Throw It All Out The Window

It’s time to throw all those financial “mumbo jumbo” ratios out the window. That’s right. You can take your P/E, P/B, P/S ratios and send them out packing with EV/EBITDA and the PEG ratio. While you’re at it, why don’t you free up some space and toss out all those finance textbooks you bought in college and grad school. None of it matters. At least not this week where making money in the market has been as simple as “buy low and sell high.”

Through yesterday’s close, the S&P 1500, which is comprised of large-caps (S&P 500), mid-caps (S&P 400), and small-caps (S&P 600), was up just under 1% on the week. The average week to date performance of individual stocks in the index, however, was a much more impressive gain of 5%. By far the biggest gains have come from the stocks with the lowest share prices. Coming into the week, there were 55 stocks in the S&P 1500 that had share prices of less than $5, and through Wednesday’s close, they were up an average of 21% with 54 of 55 in the black.21%!!!! Coming into today, there were also seven stocks in the S&P 1500 that were already up over 40% this week, and guess what? They all came into the week with share prices below $5.

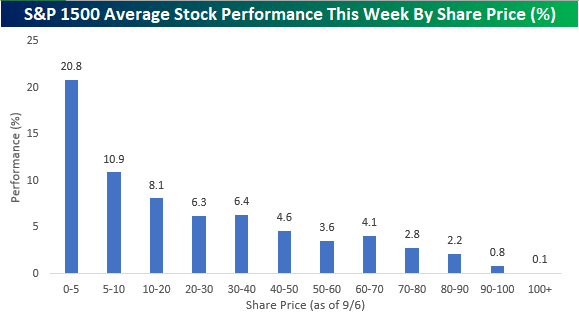

Looking at the performance of individual stocks this week shows that share prices appear to have been a key driver of performance. In the chart below, we grouped stocks in the S&P 1500 based on their share prices as of last Friday and then calculated the average performance of the stocks in each group so far this week (through Wednesday’s close). While stocks with share prices of less than $5 per share were up an average of 20.8%, the performance of stocks priced between $5 and $10 per share were up a still impressive 10.9%. What’s even crazier about this chart is the fact that as you move out to the right (higher share prices), average performance consistently weakens to the point where stocks with high share prices ($100+) have only gained an average of 0.1% so far this week. Who needs Alphabet (GOOGL), Amazon (AMZN) and Chipotle (CMG) when you could have had JC Penney (JCP), Dean Foods (DF), or Mallinckrodt (MNK). If these high priced stocks know what’s good for them, they better start announcing 10-1 splits pronto! (That was a joke.)

In all seriousness, the performance numbers listed below further illustrate this week’s massive rotation out of momentum strategies, where stocks and sectors that had been leading have been sold off while those that had lagged or been written off for dead have seen some buying interest or at least an easing of selling pressure. All the textbooks and financial ratios in the world may provide comfort to analysts and investors, but they don’t help at all when the momentum tide turns.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Premium for our most actionable investment ideas.

Disclaimer: Read our ...

more