Time For A Reality Check?

Greetings from PGA West in La Quinta, CA where it is sunny and warm. However, getting here took some doing and I had kind of a rough travel schedule last week... First I flew from Denver to NYC for meetings Monday through Wednesday. Then after a brief stop/nap in Denver very late Wednesday night, it was on to LA early Thursday morning (in hindsight, I REALLY should have paid more attention to my flight schedule here!). So, after tagging both coasts of our great country within a 24-hour period and catching a nasty head cold in the process, I've decided that it is probably best to let my indicators do the majority of talking this week.

Briefly, I will point out that Apple's (AAPL) warning on revenues due to supply chain interruptions and demand issues in China appears to have created a bit of a reality check for the stock market. The good news is that the number of Coronavirus cases looks to have declined over the weekend. The bad news is the reality that there will indeed be an economic impact to deal with - even for companies here in the good 'ol USofA.

My current take is that investors will have to sort this through and determine whether or not there is anything to worry about outside of some near-term interruptions. To date, the thinking has been that any problems are likely to be temporary and that demand will snap back once the health emergency fades. (This has been the pattern of past health emergencies.) From my seat, it looks like this will still be the case. But this doesn't mean that investors won't rethink their positions and/or take some of the outsized YTD gains off the table for a spell. As such, a pullback to test the bulls resolve and remove some of the froth makes sense to me in here somewhere.

However, my bottom line is that until/unless my Primary Cycle models or the Fundamental indicators start to falter, the dips should continue to be bought.

Weekly Market Model Review

Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

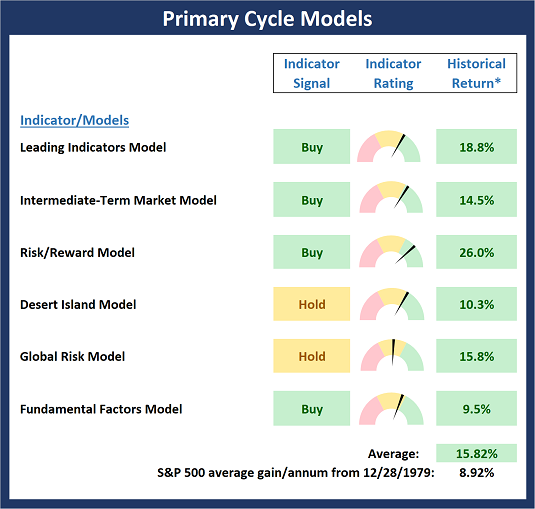

The Major Market Models

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There is one change to report on the Primary Cycle board this week... The Leading Indicators moved back up into positive territory, albeit by skinniest of margins. So, with no sell signals and more green than yellow, my take is the board should continue to be viewed as positive. As I've been saying for some time, I feel the board suggests that the bulls should be given the benefit of any doubt and that dips should be viewed as buying opportunities.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

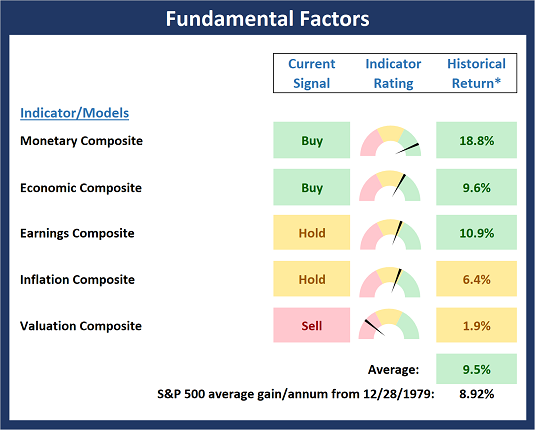

The State of the Fundamental Backdrop

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

There were no obvious changes to Fundamental Factors board this week. However, if you look very closely, you will see that the historical return of the S&P 500 when the Economic model is in its current mode moved down a bit from last week. While it may sound counterintuitive, the historical average return is lower because the model actual improved a bit. And history shows that when the economic model improves, the return of market does not move up correspondingly. This is likely due to the fact that stocks tend do discount the future and when the economic model is moving up, stock prices may look ahead to the next trend.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Trend

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

The good news is the Short-Term Channel Breakout System is back on a buy signal this week. As the saying goes, one of the most bullish thing a market can do is make new highs. However, the bad news is the Cycle Composite points south for the next two weeks. However, since the market isn't exactly in sync with the cycle projection at this time, I think we can take solace in the idea that the trend is a friend to the bulls here.

NOT INDIVIDUAL INVESTMENT ADVICE.

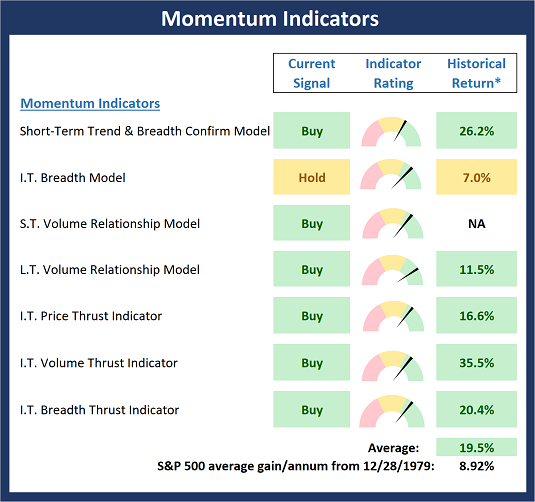

The State of Internal Momentum

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

The was a fair amount of improvement to be found on the Momentum board this week. And since I spent my time in this space last week whining about a lack of "mo" in the market, the upticks seen in the S.T. Trend & Breadth Confirm and all three of the "thrust" indicators suggests that perhaps there is a little "mo" working in the bulls' favor. Personally, I am still a little skeptical given the parabolic moves seen on some of the market leaders. But if the bulls can hang in there during the next pullback, I'll have to get over my issues!

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

Although the Mean Reversion model upticked to a buy signal last week, the rest of the Early Warning board looks to be sliding back toward the bears side of the field. To be sure, the board is neutral at this time. However, given the fact that the sentiment indicators suggests a fair amount of complacency remains in place and that stocks remain overbought, the scale could very easily tip in the bears' favor at any time. The point is that if some sort of pullback shows up in the near term, it shouldn't come as a surprise. Yet, I'd continue to view any pullbacks/corrections/sloppy periods as opportunities to put money to work.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more