Top 7 Dividend Champions To Buy Now

Income investors are always on the hunt for high-quality dividend stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

Investors are likely familiar with the Dividend Aristocrats, a group of 65 stocks in the S&P 500 Index with 25+ consecutive years of dividend increases. Meanwhile, investors should also familiarize themselves with the Dividend Champions, which have also raised their dividends for at least 25 years in a row.

While their length of dividend increases is the same, leading to some overlap, there are also some important differences between the Dividend Aristocrats and Dividend Champions. As a result, the Dividend Champions list is much more expansive. There are many high-quality Dividend Champions that are not included on the Dividend Aristocrats list.

Overview of Dividend Champions

The requirement to become a Dividend Champion is simple: 25+ years of consecutive annual dividend increases. The Dividend Aristocrats have the same requirement when it comes to number of years, but with a few additional requirements.

To be a Dividend Aristocrat, a company must also be included in the S&P 500 Index, must have a float-adjusted market cap of at least $3 billion, and must have an average daily value traded of at least $5 million. These added requirements preclude many companies that possess a sufficient track record of annual dividend increases but do not qualify based on market cap or liquidity reasons.

As a result, while there is some overlap between the Dividend Aristocrats and the Dividend Champions, there are also many Dividend Champions that are not Dividend Aristocrats. Income investors might want to consider these stocks due to their impressive histories of annual dividend increases, so we have compiled them in the downloadable spreadsheet above.

In addition, we have ranked the top 7 Dividend Champions according to total expected annual returns over the next five years. Our top 7 Dividend Champions right now are ranked below.

The Top 7 Dividend Champions To Buy Right Now

The following 7 stocks represent Dividend Champions with at least 25 consecutive years of dividend increases, but they also have durable competitive advantages, long-term growth potential, and high expected total returns. Stocks have been ranked by expected total annual return over the next five years, from lowest to highest.

Top Dividend Champion #7: Old Republic International (ORI)

- 5-year expected returns: 12.3%

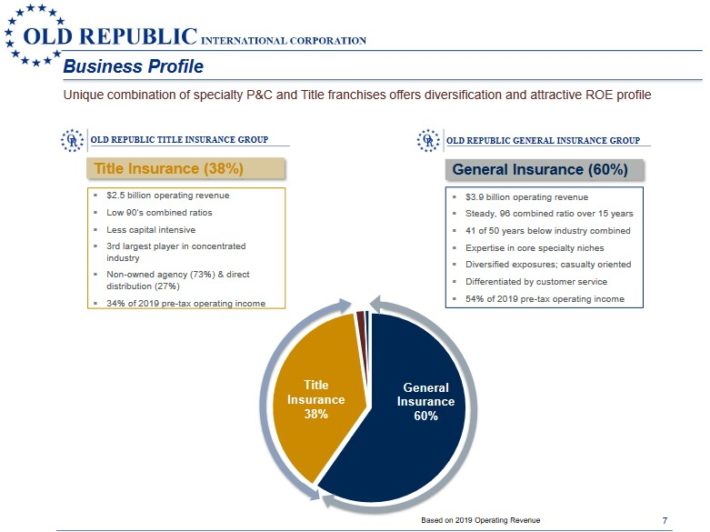

Old Republic was founded back in 1907, and the past 113 years have not always been easy. However, the company has persevered and today, it markets, underwrites and provides risk management services for a variety of general and title insurances. It generates over $6 billion in annual revenue.

Source: Investor Presentation

Old Republic reported third-quarter earnings on October 22nd, with results coming in easily ahead of expectations on both the top and bottom lines. Core earnings-per-share, which excludes investment gains and losses, came to $0.62 in Q3, up from $0.51 in the year-ago period, and blowing past estimates of just $0.43. Strength came from both of the company’s core insurance segments.

Total revenue was up from $1.77 billion in the year-ago period to $1.88 billion in Q3. Net investment income was down -5.6% year-over-year to $106 million as the company’s investment base continues to grow, but lower yields offset that growth. The combined ratio came to 92% against 94.4% in the same period last year, improving margins and profitability. Book value came to $20.39 at the end of the quarter, up from $19.68 at the end of June.

We expect 4% annual EPS growth over the next five years. This rate of growth will be possible as the company looks to continue its low to mid-single-digit growth in premiums, strong investment income, as well as lower losses, with recent results supporting this.

