Twilio: Sustained Growth Ahead

Twilio (TWLO) reported remarkably solid numbers for the third quarter of 2020 on Monday. The initial market reaction to the number looks rather muted, which is understandable because the company had already announced that the numbers were going to be materially above guidance and this was already reflected on market expectations to a good degree.

From a long-term perspective, however, it is good to see Twilio delivering strong execution and setting the stage for sustained growth in the years ahead.

Strong Execution

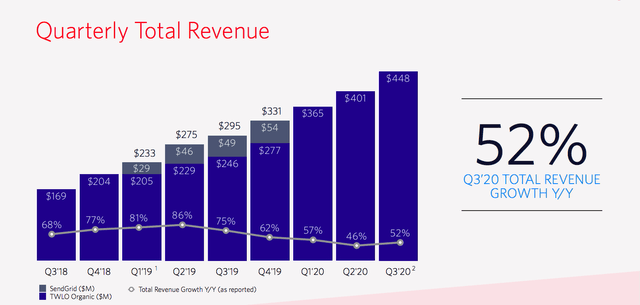

Revenue for the third quarter of 2020 came in at $448 million, an increase of 52% year over year, and surpassing Wall Street expectations by $40.8 million. The company ended the quarter with 208K active customer accounts, an increase of 21% year over year.

Source: Twilio

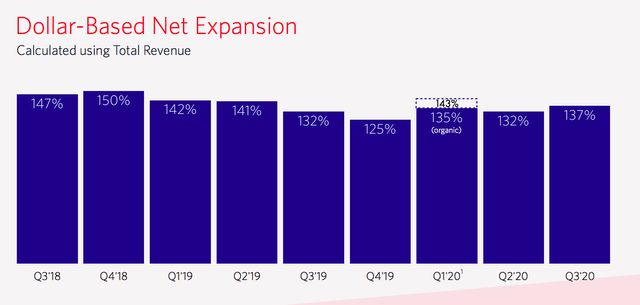

The dollar-based net retention rate was a particularly strong data point in the quarter, at 137%. This represents an acceleration versus 132% in the second quarter and it speaks well about engagement levels and the company's ability to deliver what customers need and want.

Source: Twilio

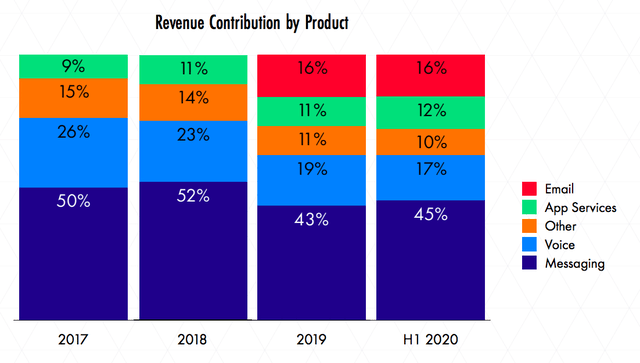

Gross margins as a percentage of revenue are under pressure because the company is seeing a larger proportion of revenue coming from messaging, a lower-margin segment. But Twilio is still making more gross profit dollars at $231 million during the quarter versus $158 million in the same quarter last year, so this is no reason for concern.

Revenue guidance for next quarter was ahead of Wall Street expectations. Management is expecting $452.5 million versus $430.6 million forecasted by analysts at the time of the report. This guidance does not include the impact of the Segment acquisition.

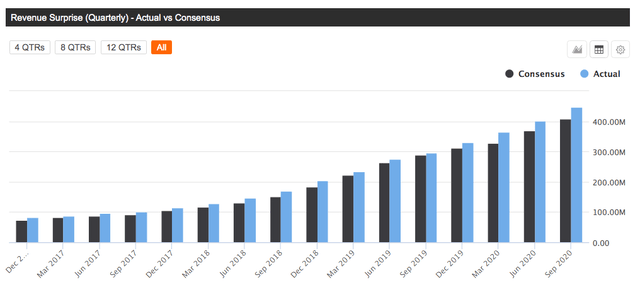

This guidance would represent a year over year increase of 37% in sales for the fourth quarter, and this is a solid number but not particularly impressive. On the other hand, if past history is a valid guide for the future, there is a good chance that management is being conservative with the guidance numbers.

Twilio has delivered revenue about Wall Street expectations in each of the past 16 consecutive quarters. This clearly shows that management tends to provide conservative guidance and to consistently overdeliver.

Source: Seeking Alpha

When asked more specifically about the outlook over the middle and long term in the conference call, management explicitly said that the business is firing on all cylinders across the board, which bodes well in terms of assessing the chances for a strong quarter in the fourth quarter of 2020.

We're seeing across the board is that there's just broad-based strength across the entirety of the business

Over the long term, the digital transformation trend is accelerating for obvious reasons, but this is a major trend with a sustained long-term impact that goes well beyond the pandemic.

