Traders Still Buying The Dips

Both the Early Warning board and my favorite stochastic indicators suggest that stocks are overbought. As such, one can argue that "the table is set" for some downside action. However, I will opine that we've got a "good overbought" condition on our hands. And given that the news on the virus, earnings, and economic fronts have been largely BTE (better than expected), investors continue to put money to work into any pullbacks. As such, a "buy the dip" strategy would appear to remain appropriate in the current environment.

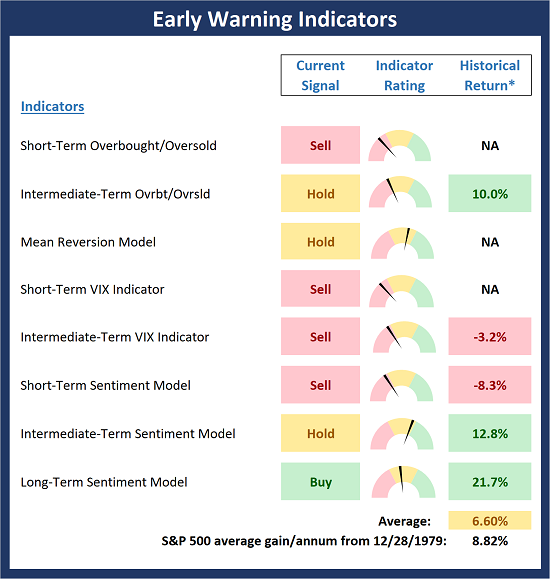

The State of the "Early Warning" Indicators

To review, I believe one of the keys to longevity in the investing business is having a repeatable process. Thus, I start each week with a review of the state of the big-picture environment. I then look at the current trend and the degree of momentum behind the move. Next, I explore the potential for a countertrend move to develop via our Early Warning Indicator Board, which is designed to indicate when "the table might be set" for the trend to "go the other way" for a while.

In reviewing the Early Warning board, my current view is the odds for some downside exploration (aka a countertrend move) continue to favor the bears. However, the table has been set for our furry friends many times during the current bull run and save an ugly day here, and there, the bears have unable to do much with their opportunities. So, while stocks remain overbought, the onus looks to be on the bears to produce a scary down day or two.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

As I mentioned last week, I think we probably need to take the current sentiment readings with a grain of salt. The bottom line is the state of the virus and the economic data appear to be driving traders' views. And with so much uncertainty remaining in these areas, the readings could easily fluctuate quickly.

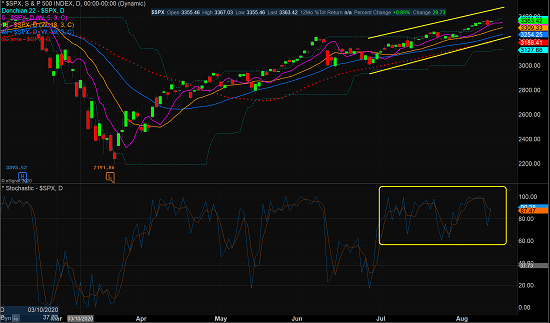

Stochastic Review

Over the years, I have found that reviewing the basic stochastics is a solid way to determine when an index or security may be ripe to "go the other way" for a while. I like to keep it simple here by using a 14 day %K (with 1-day smoothing) and a 3-day %D. It's not fancy, but it tends to be an effective tool for an oftentimes complex subject.

S&P 500 - Daily

(Click on image to enlarge)

My key takeaway from the "state of the stochastics" is that we've got a "good overbought" condition on our hands. As the chart shows, the S&P has been unable to create any sort of oversold condition since early July. This tells me that buyers remain active and all the dips - even the intraday moves - are being bought.

How long this condition will last is anybody's guess. And yes, this will end at some point. My thinking is that it will take a change in the news in order for the bears to get something going to the downside.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more