Two "Game Changers" Improve Outlook

Executive Summary

The combination of Abbott (ABT)'s new rapid COVID-19 test and Jay Powell's announcement that the Fed is taking a new tack on their approach to inflation pushed the S&P 500 to another all-time high on Thursday, August 27.

While both can be viewed as "game changers," the realization that the Fed won't be embarking on any preemptive rate hikes if/when inflation rises means rates are likely to stay near zero for longer than even the most ardent bulls had expected. And this looks to be the real key to the fundamental backdrop to this market.

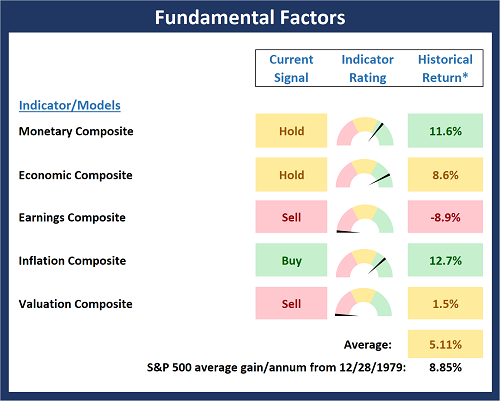

The State of the Fundamental Models

There are no changes to report on the Fundamental Factors board this week. However, I will contend that the Fed's major policy shift announcement effectively should tilt Monetary conditions toward a very bright shade of green.

Since the idea of an "average inflation target" is brand new, it will be interesting to see if any of our monetary indicators will pick up on this over time. But for now, the Fundamental board is largely neutral.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR.

About Yesterday's Rate Move

In light of the fact I am arguing that Jay Powell and Company's new approach to inflation will be a positive for monetary conditions, you may be wondering why the yield on the ten-year spiked 6 bps yesterday. While 6 basis points (0.06%) doesn't sound like much, the move represented an 8.6% increase in yield. Thus, one might argue that the bond market reacted negatively to Powell's announcement.

US 10-Year Yield - Weekly

However, I will contend that the move up in yields was more likely connected to the news that Abbott Labs has a cheap, accurate, and fast COVID-19 test.

Exhibit A in my case here is the action in the airlines and other industries that can't function with social distancing requirements. Stocks like United Airlines (UAL) and Marriott (MAR), which are poster children for this space, enjoyed good days - rising 5.75% and 4.5%, respectively.

In addition, as the weekly chart of the ten-year shows, yields did move up yesterday. Yet the primary trend is still down.

For me, the bottom line is that if the public can get access to cheap, accurate, and fast COVID-19 tests, then some semblance of normalcy could possibly be on the horizon. Especially when you combine such testing with the upbeat news on the vaccine front. And if a return to "normal" is something investors can begin to entertain, then one has to be optimistic about both the economy and stock prices.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more