Twitter - Stock Of The Day

Summary

- 100% technical buy signals.

- 17 new highs and up 64.34% in the last month.

- 101.16% gain in the last year.

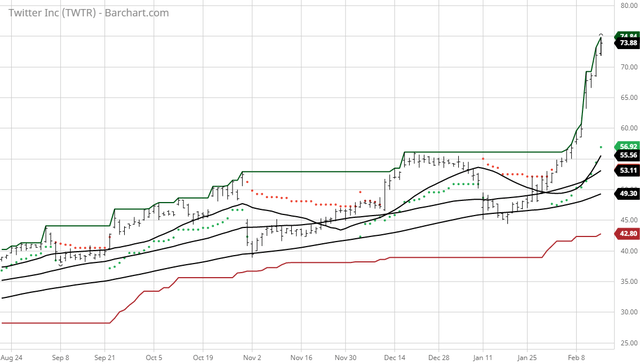

The Barchart Chart of the Day belongs to the social media company Twitter (NYSE: TWTR). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 2/2 the stock gained 37.28%.

Twitter, Inc. operates as a platform for public self-expression and conversation in real-time United States and internationally. The company offers various products and services, including Twitter, a platform that allows users to consume, create, distribute, and discover content; and Periscope, a mobile application that enables user to broadcast and watch video live with others. It also provides promoted products and services, such as promoted tweets, promoted accounts, and promoted trends, which enable its advertisers to promote their brands, products, and services. In addition, the company offers a set of tools and public application programming interfaces for developers to contribute their content to its platform, syndicate and distribute Twitter content across their properties, and enhance their Websites and applications with Twitter content. Further, it provides subscription access to its public data feed for data partners. Twitter, Inc. was founded in 2006 and is headquartered in San Francisco, California.

Barchart technical indicators:

- 100% technical buy signals

- 123.43+ Weighted Alpha

- 101.16% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 17 new highs and up 64.34% in the last month

- Relative Strength Index 87.16%

- Technical support level at 69.14

- Recently traded at 73.88 with a 50 day moving average of 53.11

Fundamental factors:

- Market Cap $57.20 billion

- Revenue expected to grow 27.20% this year and another 18.30% next year

- Earnings estimated to increase 202.30% this year, an additional 29.20% next year and continue to compound at an annual rate of 30.70% for the next 5 years

- Wall Street analysts issued 2 strong buy, 2 buy, 21 hold, 10 under perform and 2 sell recommendations on the stock

- The individual investors following the stock on Motley Fool voted 971 to 248 that the stock will beat the market

- 246,010 investors are monitoring the stock on Seeking Alpha

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more