Ulta Ugly And Other Earnings Losers

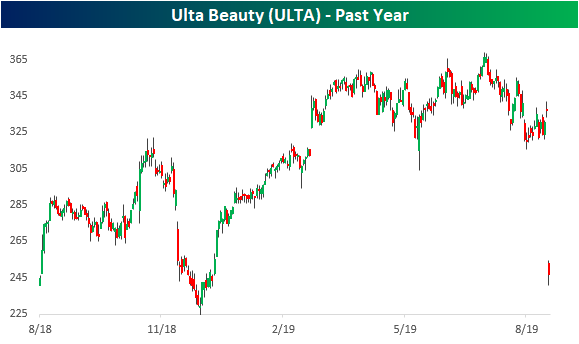

Last week, retail had been showing some strength with solid earnings results and solid price action to match. While stocks like Target (TGT) and Lowe’s (LOW) saw record positive price reactions in response to their earnings reports, Ulta Beauty (ULTA) reported after the close last night and is seeing quite the opposite result. ULTA’s quarter left a lot to be desired. In addition to lowering guidance, the company missed EPS estimates by 4 cents while revenues were also weaker than estimates. In response to this negative “triple play” report, investors are dumping the stock. ULTA gapped down 25.1% at the open and has fallen another few percentage points lower intraday as the stock now sits down 28.7% as of this writing. This is the worst stock price reaction to earnings that ULTA has ever seen, surpassing the previous worst 21.81% gap down and 20.5% full-day decline in response to its December 5th, 2013 report. As shown below, 10 months of strength for the stock have been wiped out in one morning. It doesn’t get much more depressing than that for a shareholder.

(Click on image to enlarge)

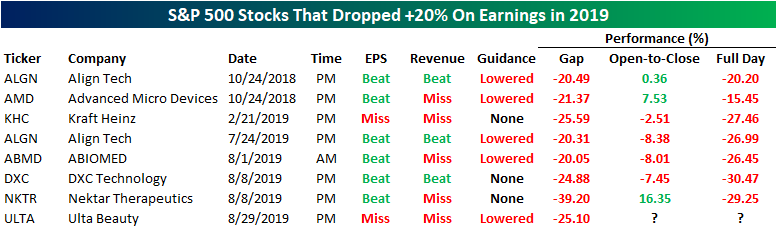

Since this time last year, other than ULTA, there have only been six other S&P 500 stocks that gapped down over 20% in response to earnings, and only two of these—Kraft Heinz (KHC) and Nektar Therapeutics (NKTR)—gapped down over 25%. Align (ALGN) is the only stock to have gapped down over 20% in two different quarters in the past year.

(Click on image to enlarge)

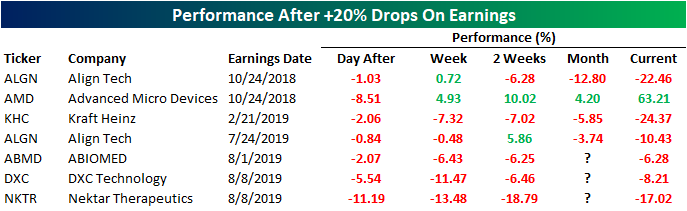

For these stocks that have experienced severe declines in reaction to earnings, forward performance has not been great. The next day after earnings, each of these stocks has fallen further with declines ranging from 0.84% all the way to -11.19%. The week, two weeks, and month after also see little respite as only Advanced Micro Devices (AMD) moved higher in each of these periods. In fact, AMD is the only stock that is higher today than it was after its large drop in response to earnings.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer and much ...

more