UMC Stock Forecast: What Is The Potential After Explosive Growth?

Highlights:

- 2Q21 Revenue: NT$50.91 billion (US$1.83 billion) up 8.1% from the previous quarter

- Production capacity utilization exceeded 100% in 2Q21

- Global 5G connections will more than double by 2025

Overview

United Microelectronics Corporation (UMC) is a Taiwanese company based in Hsinchu, Taiwan. It was founded as the first Taiwanese semiconductor company in 1980. The Company’s main products are consumer electronic ICs, memory ICs, personal computer peripheral ICs, and communication ICs.

UMC is best known for its semiconductor business and IC wafer manufacturing for semiconductor companies that do not have a factory. In this role, UMC is inferior to its competitor TSMC. It has four 300mm factories: one in Taiwan, one in Singapore, one in China, and one in Japan. UMC is listed on the Taiwan Stock Exchange as 2303. UMC has 12 manufacturing facilities worldwide and employs approximately 19,500 people. UMC is a major supplier to the automotive industry.

Is UMC A Good Growth Stock?

United Microelectronics Corporation UMC is a good example of growth stocks. The electronics and semiconductor firm saw of 182.11% EPS increase year-over-year for the twelve months (ending June 30, 2021) and tripled over the past 12 months. Let’s take a look at the company’s key performance indicators for the last quarter to see if the stock still has upside potential.

Consolidated revenue in the second quarter of 2021 (April 1 – June 30) was NT $ 50.91 billion (US$ 1.83 billion), that up by 8.1% from the previous quarter. Compared to last year, revenues in 2Q2021 grew by 14.7% YoY from 44.39 billion New Taiwan dollars in 2Q2020.

(Figure 1 – Monthly Sales Revenue 2021 compared to 2020 (1,000 New Taiwan dollar))

Jason Wang, co-president of UMC, said in a quarterly report that strong demand caused by the introduction of 5G and digital transformation provided the company with strong results in the second quarter. Production capacity utilization exceeded 100%, wafer shipments increased 2.9% QoQ to 2,440K, while quarterly capacity grew to 2,370K. Revenues from 28nm technology continued to grow steadily, driven by applications built into 4G / 5G smartphones, solid-state drives, and digital TV.

According to the GSMA, Global 5G connections will more than double by 2025. The merchant predicts that 5G will account for 21% of all mobile Internet connections by 2025, as carriers invest more than 80% of their capital investments in 5G infrastructure. The GSMA predicts that by the end of 2025, more than two-fifths of the world’s population will live in areas covered by 5G connections, and 4G will peak at just under 60% of total connections in 2023. Considering that the introduction of 5G technologies is going on at an intensive pace, this will provide serious support to the company’s business.

It is also worth paying attention to the news that Wallace Kou, president of Silicon Motion Technology Corp., predicted that the flash memory controller chip supply crisis would continue in 2022. Kou expects the 28nm and 40/55nm technology capabilities in foundries to remain incredibly limited and may not meet demand by up to 50% in 2022. Under these conditions, UMC raised prices in July for 28 mm chips by about 13%, which will ultimately have a good impact on profit in the 3rd quarter. The 28nm process is now the leading technology for the company, and in the structure of revenue from the sale of wafers, it occupies a 20% share for the second quarter in a row. It targets a wide range of applications, including portable devices such as mobile and wireless, as well as high-performance applications such as the digital home and high-speed networks.

Let’s take a look at some of the fundamental indicators of the company that will help us understand its current financial health and position in the market and industry. First, we can see a steady decreasing UMC’s debt-to-equity ratio since the beginning of 2019 (now it 0.26). A declining debt-to-equity ratio indicates a declining level of leveraged financing, which indicates that the business is more resilient to market shocks.

According to GuruFocus, UMC’s ROE of 15.9% is higher than 70% of its peers in the Semiconductors industry. This can exhibit the company’s excellent profit generation ability from its equity. Net Margin of 19.31% is higher than 82% of its peers in the industry. During the past 12 months, United Microelectronics’s average earnings per share (NRI) Growth Rate was 163.70% per year. During the past 3 years, the average earnings per share (NRI) Growth Rate was 35.60% per year that better than 74% of companies in the Semiconductors industry.

UMC looks interesting in terms of Piotroski F-Score and Altman Z-Score. Piotroski F-score is a number between 0 and 9 that is used to assess the soundness of a company’s financial position. A score of 7 may indicate that the company’s stock is undervalued and can be interpreted by investors as a good signal to buy the stock. The Altman Z-score is the result of a credit test that measures the likelihood of a publicly owned manufacturing company going bankrupt. It is also at a good level for UMC.

