Two Enticing Midstream MLPs To Own For Growth

The most recent deal in the midstream MLP industry strengthens the thesis that the sector is severely undervalued and offers investors great growth opportunities. Sometimes the market gets it wrong, here’s how to take advantage.

There’s a lot going on among master limited partnerships (MLPs) and the midstream oil and gas industry right now. And I’m not talking about the 50% fall in oil prices over the last year.

To start, both Kinder Morgan Inc (NYSE: KMI) and Williams Companies (NYSE: WMB)decided to re-consolidate their operations by buying up their respective MLPs. A move that could spur others to follow suit, helping to reduce their dependence on capital markets.

Then, more recently, Energy Transfer Equity (NYSE:ETE) has stepped up with a $64 a share offer for Williams Companies; an offer that the latter has rejected. With $35 billion and $44 billion market caps, respectively, this would create a midstream giant.

However, the wave of “interesting” deals in the MLP industry continues, with things heating up even more last week.

The $5.7 billion market cap MLP, MPLX LP (NYSE: MPLX), is buying the $11.9 billion market cap natural gas transporter, Markwest Energy Partners LP (NYSE: MWE).

MPLX is paying close to $16 billion for Markwest in one of the biggest deals in the oil industry over the last year. The two are joining forces to create the fourth largest MLP.

The key here is that MLPX is controlled by the $29.6 billion market cap pipeline and refinery operator, Marathon Petroleum Corp (NYSE: MPC).

The price action is the most interesting part of this deal. Certain investors are not excited about the buyout.

Marathon Petroleum shares are up 10% over the last week and Markwest units are up close to 18%. However, MPLX saw its units crater 17% last week. The market is a bit concerned about what adding a natural gas processor (Markwest) to an oil transporter (MPLX) does to growth.

But it’s still a diversification across commodity prices, as well as geographical. However, the bigger trend that might be getting overlooked here is that with oil prices still hovering around $50 a barrel, natural gas is an enticing market to have exposure to right now.

Meanwhile, the move will help smooth out earnings across various commodity cycles for MPLX, but the distribution yield leaves a lot to be desired for MPLX, yielding just 2.9%. Especially troublesome when the Alerian MLP (NYSEArca: AMLP) is offering a 7.4% distribution yield.

Now, back in June we did profile a Markwest as one of the top three takeover targets in the oil and gas midstream industry. The other two on the list are also still very enticing. But, for now, we’re changing gears.

Specifically, toward the midstream natural gas industry, which looks to be undervalued — something that MPLX has realized. The demand for natural gas infrastructure is still high despite the recent fall in natural gas prices.

With that in mind, here are the two MLPs to own on recent industry bullishness:

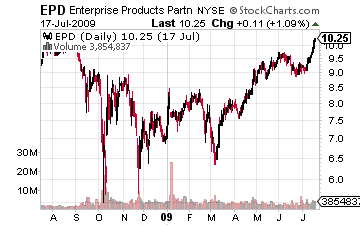

Must own natural gas MLP No. 1: Enterprise Products Partners (NYSE: EPD)

Units of Enterprise Products Partners have been pressured a bit more than other MLPs given the concerns over natural gas pricing. Enterprise Products Partners is down 18% year-to-date while the Alerian MLP is off just 11%.

With a $59 billion market cap, it’s not unreasonable that Enterprise Products Partners could come in and offer a higher price for Markwest. The other key is that Enterprise Products Partners has plenty of growth opportunities in key markets where we could see renewed buildout of natural gas infrastructure in key demand areas like the Gulf Coast, New England, and the Midwest.

For yield seekers, its 5.2% distribution yield is enticing.

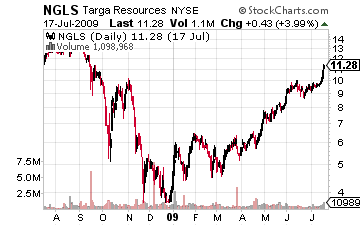

Must own natural gas MLP No. 2: Targa Resources Partners (NYSE: NGLS)

Targa Resources Partners offers one of the highest distribution yields among MLPs, coming in at a hefty 8.3%. It’s a gatherer and processor of natural gas. Thus, it too has seen its units pressured due to natural gas pricing, falling 18% year-to-date.

The big news of late for this $7 billion market cap natural gas player is its acquisition of fellow natural gas pipeline operator Atlas Energy. This gives Targa Resources Partners a greater presence in the Gulf Coast area, where demand is higher for processing natural gas liquids. This is also part of Targa’s shift toward more fee-based revenues, meaning it will be less exposed to commodity prices — collecting revenues on the gas it moves irrespective of the price.

In the end, one trend in the MLP space that looks powerful is the realization that oil prices might be capped for some time, which means that other commodity focused MLPs will be getting noticed — most notably, the natural gas players.

Disclosure: None.

They’re the kind that are an integral part of the reliable income strategy ...

more