Twitter Is Showing The Public What It's Good At

Twitter was upgraded on Friday from neutral to buy by Goldman Sachs analyst Heath Terry, with a price target of $35, up 51.6% from Friday's close of $23.09, citing its positive metrics before and now during the coronavirus pandemic that "leave Twitter well positioned to exit this crisis stronger than it entered it." Mr. Terry is correct in that the pandemic has shown the distinct niche Twitter occupies in contrast to other social media platforms and online advertising giants such as Facebook, Google, Instagram, Snapchat, and otherwise, as Twitter has become a major source of real-time, crowd-sourced, worldwide information since the start of the pandemic.

People Are Relying On Twitter Like Never Before

Twitter has been used amid the pandemic for everything from spreading reports, news, and stories from medical professionals to journalism headlines to public announcements by institutions and government agencies to people sharing stories of how to adapt to life under lockdown. Even with an active fight by the platforms against incorrect and disinformation, as Dr. Raja, Executive Vice Chair of Mass General's Department of Emergency Medicine told CNN, "Twitter is the best way to get medical information out."

What the pandemic has shown about Twitter is that there are many situations where communication with, or even viewing information and updates from, complete strangers in a relatively easy-to-search-and-retrieve format is beneficial and far better than being merely confined to a circle of friends and acquaintances as in some other social networks. Even as Twitter states that it, like many other online advertising companies, will see a hit to its ad revenue as its business customers spend less nonetheless it has undoubtedly gained the attention, use, and appreciation of an immense segment of the public. Furthermore, and importantly, this increase in usage, trust, and adoption isn't just among users in the United States but among its essential international user base as well as coronavirus sweeps across the world.

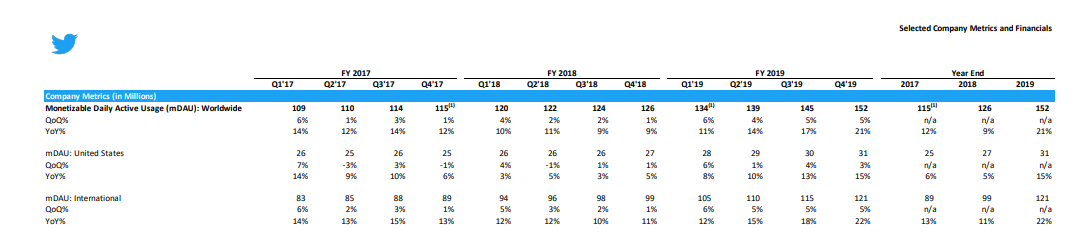

(Source: Twitter Q4 2019 Selected Metrics and Financials)

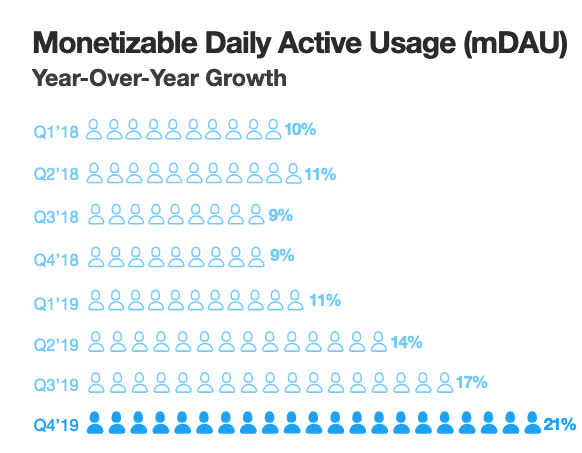

One of Twitter's biggest struggles prior to this pandemic was still in trying to carve out a niche to attract and keep users and to better monetize its advertising mechanisms. While the latter may still be a struggle at times for Twitter it seems certain that for a large segment of the public Twitter has well-demonstrated its worth and use in these trying times. The data bears this out - in the latest statement from about two weeks by Twitter regarding the impact of the coronavirus on its metrics the company has seen monetizable Daily Active Users grow from 134 million in Q1 2019 and 152 million in Q4 2019 to 164 million as of far, up 23% and 8% respectively. The 23% year-over-year growth would appear to be among the largest Twitter has on record.

(Source: Twitter Q4 2019 Investor Fact Sheet)

Twitter Is Increasingly Shifting To A Normal Internet Stock And Now With Added And Stable User Surge

Twitter stock was already having a bad year and just before the bottom fell out of markets in late February Twitter was struggling to reach again its $40+ a share high point it had fallen from in September last year. The company has only recently began to post positive earnings, despite being public since 2013 and in existence since 2006, and now at a P/E ratio of just a hair above 12 is far lower than its historical, yet short, levels and well below the P/E ratio of many of its online advertising and social media peers. For the purposes of contrast Facebook stock currently holds a roughly 23.9 P/E, Google a 22 P/E, and Weibo a 14.6 P/E.

(Source: MacroTrends)

The development of interested new users who now are understanding how to use Twitter may be the fuel that pushes the company up and out of the gutter its trying to escape the past few years. Twitter seems unlikely to majorly change strategy or design as a company, an uncertainty more prominent in its "wilderness years" as the company was still trying to decide exactly what it was, and particularly as CEO Jack Dorsey appears to be remaining in place for the foreseeable future after resolving a recent dispute with activist investors.

Conclusion

I am positive on Twitter for its path after the crisis because its function and design appears stable and the inputs that go into the company, monetizable users and advertiser interest, appear to be increasing and particularly the former. There is no reason why Twitter should see its P/E multiple rise back to the 20+ level once the pandemic is over and with a potential surge in monetizable user activity and the advertisers that follow that means a strong, stable gain from its current downtrodden price.

Disclosure: I am long TWTR.

Disclaimer: These are only my opinions and do not constitute investment advice.