We're seeing digital acceleration. We're seeing that people are especially in this environment, realizing that there's a greater push than ever to be able to engage consumers and customers on digital channels in new ways and new modalities. And so, our research shows that this digital transformation is being accelerated by up to six years.

So, at every level, I think that this is not just a temporal thing, but part of a new way the companies to engage. And so I think it's that macro shift we're seeing in the market, its macro acceleration that gives us confidence that we are where the market is and is going, but this is a huge need, a tremendous need in the marketplace, that there's a need that every company in the world has from small business all the way up to the enterprise.

The Big Picture

One of the most critical aspects to consider when analyzing a growth stock is the company's ability to exceed expectations over time. In simple terms, current stock prices are reflecting a particular set of expectations for a business. If growth slows down more than anticipated, this will obviously have a negative impact on the stock price. Alternatively, the stocks that deliver the best returns are the companies that can consistently and materially outperform expectations over time.

We already know that Twilio tends to deliver conservative guidance numbers and to consistently beat those numbers, so we know where management culture stands in that regard. The company likes to overdeliver, does it have the strength to continue doing so? I think it does.

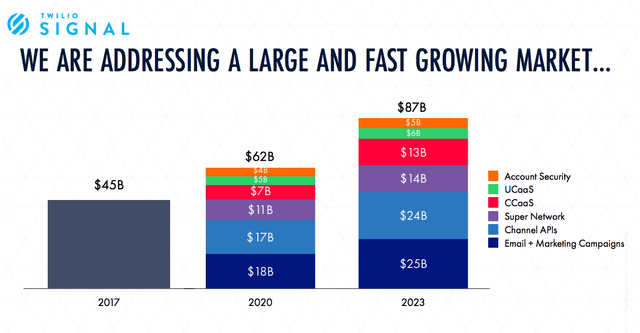

First of all, the market opportunity is huge and growing. Twilio estimates that the addressable market is growing from $62 billion in 2020 to $87 billion in 2023. Even beyond 2023, the needs for all kinds of communications solutions will only continue expanding, and the Segment acquisition puts Twilio in a position to provide a complete customer engagement solution beyond communications alone.

Source: Twilio

The company is broadening its portfolio via both internal developments and acquisitions in order to expand its growth opportunities and to adapt to evolving customer needs. Twillio acquired SendGrid to make a big move into email last year, and it has recently launched the Twilio Flex ecosystem as an effective contact center solution, including more than 30 validated solutions from partners Google (GOOG) (GOOGL), Salesforce (CRM), and Zendesk (ZEN). According to management's own words, "usage of Twilio Video has skyrocketed" recently.

Source: Twilio

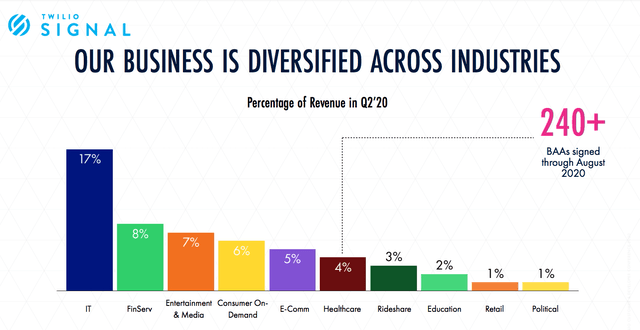

There will obviously be a lot of technological change and innovation in the industry, and different sectors of the economy will have evolving needs over time. But Twilio is building a diversified presence across different areas, and the company has a large ecosystem of more than 300 partners to fuel its growth opportunities going forward.

Source: Twilio

Source: Twilio

A bet on Twillio is not a bet on a specific set of solutions, but on a management team that has pioneered the Cloud Communications Platform-as-a-Service (“CPaaS”) business model.

Not only Twillio has the strength to adapt to changing industry conditions, but the company also learns a lot of valuable information about what customers need by interacting with them and observing how customers use Twilio's solutions. There is a big chance that Twilio will remain at the forefront of industry innovation over the years to come.

The company recently said during the Investor Day that it intends to produce 30% organic annual revenue growth over the next four years and that operating margin should be around 20% in the long term. Considering the way things are going and Twilio's track record of execution, I wouldn't be surprised to see it exceed this guidance.

Acquisitions are always risky and uncertain, but Twilio has proven that it knows how to make smart strategic bets to significantly expand its market opportunity and build the foundations for long-term growth.

At a price to sales ratio of 21.8 times revenue estimates for 2021, Twilio is not cheap at all, but the stock doesn't need to be cheap in order to deliver solid returns for investors. Twilio remains one of the best stocks in the sector, management is executing solidly, and the company still has plenty of room for sustained growth in the years ahead.

Disclosure: I am/we are long TWLO, GOOG, CRM.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business ...

more