"Two Weeks That Changed The World": A Goldman Post-Mortem On "The Squeeze"

It was almost exactly three months ago, long before the Reddit short squeeze fireworks, when we were parsing through the latest quarterly Hedge Fund Tracker report from Goldman Sachs which famously breaks down the 50 most popular hedge fund long and short positions, when we repeated what we have said for much of the past decade:

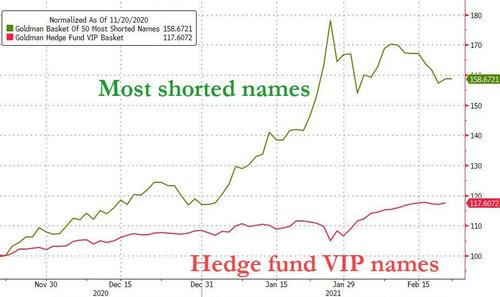

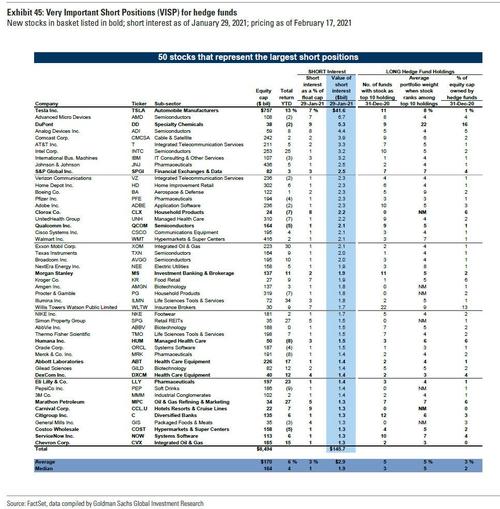

... since it is the most shorted stocks that end to do far better than the most popular ones, especially during market-wide squeezes such as the one seen since March, here is also the list of 50 most-shorted stocks. As usual, our advice is to go long the most hated names and short the most popular ones - a strategy that has generated alpha without fail for the past 7 years, ever since we first recommended it back in 2013.

We said this on November 20, 2020, which we bring up because as everyone knows by now, what transpired since has been the biggest coordinated short squeeze in history, and anyone who listened to our advice and put on the abovementioned pair trade is now up some 40% in the past 3 months, an annualized return of over 160%.

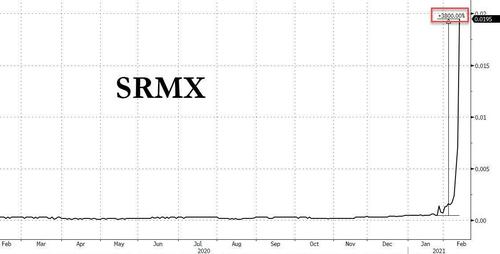

Actually, those who were reading us during this historic short squeeze melt-up may already have retired, because while many were chasing GameStop, one of our favorite squeeze trades was to go long a heavily shorted microcap, SRMX, as we revealed on Jan 27, and just two weeks later, SRMX was up 3,800%, double the peak performance of GameStop.

Yet while our readers profited handsomely from January's epic moves, in many cases generating historic returns, there were also just as many who had a terrible month: they are better known as hedge funds. And it is their plight that Goldman's latest Hedge Fund tracker focuses on.

What follows below will not be surprising or new to any of our readers, who were presented with front-row seats to the historic events as they unfolded in January and early February. Still, what Goldman's Ben Snider has done in his latest Hedge Fund Trend monitor (in which he analyzes the holdings of 820 hedge funds with $2.8 trillion in gross equity positions), is a good recap of some of the key catalysts and milestones behind what was to many financial professionals, two weeks that changed the world of finance starting with the January 22 breakout in Gamestop stock, and ending with the February 5 collapse in the most shorted names and the apparent return to normalcy.

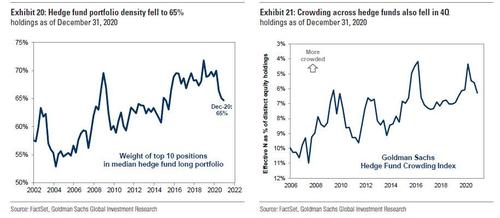

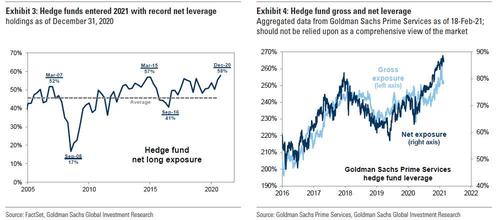

As Snider writes, January’s short squeeze showed the risk posed to both hedge fund returns and broad market performance by record leverage and a high degree of crowding, two factors (both the byproduct of years of "idea dinners") which we have repeatedly warned in the past would one day come and bite the hedge fund industry in the ass.