Additional caution is warranted for this year given the extreme uncertainty surrounding the COVID-19 pandemic, but long-term holders should find value in Old Republic’s earnings streams and growth prospects. The dividend will likely continue to grow at a relatively slow pace as dividend increases in the past decade have been very small. On December 18th, the company declared a special dividend of $1.00 per share.

Old Republic operates in a tremendously competitive field, making advantages hard to come by. However, it sets itself apart with its strong premiums against claims, which is the product of prudent underwriting. We note that Old Republic is thriving in a tough environment in 2020.

Based on expected earnings-per-share of $1.95 for the current fiscal year, ORI stock trades for a price-to-earnings ratio of 9.5, compared with our fair value estimate of 12.5. An expanding P/E multiple will boost shareholder returns over the next five years. Combined with 4% expected EPS growth and the 4.4% dividend yield, total returns are expected to reach 12.3% per year.

Top Dividend Champion #6: AT&T Inc. (T)

- 5-year expected returns: 12.4%

AT&T is the largest communications company in the world, operating in three distinct business units: AT&T Communications (providing mobile, broadband and video to 100 million U.S. consumers and 3 million businesses); WarnerMedia (including Turner, HBO, Warner Bros. and the Xandr advertising platform); and AT&T Latin America (offering pay-TV and wireless service to 11 countries).

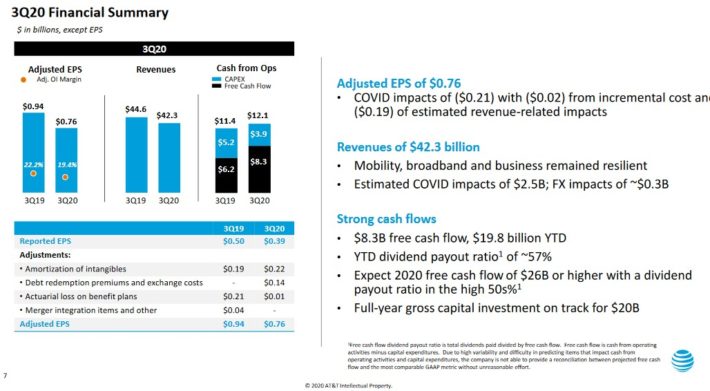

In the 2020 third quarter, AT&T generated revenue of $42.3 billion, along with operating cash flow of $12.1 billion. Among the highlights, AT&T recorded more than 5 million total domestic wireless net adds along with over 1 million postpaid net additions. The company’s postpaid churn was an impressive 0.69% for the quarter.

AT&T still expects free cash flow of at least $26 billion for the full year. This will help the company continue to invest in growth, pay dividends to shareholders, and also pay down debt. AT&T’s net debt-to-EBITDA ratio was ~2.66x at the end of the quarter.

Source: Investor Presentation

AT&T is a colossal business, easily generating profits of $20+ billion annually, but it is not a fast grower. From 2007 through 2019 AT&T grew earnings-per-share by 2.2% per year. While the company is picking up growth opportunities, notably in its recent acquisition of Time Warner, we recognize the premiums paid and the fact that the company’s legacy businesses are steady or declining. AT&T is optimistic about generating reasonable growth and the payout ratio had been falling, resulting in excess funds to divert toward paying down debt.

Two individual growth catalysts for AT&T are 5G rollout and its recently-launched HBO Max service. AT&T continues to expand 5G to more cities around the country. On June 29th, AT&T announced it had turned on 5G service to 28 additional markets. AT&T now provides access to 5G to parts of 355 U.S. markets, covering more than 120 million people.

On May 27th, AT&T launched streaming platform HBO Max which is priced at $15 per month and offers subscribers approximately 10,000 hours of programming. The new platform is a critical step for AT&T to keep up in the streaming wars.

Shares of AT&T trade for a 2020 price-to-earnings ratio of 8.9, below our fair value P/E of 11. The stock also has an attractive dividend yield of 7.1%. Combined with 3% expected annual earnings-per-share growth, we expect total annual returns of 12.4% per year over the next five years.

