TransMedics Could Slump When IPO Lockup Expires

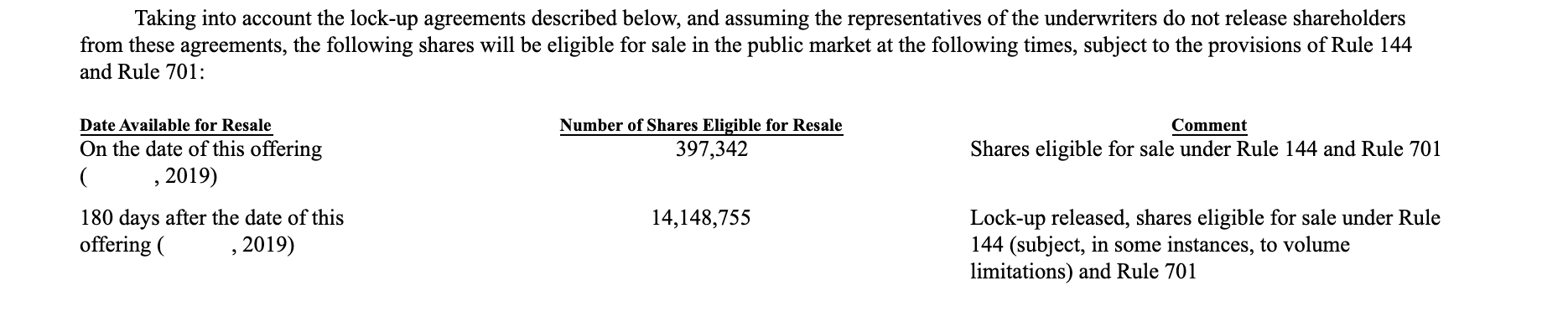

When the lockup period ends for TransMedics Group (TMDX) on October 29, pre-IPO shareholders and company insiders will have the opportunity to sell more than 14 million currently-restricted shares. The number of restricted shares dwarfs the 5.69 million shares offered in the IPO.

(Click on image to enlarge)

Significant sales of currently restricted stock could flood the secondary market when the lockup expires and send shares of TMDX sharply lower in the short term. We believe that pre-IPO shareholders and company insiders will be motivated to cash in on some of their profits - despite a sharp decline in share price over the past month; TMDX still has a return from IPO of nearly 14%.

The upcoming lockup expiration presents a short opportunity for aggressive, risk-tolerant investors to short shares ahead of the October 29th expiration.

Business Overview: Medical Technology Company Providing Solutions in Organ Transplants

TransMedics Group is a medical technology company in the commercial stage. Their solutions are for organ transplant therapy for patients at end-of-life across varying disease states. They developed their TransMedics Organ Care System (OCS) to improve standard care of donated organs. The OCS proprietary technology mimics many elements of an organ's natural functional environment once outside the body. The company believes that its OCS system provides a dynamic environment rather than the older therapies that rely on a static state. This is a significant change in organ preservation for transplanting. They believe that their system significantly improves organ assessment, optimization, and outcomes, and they have compiled a large body of clinical evidence to support their conclusions.

(Source: S-1/A)

TransMedics Group developed its system to address the limitations of the current standards of cold storage. The OCS is a portable system that replicates near-physiologic conditions necessary for donor organs to remain viable outside the body. The system provides donor organs with nutrient-enriched, oxygenated, and temperature-appropriate blood to maintain the organs in a living state, which means that a heart is beating, a lung continues breathing, and a liver continues to produce bile.

TransMedics Group notes that there are around 67,000 potential donors each year in Canada, the European Union, the United States, and Australia. However, the majority of donated lungs and hearts go unutilized.

The company has approximately 92 employees and keeps its headquarters in Andover, Massachusetts.

Company information was sourced from the firm's website and S-1/A.

Financial Highlights

TransMedics Group reported second-quarter financial highlights for the period ending June 29, 2019:

- Net revenue was $5.7 million for an increase of 94% versus $2.9 million in the second quarter of 2018.

- Gross margin was 59% versus 40% in the second quarter of 2018 driven by higher sales volume.

- Operating expenses were $11.0 million versus $6.3 million in the same quarter of 2018.

- Net loss was $9.2 million in contrast to $6.1 million in the same period of 2018.

- Cash, cash equivalents, and marketable securities were $96.2 million.

Financial highlights were sourced from the firm's website.

Management

Founder Waleed Hassanein also serves as President and Chief Executive Officer. Dr. Hassanein served a 3-year cardiac research fellowship at West Roxbury VA Medical Center. Prior to that fellowship, he served in general surgery residency at Georgetown University Medical Center. He earned his M.D. from Georgetown University after transferring there from Cairo University School of Medicine. He also earned a General Certificate of Education from the University of London.