As we noted at the time:

hedge fund net leverage at all time high pic.twitter.com/zgtHwkuheD

— zerohedge (@zerohedge) December 7, 2020

Hedge funds entered 2021 with the highest levels of net and gross exposure on record. And although the average fund’s portfolio concentration and the degree of crowding across hedge fund portfolios declined in 2020, both of those measures remained elevated relative to history, Snider notes.

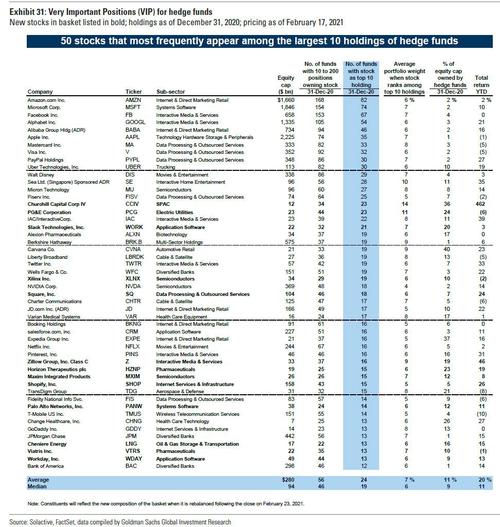

As an illustration, the top five constituents of Goldman's Hedge Fund VIP list of the most popular hedge fund long positions have remained unchanged for 10 consecutive quarters, including this quarter’s rebalance (although while 13Fs showed positions as of Dec 31, this may well have changed after the January fireworks).

That's because short covering that began following vaccine efficacy announcements in November accelerated in January, leading eventually to broad hedge fund de-grossing that weighed on popular hedge fund long positions and the aggregate S&P 500.

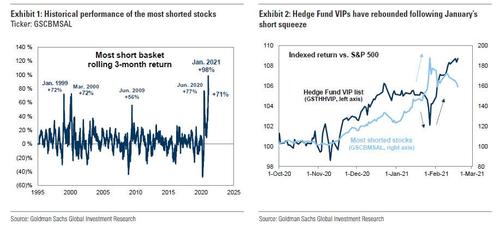

Meanwhile, as we predicted well in advance, Goldman retroactively points out that a rolling basket of the Russell 3000 stocks with the highest short interest as a share of float rose 42% in January, capping a record three-month return of 98% for the most heavily-shorted stocks (to those who listened to us and put this basket on as a long, congratulations).

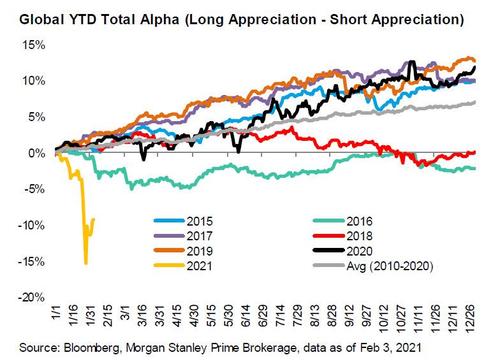

As Goldman then notes, "this tipped a chain of dominoes that led to the largest week of active hedge fund de-grossing since February 2009, according to Goldman Sachs Prime Services, which caused our Hedge Fund VIP list to decline by 6%, the S&P 500 to dip by 4%, and an average January return of -1.2% for long/short equity hedge funds."

Conveniently, starting with the day Robinhood decided to block most purchases of most shorted stocks - effectively putting a stop to the process that "scared" Interactive Brokers CEO Thomas Peterffy said brought markets "frighteningly close" to breaking during the Reddit Raid - hedge fund performance has rebounded in the weeks since the short squeeze, and leverage - while off its peak - remains close to the highest levels on record. In fact, hedge funds are now even more levered:

"Aggregate hedge fund net leverage calculated based on publicly-available data registered 58% at the start of 2021, surpassing the previous record level of 57% in early 2015. Higher-frequency exposures calculated by our colleagues in Goldman Sachs Prime Services also showed record leverage prior to the January short squeeze. According to their data, net and gross leverage each now register at the 99th percentile."

