Tim Sloan: Is Wells Fargo’s CEO Worth The Pay?

The Chief Executive Officer role is one of the most important jobs in any large organization.

Because of this, many of the top leaders in publicly-traded corporations have become household names. Warren Buffett and Jeff Bezos are both examples of this.

But many other CEOs fly under the radar – despite their remarkable success. Recently we have published research on severalchief executives who run well-known companies like:

In this article, we will be performing an analytical deep dive into the performance and compensation of Tim Sloan, the Chief Executive Officer of the publicly-traded financial institution Wells Fargo (WFC).

Tim Sloan’s History Prior to Becoming CEO

Tim Sloan (pictured below) has had a long history in the financial services industry.

Before starting his career, he studied at the University of Michigan-Ann Arbor, where he earned a B.A. in economics and history and, later, an MBA in finance and accounting. His early years in the workforce were spent at the Continental Illinois Bank in Chicago, where his first job was as a bank teller.

Tim Sloan joined Wells Fargo in 1987, where his first role was in the bank’s Loan Adjustment Group. Between 1991 and 2010, he held various role in the firm’s Wholesale Banking division, including stints as the head of Commercial Banking, Real Estate, and Specialized Financial Services.

Mr. Sloan’s more recent experience has been more typical of a corporate executive.

Beginning in 2010, he served as Wells Fargo’s Chief Administrative Officer, managing Corporate Communications, Corporate Social Responsibility, Enterprise Marketing, Government Relations, and Corporate Human Resources. In 2011, he was appointed as Wells Fargo’s Chief Financial Officer, responsible for all enterprise financial management functions.

In 2014, Mr. Sloan was appointed as the head of Wells Fargo’s Wholesale Banking business – the unit in which he had spent all of his career to date.In fact, many pundits believed that Tim Sloan’s background outside of the Community Bank (the business unit which had experienced so many ethical problems before his appointment as CEO) was an important reason why he was awarded the top job.

He became Wells Fargo’s President and Chief Operating Officer in October of 2015, a role that made him responsible for Wells’ four main business groups: Community Banking, Consumer Lending, Wealth and Investment Management, and Wholesale Banking. Later, Mr. Sloan was elected to the firm’s Board of Directors in October of 2016.

Tim Sloan has been the Chief Executive Officer of Wells Fargo since October of 2016 – the same month he was elected to the bank’s board – succeeding long-time CEO John Stumpf.

In the next section of this article, we will perform a detailed analysis of Wells Fargo’s performance under Sloan.

Wells Fargo’s Performance Under Tim Sloan

Wells Fargo announced Tim Sloan’s appointment as CEO on October 12th, 2016. The company’s stock closed at $45.32 that day. For context, Wells Fargo is trading below $45 today – lower than its price when Mr. Sloan was appointed as CEO more than two years ago.

But this does not tell the entire story. Wells Fargo is a dividend-paying stock, which means that stock price movements do not capture all of the company’s wealth-generating capabilities. A better way to measure Sloan’s performance is by assessing its returns including reinvested dividends.

In the following image, Wells Fargo’s total return is compared to the total return of the S&P 500 Index (including reinvested dividends) since Sloan’s appointment as CEO on October 12th, 2016.

The bank’s stock price – including reinvested dividends – has been rather poor, underperforming the S&P 500 by a wide margin. We believe there are four reasons why Wells Fargo’s performance (as measured by stock price) has been so poor under Mr. Sloan’s tenure.

First, this is a relatively short period of time to measure the performance of any company – let alone its CEO. At a minimum, we believe that a CEO’s ability to generate value for shareholders should be measured in time periods no shorter than three to five years. It may be worthwhile to revisit Mr. Sloan’s performance (as measured by Wells Fargo’s stock price) once more time has passed. In addition, it may also be useful to measure the company’s performance using business fundamentals (like earnings or revenues, each measured on a per-share basis).

Second, we are in the midst of a correction in the equity markets, which has caused Wells Fargo’s stock price to decline along with the rest of the broader stock market. If you measured Mr. Sloan’s performance through the end of August 2018 (the bear market began in mid-September), then Wells Fargo’s stock returned 37% including reinvested dividends, not far behind the S&P 500’s total return of 41%.

Third, Mr. Sloan was placed into his job during a period of significant difficulty and uncertainty for Wells Fargo. This was not your normal succession planning. Instead, Wells Fargo’s past CEO John Stumpf was fired amidst a scandal that saw retail bank employees open unauthorized bank accounts on behalf of their customers to hit sales goals that were otherwise unachievable. These issues have likely consumed a large amount of Sloan’s time and efforts, making his job as CEO more difficult than it would have been otherwise.

Lastly, Wells Fargo has had some artificial impairments placed on its business model that have certainly impacted the firm’s ability to generate long-term value. More specifically, on February 2nd, 2018, the Federal Reserve published a press release titled “Responding to widespread consumer abuses and compliance breakdowns by Wells Fargo, Federal Reserve restricts Wells’ growth until firm improves governance and controls. Concurrent with Fed action, Wells to replace three directors by April, one by year end.“

Note: The Federal Reserve appears to be a fan of long titles for their press releases.

The press release contained two major points of interest.

