Twitter Trade Idea

I noticed something today on Twitter's stock with regards to the implied volatility through the year.

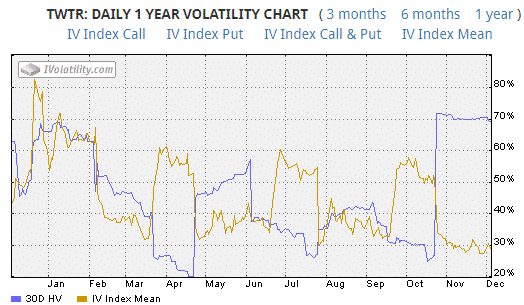

You can see on the chart below a clear pattern of rising volatility every 3-4 months.

The other thing to note about the above chart is that the current level of implied volatility is about the lowest we’ve seen in the last 12 months.

That means options are cheap to buy relative to the recent past.

So if volatility is low, and we think it will rise in the near future (in the lead up to earnings on Feb 5th), then a long straddle might be a good idea.

You can read in more detail about buying pre-earnings straddles here, and I also did an interesting case study on long strangles which you can check out here.

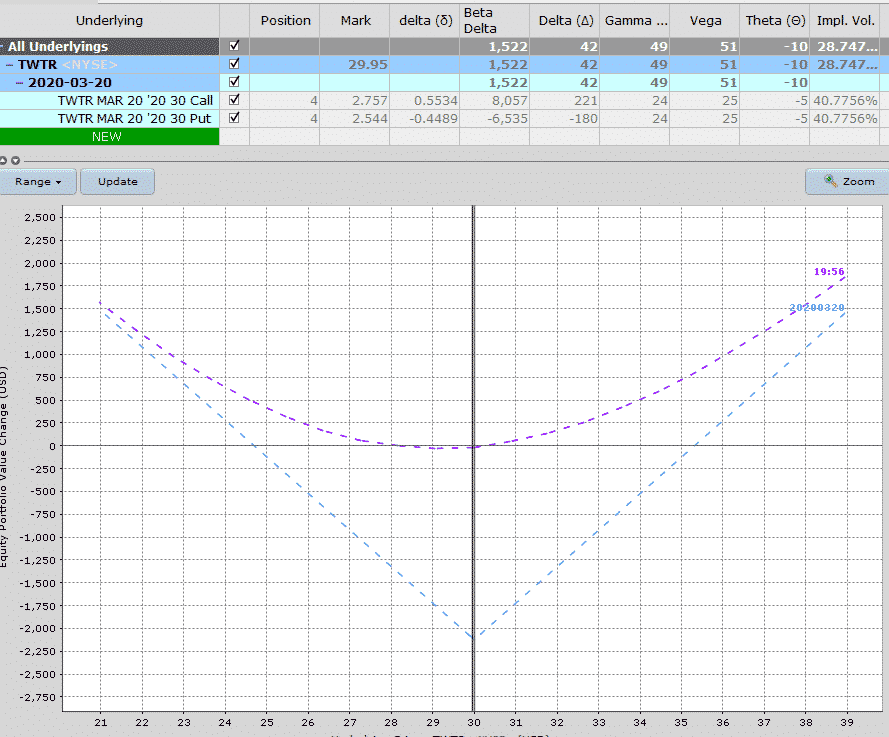

For the TWTR long straddle, I would looTWTR k at going out to March expiry because there aren’t any February options yet.

Buying the $30 calls and $30 puts will cost about $5.30 per contract or $530. In theory, this straddle shouldn’t decay too much because the options will hold there value reasonable well even if TWTR stays flat, due to the uncertainty surrounding the February earnings announcement.

Here’s what the trade looks like:

If the market tanks any time in the next few months, then TWTR is likely to tank along with it. In that case, this straddle will do quite well.

As I mentioned earlier, it shouldn’t decay too much given that the options will hold their value.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more