Trading UBER And LYFT Now That They’re An Election Issue

2020 flipped the investment world on its head. Many stocks that had been investor favorites like UBER and LYFT heading into the year were forgotten in favor of companies that could thrive during a pandemic. To put it simply, the coronavirus pandemic changed the entire investment landscape.

One industry that was enormously impacted by the pandemic was ride-sharing. Once the future of local transportation (and potentially car ownership in general), the industry took a back seat in 2020. It’s obvious after the fact, but ride-sharing was a clear candidate to take a huge revenue cut due to the pandemic. After all, who wants to share rides in the era of a deadly pandemic?

And now with Proposition 22 on the ballot next week in California, the future of their business in that state could have a ripple affect across the country. Nonetheless, there are still good options trades in this sector.

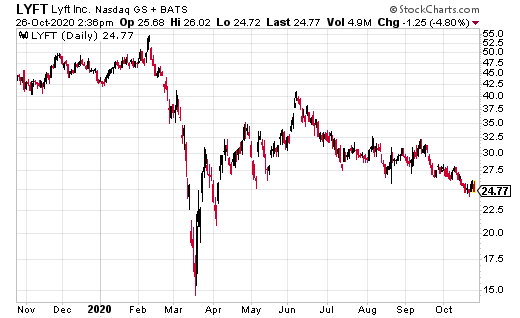

The two big players in ride-sharing, Uber (UBER) and Lyft (LYFT), both were punished in the market when the corona crash hit in March. UBER has recovered to some extent due to its aggressive acquisitions in the food delivery space. Conversely, Lyft is still down 43% year-to-date.

However, the stock market is typically very much a forward-looking market. Eventually, investors will focus on the long-term prospects for a company like Lyft. And all in all, it does seem like there could be a light at the end of the tunnel for the beleaguered company.

The pandemic will have a lasting impact on the economy, but eventually, the virus will go away to the point at which ride-sharing returns to something akin to normal. The focus moving forward is on how drivers are classified (employees or contractors) and how autonomous driving will change the industry. For its part, LYFT has invested heavily in the autonomous driving space.

In the options market, one investor is making a long-term bet that Lyft has a reasonably bright future (in terms of stock price). The trade is a long-term covered call trade, which is a moderately bullish play on Lyft.

Specifically, the investor bought shares of Lyft for $25.18 while selling the January 2023 35 calls for $5.80. The trade was done 3,450 times, which resulted in a whopping $2 million being collected in premiums. The premiums will be fully earned if Lyft is below $35 in January of 2023.

On the one hand, that’s a lot of premium to collect. It means the investor can’t lose money on the Lyft shares down to $19.38. It also provides a yield of 23% over a 27-month period, which works out to slightly more than a 10% annual return. On the other hand, the stock appreciation gains are capped at $35 per share. So, if Lyft does take off, the investor could be missing out on substantial upside potential.

Ultimately, I think this looks like a yield trade. Lyft’s long-term future is intact, so there isn’t a tremendous amount of downside to holding the stock. In the meantime, 10% per annum returns are impressive in this era of ultra-low interest rates. Sure, there’s some potential missed upside in the share price. However, the position does allow for nearly $10 of price appreciation.

Disclosure: Information contained in this email and websites maintained by Investors Alley Corp. ("Investors Alley") are provided for educational purposes only and are neither an offer ...

more