The first is that Wells Fargo is hereby restricted from increasing the size of its balance sheet beyond its value at year-end 2017. Looking to the company’s fourth quarter earnings release, this amounts to a balance sheet no greater than $1.94 trillion. The second is that Wells Fargo was required to replace three directors by April 2018 and another by the end of the calendar year.

Then-Chair of the Federal Reserve Janet Yellen made the following statement about the restrictions placed on Wells Fargo’s business model:

“We cannot tolerate pervasive and persistent misconduct at any bank and the consumers harmed by Wells Fargo expect that robust and comprehensive reforms will be put in place to make certain that the abuses do not occur again. The enforcement action we are taking today will ensure that Wells Fargo will not expand until it is able to do so safely and with the protections needed to manage all of its risks and protect its customers.”

The penalty was unprecedented in the history of the Federal Reserve. Accordingly, on the same day as the Federal Reserve’s press release, Wells Fargo countered with an equivalent press release titled “Wells Fargo Commits to Satisfying Consent Order With Federal Reserve.”

In the release, the bank stated:

“It is confident it will satisfy the requirements of the consent order it agreed to today with the Board of Governors of the Federal Reserve System. Under the consent order, the company will provide plans to the Federal Reserve within 60 days that detail what already has been done, and is planned, to further enhance the board’s governance oversight, and the company’s compliance and operational risk management. The order also provides for third-party reviews of such plans and, until they are approved and implemented, limits on the growth of the company’s total consolidated assets to the level as of December 31, 2017.”

Moreover, the following remarks were contributed by Mr. Sloan:

“We take this order seriously and are focused on addressing all of the Federal Reserve’s concerns. It is important to note that the consent order is not related to any new matters, but to prior issues where we have already made significant progress. We appreciate the Federal Reserve’s acknowledgment of our actions to date. In addition, the order is not related to Wells Fargo’s financial condition — we remain in a strong financial position and stand ready to serve the varied financial needs of our customers.”

This cap on assets and shakeup in the board room has likely impaired Mr. Sloan’s ability to focus on generating long-term value for Wells Fargo’s shareholders.

The main takeaway from this digression is this: while Wells Fargo has inarguably underperformed the public markets since Mr. Sloan has became the company’s CEO, there are a number of intrinsic and external factors that have contributed to this. It is impossible to measure how much the firm’s poor performance has been due to Mr. Sloan directly, but overall the bank has underperformed.

Tim Sloan’s Compensation Package

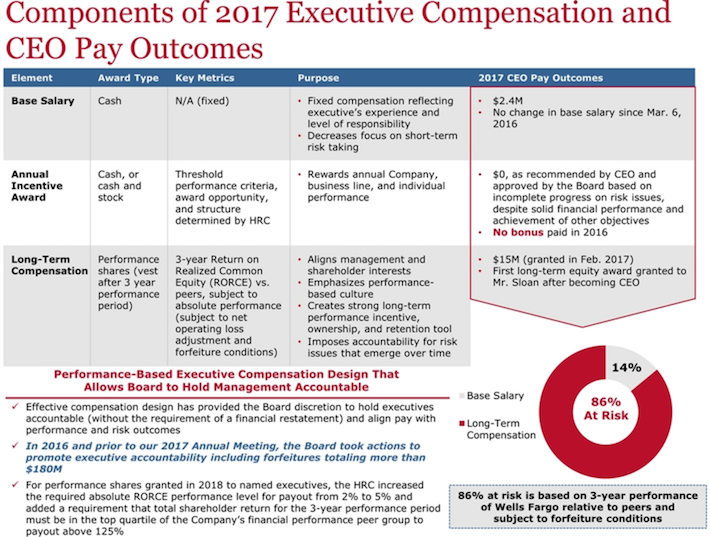

Tim Sloan’s compensation package in fiscal 2017 is shown below.

Source: Wells Fargo Proxy Document

Mr. Sloan earned $2.4 million in base salary and $15 million in long-term compensation, which is composed of performance shares that vest 3 years after the performance period. Overall, Sloan’s compensation package totaled $17.4 million in the most recent fiscal year.

Here’s how that compared to other CEOs in the large-cap financial services space:

- JPMorgan Chase & Co. (JPM): Jamie Dimon, $30 million

- Goldman Sachs (GS): Lloyd Blankfein (recently retired), $24 million

- Citigroup Inc. (C): Michael Corbat, $23 million

- Bank of America (BAC): $23 million

Tim Sloan’s compensation package was lower in 2017 than every one of his major peers. Given Wells Fargo’s ethics problems and the company’s poor stock price performance, we believe that this is a fitting outcome for the Chief Executive Officer.

Final Thoughts

Tim Sloan has had a long career at Wells Fargo and assumed leadership of the company at one of the most difficult points in its history. After nearly two years leading the company, his job was made even more difficult when the Federal Reserve imposed its unprecedented asset cap.

While Wells Fargo has underperformed the S&P 500 since Tim Sloan has assumed leadership, there are several outside factor that have influenced this (including the aforementioned asset cap).

It is possible that Tim Sloan successfully turns around Wells Fargo and restores its reputation among consumers. And, at just 58 years old, the CEO has plenty of runway left in his career to do so.We are taking a ‘wait and see’ approach on grading Tim Sloan’s performance at Wells Fargo.It’s too early yet to tell Sloan’s long-term value creation ability at the helm of Wells Fargo.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more