Top Dividend Champion #5: New Jersey Resources (NJR)

- 5-year expected returns: 12.6%

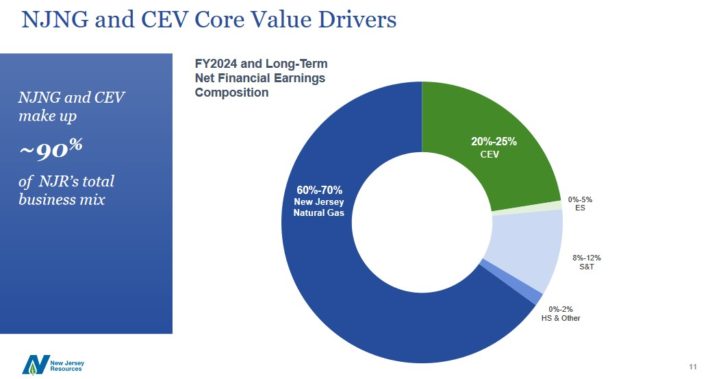

New Jersey Resources provides natural gas and clean energy services, transportation, distribution, asset management and home services through its five main subsidiaries. The company owns both regulated and nonregulated operations. NJR’s principal subsidiary, New Jersey Natural Gas (NJNG), owns and operates over 7,500 miles of natural gas transportation and distribution infrastructure serving over half a million customers.

Separately, NJR Clean Energy Ventures (CEV) invests in and operates solar projects, to provide customers with low-carbon solutions. NRJ Energy Services manages a portfolio of natural gas transportation and storage assets, as well as provides physical natural gas services to customers in North America.

The midstream subsidiary owns and invests in several large midstream gas projects. Finally, the home services business provides heating, central air conditioning, water heaters, stand-by generators, and solar products to residential homes.

Source: Investor Presentation

New Jersey Resources reported fourth quarter and fiscal 2020 results on November 30th, 2020. For the fourth quarter, net income of $43.3 million was 143% higher than the prior year’s $18.1 million. Basic earnings per share grew 135% to $0.45. Net financial earnings (NFE) for the company was $54.7 million, up 112% year-over-year.

For the full fiscal year 2020, consolidated net income of $194 million was higher by 14% year-over-year. Consolidated net financial earnings of $196 million grew 12% compared with $175 million in 2019. NFE per share grew 5.6% compared to last year, from $1.96 to $2.07.

The dividend payout ratio for the company on a net financial earnings basis appears to be very safe historically, especially for a utility company which can often safely pay out a large portion of earnings. We expect the company will continue to increase the dividend without a hitch.

The current P/E ratio based on 2021 normalized NFE per share of $2.20 is 15.2. Over the past ten years, NJR has had an average P/E ratio of 18.1. Given the minor impact of the pandemic on NJR’s results, we expect that the valuation could return near the 10-year average to 17.5. The combination of valuation expansion, earnings growth, and the 4.0% dividend yield result in total expected returns of 12.6% per year.

Top Dividend Champion #4: First of Long Island (FLIC)

- 5-year expected returns: 12.8%

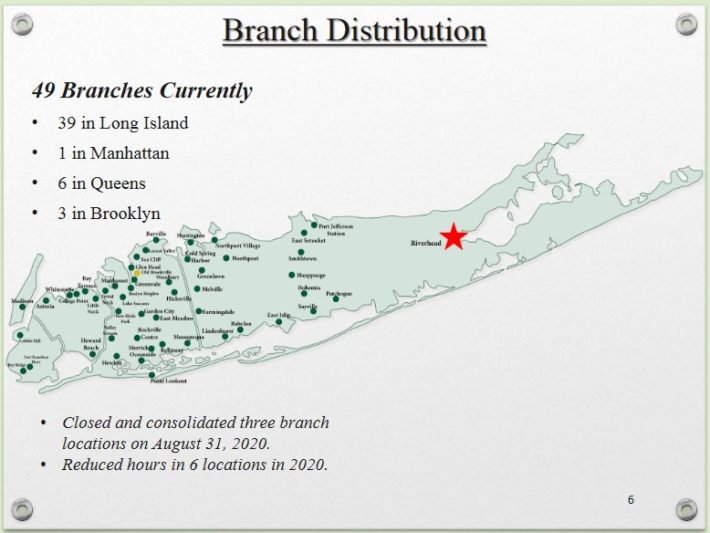

First of Long Island is a small-cap bank with a market capitalization just under $500 million. First of Long Island provides traditional banking services to consumers and small-to-midsize businesses. These include consumer loans, mortgages, savings accounts, and more. The company operates ~50 branches in New York.