Chief Financial Officer Stephen Gordon has served in his position since March 2015. He also serves as Treasurer and Secretary. His previous experience comes from senior financial positions at Analogic Corporation, Hologic, Maxtor, Cytyc, and Hewlett-Packard. He earned an MBA from Boston University.

Management bios were sourced from the company's website.

Competition: Angel Med Flight, Medical Couriers, and Paragonix Sherpa Pak

While the OCS platform is an innovation over the current standard methods of organ transportation, it faces competition from those companies that still use the older method. These include Paragonix Sherpa Pak, Medical Couriers, Angel Med Flight, and Flyreva.

Early Market Performance

The underwriters priced the IPO at $16 per share. Its expected price range was originally $15 to $17. The stock closed on the first day of trading at $27.41 for a one day gain of 39.8%. The stock continued to climb to reach a high of $30.41 on May 22. The stock currently has a return from IPO of 13.8%.

Conclusion

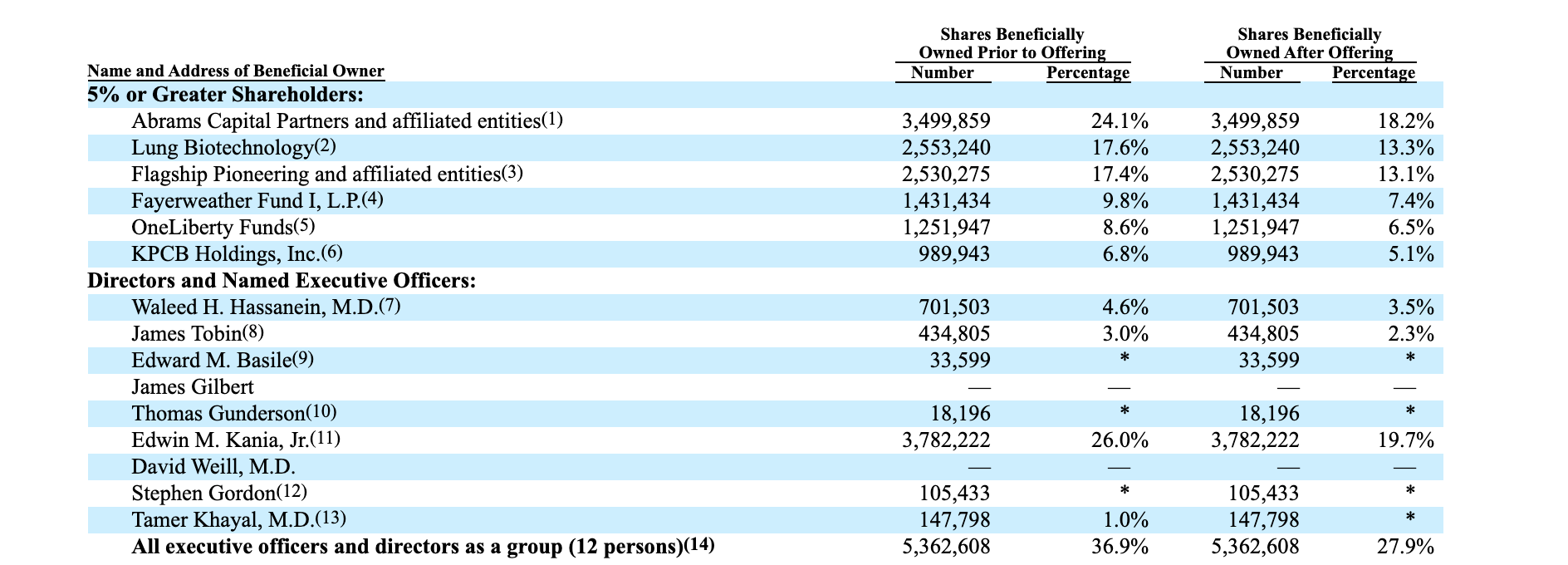

When the 180-day IPO lockup period for TMDX expires on October 19, pre-IPO shareholders and company insiders will be able to sell more than 14 million currently-restricted shares for the first time. This group of pre-IPO shareholders and company insiders includes numerous executives and VC firms.

(Click on image to enlarge)

(Source: S-1/A)

With just 5.69 million shares trading pursuant to the IPO, any significant sales of this currently-restricted stock could flood the secondary market and cause a sharp, short-term decline in TDMX's share price.

Aggressive, risk-tolerant investors should take advantage of this opportunity by shorting shares of TDMX ahead of the October 29th lockup expiration. Interested investors should cover short positions during the October 30th and October 31st trading sessions.

Disclosure: I am/we are short TMDX.

Disclaimer: I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any ...

more