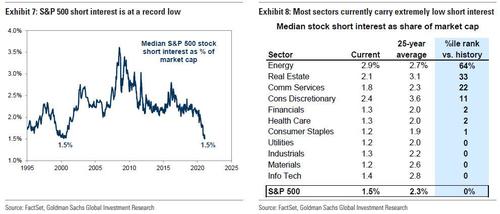

This should not be a surprise: consider that January's short squeeze occurred against the backdrop of already extremely low aggregate short interest - largely a function of the short extinction-level event unleashed by the Fed last year which sent stocks soaring to record highs - and which has continued to decline. In fact, the median S&P 500 stock has outstanding short interest equating to just 1.5% of market cap, matching the record low in 2000. In most sectors, short interest outstanding currently ranks in the bottom decile of the last 25 years, with Goldman noting that only Energy sector shorts registering above the historical average (this is why JPMorgan believes that the next massive squeeze will focus on energy names starting some time in March).

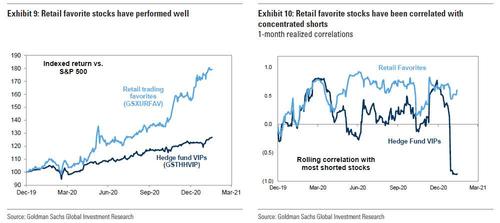

Yet while most hedge funds suffered through a devastating January, where the alpha drawdown among the hedge fund universe was the worst on record leading to cascading VaR shocks Retail investors were by and far the big winners.

That's why Goldman writes next that the January short squeeze and apparent pockets of froth in the equity market have turned investor focus to the impact of individual retail traders: "Broker activity, trading volumes in penny stocks, and inflows into levered ETFs all reflect the surge in retail trading activity that contributed to the sharp recent rally in heavily shorted stocks."

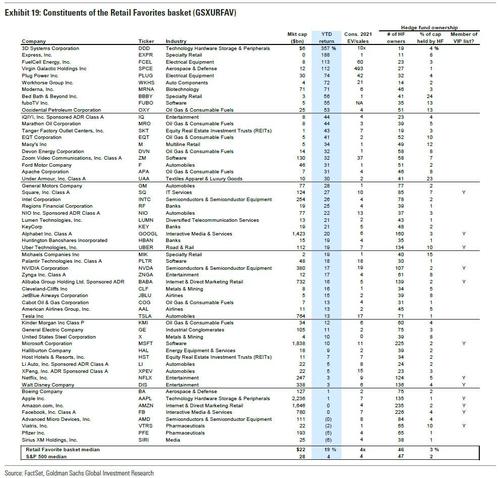

In general, the most popular stocks among retail investors have performed well; a basket of Retail Favorites (ticker: GSXURFAV) has returned 18% YTD, outperforming both our VIP basket of the most popular hedge fund long positions (+8%) and the broad S&P 500 (+4%). Notably, the retail favorites have been positively correlated with the most heavily-shorted stocks, in contrast with the recent sharply negative correlation of our Hedge Fund VIP basket (Exhibit 10).

The dramatic gains by retail investors also explain the substantial outperformance of value over growth names in 2021. Goldman explains:

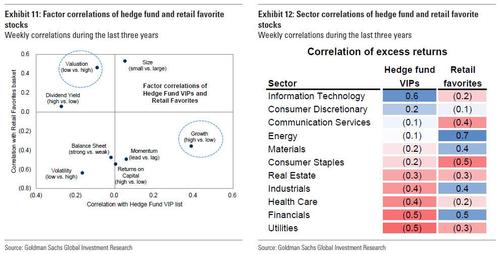

In general, the favorite retail trading stocks tend to be tilted toward Value as a factor, while hedge fund favorites are more correlated with Growth. Similarly, at the sector level, the largest weight and correlation of Hedge Fund VIPs is with Info Tech stocks, whereas retail favorites have been more correlated with cyclical value sectors like Energy and Financials.

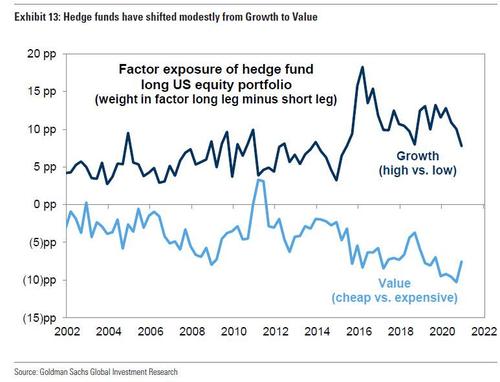

As a result, while hedge funds have shifted "slightly" toward Value in recent quarters, Goldman notes that they remain firmly in the Growth camp.

This is similar to events in the second half of last year, when ahead of vaccine efficacy results and the 2020 elections, funds rotated modestly toward Value, including lifting positions in Financials. However, the rotations fizzled in the 4th quarter, as vaccine news surpassed expectations but Election Day 2020 failed to result in a large “Blue Wave.” At the factor level, funds continued to shift from Growth to Value, but changes in sector and subsector tilts generally favored secular growth over cyclicality.