Source: Investor Presentation

The company has posted steady growth in 2020, despite the difficult environment for banks due to the coronavirus pandemic, as well as extremely low interest rates which has widely suppressed net interest margins. In the most recent quarter, First of Long Island grew revenue by 13% year-over-year due to expanding net interest margins and a growing loan portfolio. Earnings-per-share rose 2% year over year.

First of Long Island has increased its dividend for 25 consecutive years, including a 5.5% increase in September 2020. It has achieved this dividend growth history by generating steady growth in good economies and bad, as it has continued to do in 2020. According to the company, in the past 5 years First of Long Island generated annual earnings-per-share growth of 8.7% and book value per share growth of 7.7% annually. We expect 5% annual EPS growth going forward.

In the meantime, the stock is reasonably valued with a P/E ratio of 10.3, below our fair value estimate of 13. An expanding P/E will add to shareholder returns, as will future EPS growth. Including the 4.3% dividend yield, total returns are estimated at 12.8% per year over the next five years.

Top Dividend Champion #3: Walgreens Boots Alliance (WBA)

- 5-year expected returns: 13.6%

Walgreens Boots Alliance is a pharmacy retailer with over 21,000 stores in 11 countries. The stock currently has a $35 billion market capitalization. Walgreens has increased its dividend for 45 consecutive years, placing it on the Dividend Aristocrats list.

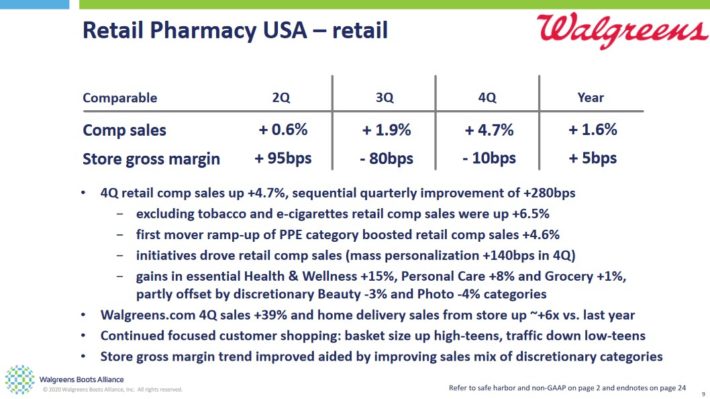

On October 15th, 2020 Walgreens reported Q4 and full-year 2020 results for the period ending August 31st, 2020. For the quarter, sales increased 2.3% to $34.7 billion. Adjusted operating income decreased -27.7% to $1.1 billion. On a per share basis, adjusted EPS decreased -28.2% to $1.02, reflecting an estimated adverse impact of -$0.46 from the COVID-19 pandemic.

For the fiscal year, sales increased 2.0% to $139.5 billion. Adjusted operating income decreased -24.9% to $5.2 billion, while adjusted earnings-per-share totaled $4.74, down -20.6% year-over-year but ahead of previous guidance of $4.65 to $4.70. This included an estimated -$1.06 adverse impact from the COVID-19 pandemic. In addition, Walgreens introduced fiscal 2021 guidance, anticipating low single-digit growth in adjusted EPS%.

Walgreens has a positive long-term growth outlook. Retail pharmacy has proven to be resistant to e-commerce and will benefit from the aging U.S. population and rising demand for healthcare. For example, in the most recent quarter Walgreens’ sales growth was led by a 3.6% increase in the Retail Pharmacy USA segment and a 4.3% increase in the Pharmaceutical Wholesale division.

Source: Investor Presentation

Pharmacy sales, which accounted for 75% of the Pharmacy USA segment’s sales in the quarter, increased 4.2% compared with the year-ago quarter. Separately, Walgreens announced more than 2,300 products will be available for delivery in Chicago, Atlanta, and Denver through DoorDash.

Walgreens has also announced a partnership with VillageMD in which Walgreens will offer full-service doctor offices co-located at its stores. Over the next five years, the partnership will result in 500 to 700 primary-care clinics in over 30 U.S. markets.

Walgreens’ competitive advantage is its leading market share. Its robust retail presence and convenient locations encourage consumers to use Walgreens instead of its competitors. This brand strength means customers keep coming back to Walgreens, providing the company with stable sales and growth.

