Twitter Fact-Checks Trump Tweets – Will The Stock Tumble?

While Twitter (TWTR), and particularly tweets from US president Trump, have been a topic for most of the last 3.5 years of his presidency, recent developments could start to affect the share price of Twitter significantly.

Trump's tweets about mail-in ballots were hit with a 'fact-check' buttons, inviting readers to "get the facts" and linking to a page calling the president's claims "unsubstantiated."

As a result, Trump signed an executive order on Thursday which pushes the Federal Communications Commission to set new rules on some websites' protections under Section 230 of the Communications Decency Act.

Twitter shares suffer after Trump's executive order

The text of the order on the White House website reads that it aims "to make it that social-media companies that engage in censoring or any political conduct will not be able to keep their liability shield".

While it seems as if the order is mainly political and tries to deflect from recent and rising criticism in regards to the Trump administration's response to the Coronavirus pandemic and misses a solid fundament in terms of enforcement, likely facing enormous legal challenges with more and more experts and lawyers expressing doubts that without an act of Congress not much can and will be done (in fact, some already stated that the executive order is unconstitutional), Twitter's stock nevertheless saw increasing selling pressure.

Twitter shares tumbled more than 10% from their May highs at 34.27 USD, mainly driven by fears in regards to massive legal fees Twitter might potentially face.

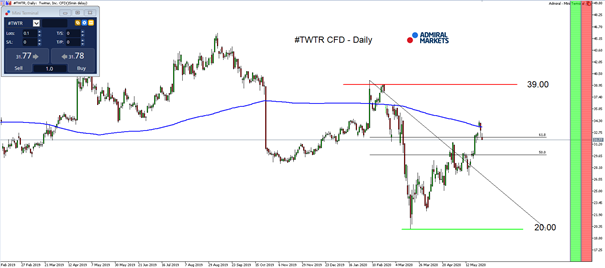

In addition to that, Twitter shares have risen nearly 70% from their March lows around 20 USD, making risk-reward ratios for long engagements generally unattractive, at least in our opinion.

And technically the re-test of the SMA(200) will potentially act as a heavier zone of resistance.

How to trade Twitter in this environment?

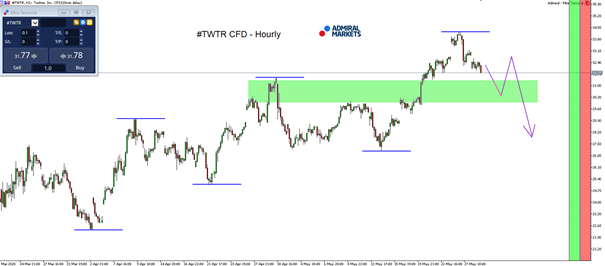

On H1, the Twitter stock finds itself in a clearly bullish environment with the long sequence staying intact as long as the stock trades above 27.20 USD.

In fact, one could consider the region between 30 and 31 USD a potential Long-trigger.

But while we expect the stock to find support against this region and probably see initially increased demand against this region, we'd like to scale into a Short trade against 32/32.50 USD with a stop above the May highs and aim for a break of the region around 27.00 USD.

If the overall bullish bias in Equities turns, a break of the long-sequence could trigger a new wave of sharp selling, activating a mid-term target around 20 USD and probably even lower:

Source: Admiral Markets MT5 with MT5-SE Add-on #TWTR CFD Hourly chart (between March 20, 2020, to May 29, 2020). Accessed: May 29, 2020, at 10:00pm GMT

Source: Admiral Markets MT5 with MT5-SE Add-on #TWTR CFD Daily chart (between February 4, 2019, to May 29, 2020). Accessed: May 29, 2020, at 10:00pm GMT - Please note: Past performance is not a reliable indicator of future results, or future performance.

In 2015, the value of Twitter Inc. (TWTR) fell by 36.1%, in 2016, it fell by 28.0%, in 2017, it increased by 47.2%, 2018, it increased by 19.4%, 2019, it increased by 13.4%, meaning that after five years, it was down by 11.5%.

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter "Analysis") ...

more