Three Growth Stocks To Benefit From Trump’s Space Force

An exciting growth area that has captured investor interest lately, as evidenced by some of the stock action we’ve seen in companies related to the sector, is space. Even the U.S. government, at the direction of President Trump, has become focused on protecting, and putting more money into, space.

If the creation of a U.S. Space Force conjures images of Star Wars style battles, you’re a few light years ahead of reality. The initial focus of the Space Force will be to protect satellites that convey vital information to our military, think GPS for ships and missiles.

China, among others, has demonstrated the ability to shoot down satellites which, in a battle, would be the equivalent of blinding our military. Politicians on both sides of the aisle see the need to protect U.S. space assets.

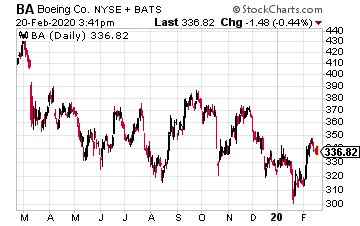

Along with an increased sense of urgency toward protecting space, new companies coming public, with others in the wings, have grabbed investor attention as well. There are few true “space” companies that have issued stock yet, with most returns on space activity being buried in large companies, like Boeing (BA).

But, I’ve found a few very interesting space companies that are well positioned to grow along with the increasing public and government focus on space.

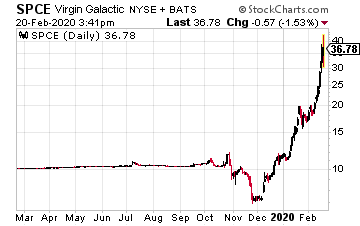

The most recent space company to go public, and completely capture the public imagination with space, is Sir Ricard Branson’s Virgin Galactic (SPCE). Virgin Galactic is a “space tourism” company, with the goal of carrying passengers to space for a few minutes of weightlessness and a great view: all for a very affordable $250,000 per ticket.

The company reports earnings on February 25th, but has one slight problem if we’re looking to value the company on fundamentals. They haven’t yet flown any paying customers to space, so they have no earnings.

The company does have deposits of over $80 million from over 600 customers who have already booked a spot to space. And, the company is projecting revenue of approximately $115 million in 2021 as the service gets off the ground.

But, what really interests me is the potential for hypersonic point-to-point travel that Virgin Galactic is targeting. While several years out, this has the potential to not only disrupt air travel, but in essence create an entirely new travel industry.

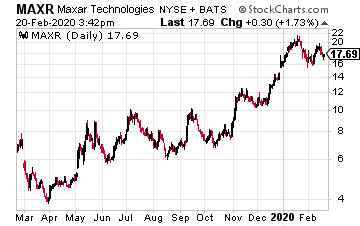

The other pure play space company available to investors right now, is Maxar Technologies. (MAXR). Over the past few years Maxar has cobbled together a number of smaller space related analytics companies, and now provides space based services to a variety of industries.

Need a satellite view of your crops? Or weather reports to guide your shipping fleet? That’s what Maxar does.

While the company had revenue of $479 million in its latest quarter, it is still working on paying down debt and becoming profitable. It lost $0.44 per share last quarter, but it appears investors are looking to the future, as the stock has more than doubled since that report.

It is very likely Maxar will be a beneficiary of the stand-up of the new Space Force. The potential for new government business, combined with its current commercial portfolio of clients, make the company a potential big winner in space.

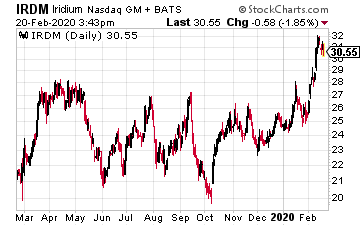

Finally, let’s talk about a communications company that uses the space environment to deliver its product. Iridium Communications (IRDM) controls the largest commercial satellite fleet in the world.

With 66 low earth orbit (LEO) satellites, Iridium boasts that it covers 100% of the world. Their satellite communications are invaluable as backup to the U.S. military operating in remote areas.

Just last month, they renewed a contract for Enhanced Mobile Satellite Services to the government. And, it’s only logical they would be a beneficiary of a Space Force deployment.

In their latest quarterly report the company lost $0.14 per share, but increased their outlook for future growth. They announced the capture of not only new communications contracts, but growth in Internet of Things (IoT) service providers as well.

Space has been on a low simmer for several years. These three companies will help you capture the growth as that simmer gets closer and closer to a boil.

Disclosure: None.