Consumers are unlikely to cut spending on prescriptions and other healthcare products even during difficult economic times which makes Walgreens very resistant to recessions. Walgreens’ adjusted earnings-per-share declined by just 7% during 2009 and the company actually grew its adjusted earnings-per-share from 2007 through 2010.

Based on expected fiscal 2021 adjusted EPS of $4.98, Walgreens stock trades at a price-to-earnings ratio (P/E) of 8.2. Our fair value estimate is a P/E ratio of 10.0, which means a rising valuation could boost annual returns by 4.0% per year. We expect this expansion to combine with 5% expected annualized EPS growth and the 4.6% dividend yield to generate 13.6% annualized total returns over the next five years.

Top Dividend Champion #2: Telephone & Data Systems (TDS)

- 5-year expected returns: 15.4%

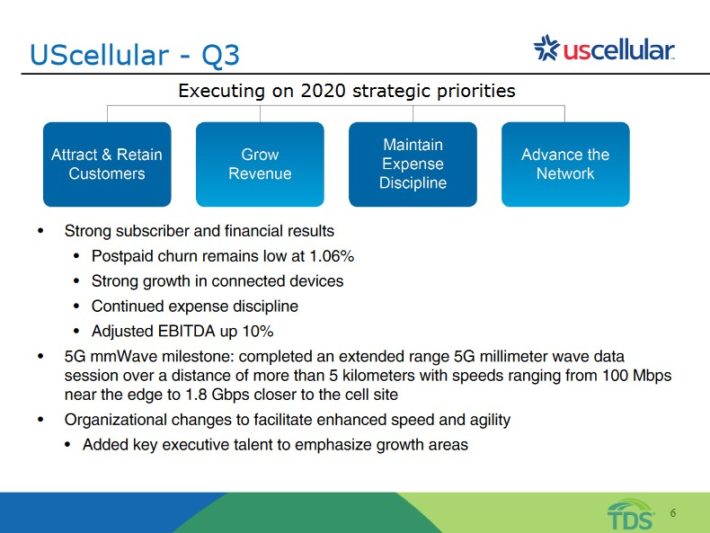

Telephone & Data Systems is a telecommunications company that provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across 24 U.S. states. The company’s Cellular Division accounts for more than 75% of total operating revenue. TDS started in 1969 as a collection of 10 rural telephone companies. Today, the company has a market cap of $2 billion and generates more than $5 billion in annual revenues.

On November 5th, TDS reported financial results for the third quarter. The company grew its total operating revenues marginally to $1.324 billion. Diluted earnings per share also grew significantly, by 340% to $0.66. Postpaid churn rate was favorable in comparison to last year, at 1.06% for the third quarter versus 1.38% in the same quarter last year. Average revenue per user for postpaid connections grew 2% which helped boost revenue. While wireline connections fell 0.5%, cable connections grew 11.7% last quarter, bolstered by the acquisition of Continuum.

The U.S. Cellular industry performed particularly well for TDS last quarter.

Source: Investor Presentation

Telelphone & Data Systems operates in the competitive telecommunications industry. Price wars are common among telecoms in the constant battle for subscribers. That said, the entire industry benefits from a high level of concentration. There are only a few major telecoms (AT&T, Verizon and T-Mobile) that dominate the U.S. market. Building a new network large enough to compete with the established giants, TDS included, would be extremely prohibitive.

TDS has historically held up extremely well during recessions; consumers are very reluctant to cut their telecommunications services like wireless, broadband, and cable, even during an economic downturn. For example, during the Great Recession, TDS’ earnings-per-share actually increased 69% from 2008-2010. The company has remained profitable during the current period of economic weakness caused by the coronavirus pandemic.

Much of TDS’ future growth potential depends on U.S. Cellular, as TDS has an 82% stake in U.S. Cellular. The company has a mixed track record when it comes to growth. During the last decade, its earnings-per-share have declined approximately 2.6% compounded-per-year on average. While the earnings trend has been volatile, book value per share has grown by 2.0% per year over the last decade. We expect 1.5% annual earnings-per-share growth over the next five years. Earnings growth will be achieved through a mix of revenue growth and margin improvements.

