Top 5 High-Yield Business Development Stocks To Buy Today

Separating out the most promising stocks from the entire sector, Tim Plaehn has discovered the top five business development companies with high yields to buy today. Each has a yield above 7% (the highest is 14.6%), ample cash flow to cover dividends, and great prospects for accelerating income.

The first calendar quarter of 2016 produced a wild ride for stock market investors. By mid-January, the markets were down over 10% and the financial infotainment shows were already talking about a record down year for the market. Now, at the end of March, the major stock indexes are above where they started the year. Investors who buy shares of business development companies (BDCs) are in them for the dividend income and do not really appreciate large share price swings. The market swings have separated the BDC pack, with a split between positive returns and negative results so far in 2016.

All of the 33 stocks in the BDC sector paid a dividend in the first quarter, which means share prices went through the ex-dividend share price drop. Now at the end of the quarter, 10 of the BDCs have share values higher than where they closed on December 31st, 2015. Investors owning shares of these stocks have earned their dividends plus some additional share price gains. The lower half of the BDC line-up consists of those companies where the share prices have fallen by a much larger amount than the dividends earned during the quarter. At the bottom of the list are a half dozen BDCs that have posted double-digit losses even when including dividends.

The current volatile economic markets and an uncertain future for the financial sector should encourage investors to stick with those BDCs that show both business and share price stability. It does no good to invest in a stock with a double-digit yield if the share price is dropping by 5% to 10% every quarter. To help you sort out the few more attractive BDC stocks from the generally not attractive pack, here are five stocks that have posted positive share price and total returns for the 2016 first quarter. They each offer a different story for investment potential going forward.

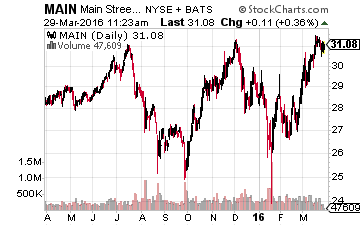

Main Street Capital Corporation (NYSE: MAIN) can be viewed as a core holding for income-focused investors. This is one of the few BDCs that has produced steady dividend growth. Since its 2007 IPO, MAIN has never reduced its dividend rate and since March 2011, the company has been able to increase the monthly payout at least once a year. Investors in MAIN have also received special dividends up to two times a year. Compared to other BDCs, this is not a high-yield stock, but the dividend growth and monthly dividends are enough to offset the current 7.0% yield.

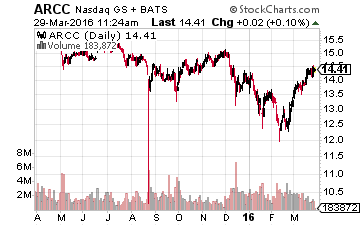

With an almost $5 billion market cap, Ares Capital Corporation (Nasdaq: ARCC) is by far the largest company in the BDC space. Ares Capital has been conservative in both the amount of dividends paid in relation to its net interest income and by using less debt leverage than the BDC rules allow. The current ARCC dividend rate has been steady since early 2012 and the dividends are well covered by cash flow. The share price has been in a downtrend since early 2014, even though business financials have remained steady. That trend seems to have reversed now in early 2016. ARCC yields 10.5%.

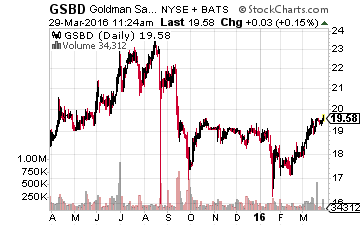

Goldman Sachs BDC Inc. (NYSE: GSBD) came to market one year ago with a March 2015 IPO. The BDC is generating net investment income well above its current $0.45 quarterly dividend rate. For the 2015 fourth quarter, net investment income was $0.62 per share, 35% above the dividend rate. The high level of excess cash flow and the Goldman Sachs management of this BDC make it a compelling investment choice. GSBD currently yields 9.0%.

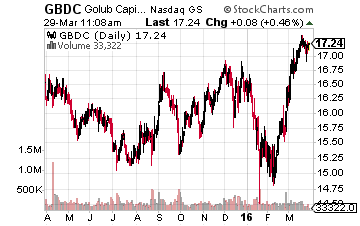

Golub Capital BDC Inc. (Nasdaq: GBDC) is a mid-sized, $900 million market cap, BDC that has paid a steady, level dividend since 2011. Through the end of 2015 the company has increased its net asset value per share for 14 consecutive quarters. That is a value creation record that few BDCs can match. GBDC currently yields 7.4%.

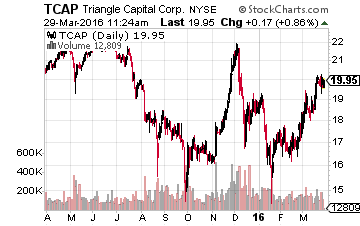

Triangle Capital Corporation (NYSE: TCAP) is a well-managed BDC with excess cash flow that trades at a mid-teens yield. The current quarterly dividend rate is $0.54 per share, and net investment income is running at $0.58 to $0.60 per quarter. When the excess cash flow builds up, Triangle capital has a history of adding to the quarterly dividend. For example, investors earned and extra 5 cents with the 2015 third quarter dividend. This BDC is more stable and better managed than the current 14.6% yield indicates.

Finding stable companies that regularly increase their dividends is the strategy that I use myself to produce superior results, no matter if the market moves up or down in the shorter term.

Disclosure: There are currently over twenty of these stocks to choose from in my more