Of course, between hedge funds' even higher (record) net leverage and continued bets on growth stocks, what happened in January may very well happen again - in fact it is virtually assured following the next big reflationary catalyst. We are starting to see that already, because as yields rise it is the growth and high-duration stocks that are getting hammered the hardest:

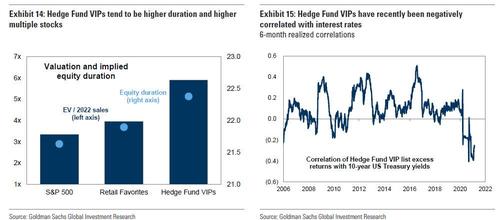

Consistent with their factor tilt toward Growth, the most popular hedge fund long positions have recently been very negatively correlated with interest rates. Hedge Fund VIPs generally have higher implied equity duration and higher valuation multiples than both the retail favorite basket and the S&P 500. For more on equity duration and sensitivity to interest rates, see Q&A on rates and equities, February 7, 2021

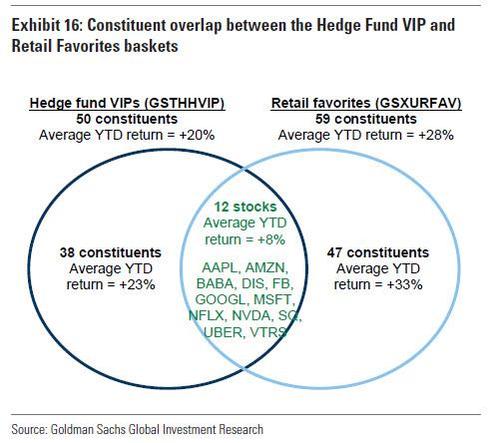

And yet despite their investing differences, hedge funds and retail investors do share some commonality in their portfolios. 12 stocks in Goldman's Hedge Fund VIP basket also appear in the Retail Favorites basket: AAPL, AMZN, BABA, DIS, FB, GOOGL, MSFT, NFLX, NVDA, SQ, UBER, VTRS.

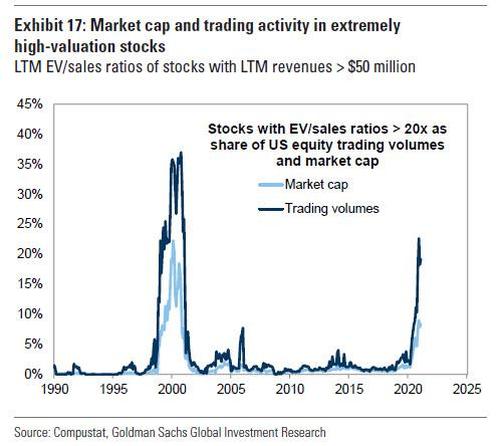

Furthermore, Goldman notes that both investor groups have also contributed to the surge in trading activity among extremely high-growth, high-valuation stocks; each basket contains a number of stocks trading above 20x EV/sales, although none of those stocks appear in the overlap between the two baskets.

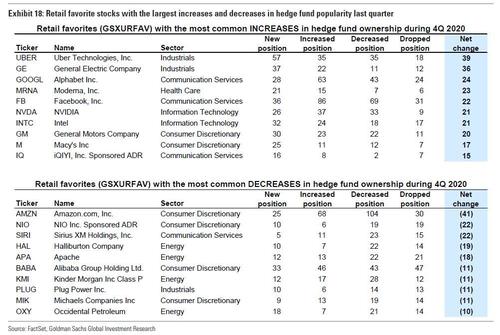

Goldman concludes, as usual, by looking ahead in the rearview mirror, and in the table below lists the retail favorite stocks with the largest increases and decreases in hedge fund popularity last quarter while the next chart shows the entire Retail Favorites basket.

The basket is rebalanced monthly to include the stocks with the highest dollar notional volume of small share trades during the previous month

And while all of this information is great, what would have been far more practical - not to mention lucrative - is for Goldman not to do a "post mortem" but to predict ahead of time, that the most shorted stocks would explode and the most popular ones would collapse- you know, as analysts used to do once upon a time when they correctly called the future... like for example we did in our Nov. 20 post.

And since all of the above confirms that absolutely nothing has changed, we will end this post the same way we end all our hedge fund performance wraps - by telling our readers that the most profitable decision they can make is to once again go long the most shorted names while shorting the hedge fund hotel of 50 or so "VIP" names that have emerged after countless shadowy and collusive (if not collusive enough to warrant a Congressional hearing) idea dinners.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more