signal, therefore the position recommended is neutral in this case as we don’t see strong signals from the algorithm.

On June 14, 2020, the I Know First algorithm issued a bullish forecast for the United Health stock price for a period of one year. The algorithm successfully forecasted the movement of the UNH share. After one year, UNH shares rose by 39.98% in line with the forecast. See chart below.

Here at I Know First, our stock market AI has modeled and predicted assets price movement worldwide for short-term and long-term time horizons, ranging from 3 days to a year. Since 2011, we ...

more