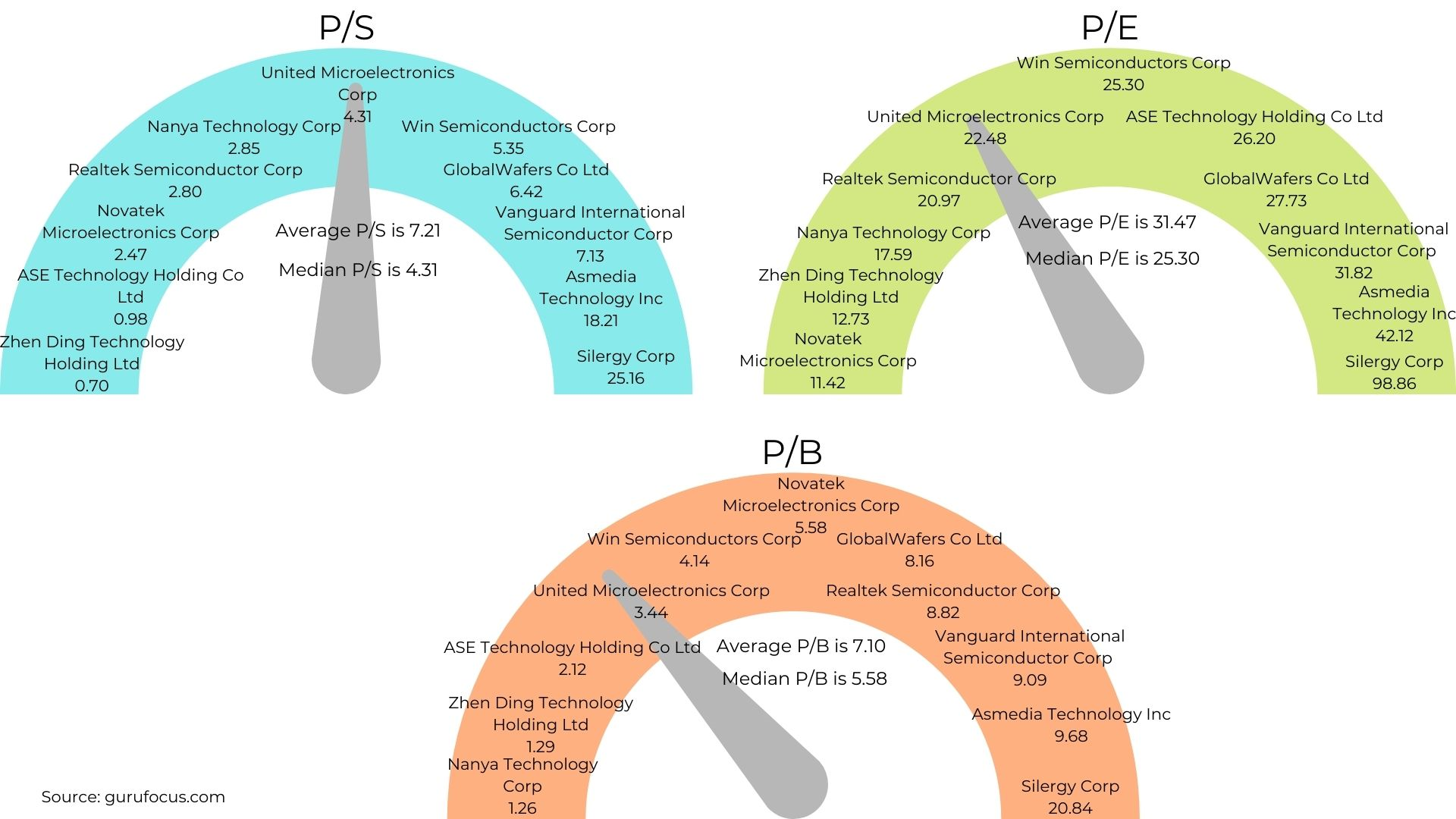

Next, we can choose several comparable companies of UMC and make a comparable valuation. UMC’s current P/B ratio of 3.44 and P/S ratio of 4.31, and P/E ratio of 22.48 present that UMS stocks are being undervalued. These price ratios may indicate that despite strong gains in the past 12 months, the company’s potential has not yet been exhausted.

Technical Analysis

The daily chart shows that an ascending triangle figure has formed in the company’s shares, and since August 27, the company’s shares have gone up beyond the resistance line. The rally in the company’s shares lasted 7 months from mid-July 2020 to mid-February 2021, and since then there has been accumulating in the triangle channel. The uptrend in shares is also confirmed by the EMA-50 days, 100 days, and 200 days, and since the beginning of August, the EMA has accelerated its growth.

(Figure 4 – UMC 1D: December 2020 – September 2021)

Conclusion

In a nutshell, UMC is one of the most efficient companies in the Semiconductors industry with an ROE of 15.9% is higher than 70% of its peers. United Microelectronics Corporation is optimistic that the number of 5G connections will more than double by 2025, which will directly affect the demand for its products. The technical picture in the company’s shares also indicates the upside potential of the securities, so I am optimistic about the growth of the company’s shares in the next 12 months.

It is worth paying attention that the stock-picking AI of I Know First has a high signal on the one-year market trend forecasts, supporting my position for the UMC stock forecast. UMC has a strong signal for all time horizon forecasts.

Past Success With UMC Stock Forecast

On August 5th, 2021, I Know First’s Tech Giants Stocks Forecast package had accurately predicted 8 out of 10 stock movements on a 1-month forecasted period and achieved notable returns. UMC stock forecast was one among the recommended long-position stocks that saw a great return of 14.16%, outperforming the S&P 500 benchmark (3.02%) with a market premium of 11.14%.

Disclosure: This article originally appeared on Iknowfirst.com, a financial services firm that utilizes an advanced ...

more