Due to the volatility in the company’s earnings, we believe that the best way to assess the valuation of TDS is by looking at its price-to-book ratio. TDS is currently trading at a price-to-book ratio of 0.43, which is lower than its 10-year average of 0.74. Our fair value estimate is a price-to-book ratio of 0.70.

If the stock reverts to its average valuation level over the next five years, it will enjoy a 10.2% annualized gain. Shareholder returns will be boosted by expected EPS growth of 1.5%, and the current dividend yield of 3.7%. Overall, total returns are expected to reach 15.4% per year over the next five years.

Top Dividend Champion #1: Exxon Mobil (XOM)

- 5-year expected return: 16.5%

Exxon Mobil is an integrated super-major, with operations across the oil and gas industry. In 2019, the oil major generated over 80% of its earnings from its upstream segment, with the remainder from its downstream (mostly refining) segment and its chemicals segment.

In late October, Exxon reported (10/30/20) financial results for the third quarter of fiscal 2020. Production increased 1% from the previous quarter. Overall, the company reported an adjusted loss of $0.18 per share, reversing a profit of $0.68 per share in the year-ago quarter.

Exxon will cut its capital expenses 30% this year in order to protect its dividend and will slow the development of its promising growth projects in the Permian and Guyana due to the depressed oil price. It also recently announced it will cut 15% of its global workforce, and incur a non-cash charge of $17 billion to $20 billion after elimination of several less-strategic assets.

That said, we remain positive regarding Exxon’s long-term growth prospects. According to a recent company presentation, new supply of 550 billion barrels of oil and 2,100 trillion cubic feet of natural gas are required through 2040 to meet projected global demand. In preparation, the oil major has greatly increased its capital expenses in order to grow its production from 4.0 to 5.0 million barrels per day by 2025.

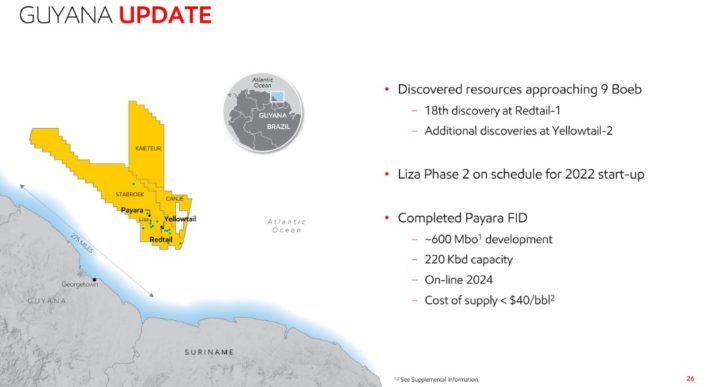

The Permian Basin will be a major growth driver, as the oil giant has about 10 billion barrels of oil equivalent in the area and expects to reach production of more than 1.0 million barrels per day in the area by 2024. Guyana, one of the most exciting growth projects in the energy sector, will be another major growth driver.

Source: Investor Presentation

In 2019, Exxon Mobil made 6 major deep-water discoveries in Guyana and Cyprus. In Guyana, Exxon Mobil has started Liza Phase I ahead of schedule. Guyana’s total recoverable resources are estimated at over 8 billion oil-equivalent barrels.

Exxon Mobil’s growth potential is challenged by the recent decline in commodity prices, as well as the prospect of a global recession due to the coronavirus. We view the coronavirus as a short-term issue. The company announced it will reduce capital expenditures to $16 billion-$19 billion for 2020 to preserve cash in this difficult environment.

Exxon Mobil’s earnings are volatile, due to the cyclical nature of the oil and gas industry. For 2020, we expect the company to report a loss, but we recognize that the actual results could vary drastically from this estimate due to the ongoing coronavirus crisis. In order to calculate future returns, we have used mid-cycle (5-year average) earnings-per-share of $3.26 as a base.

Using this estimate, the stock trades for a P/E ratio of 12.9 compared with our fair value estimate of 13. The stock is only slightly undervalued, but because of Exxon Mobil’s depressed earnings, we expect a snap-back with 8% annual expected earnings-per-share growth over the next five years. Including the 8.3% dividend yield, we expect total annual returns of 16.5% per year over the next five years.

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend stocks. In order for a company to raise its dividend for at least 25 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries. They also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 7 Dividend Champions presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more