This Year Dividend Payouts Are Expected To Pass The $500 Billion Mark For The First Time

Last week the Wall Street Journal reported that dividend payments from the S&P 500 companies are expected to exceed $500 billion in 2020. This will be the most cash ever paid to stock market investors. Are you doing everything you can to get your share?

The WSJ article does not give an estimate on how much above the half-trillion dollar mark will be paid out to investors. It noted that in 2019, the S&P 500 companies paid out $485.5 billion, which was up 6.4% from 2018.

The problem is that with the 29% gain by the S&P 500 in 2019, the index yields just 1.8%. If dividend payments go up 6% this year, investors in S&P tracking ETFs will still earn less than a 2% yield.

To invest for dividends, I recommend owning individual stocks. You can find high yield stocks that will pay an attractive current income. For dividend growth stocks – those with rising dividends, there are many with higher current yields and attractive dividend growth rates.

Big-name growth stocks have powered the gains 2019 and first few days of this year. That will not always be the way the stock market rolls. Value again will have its day. In my research, value stocks are those with the aforementioned above-average yields combined with growing dividends.

Here are three stocks from my watchlist that meet those two criteria. You should do your research to understand what will allow these companies to continue to grow their dividend rates year after year and to see how they fit into your own investing strategy.

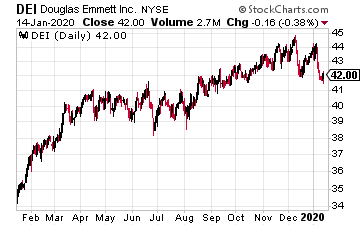

Douglas Emmett, Inc (DEI) is a real estate investment trust (REIT) that owns and operates approximately 18.4 million square feet of Class A office space and 4,147 apartment units in the coastal markets of Los Angeles and Honolulu.

This is a fully integrated real estate company, specializing in high barrier to entry markets.

Douglas Emmett is growth-focused, increasing office ownership by 59% and apartments by 45% since the 2007 IPO. Funds from operations as adjusted (AFFO) per share has compounded by 7.4% per year since the IPO.

The dividend has increased every year since 2008. Ten-year average growth has been 10.2%. DEI currently yields 2.7%.

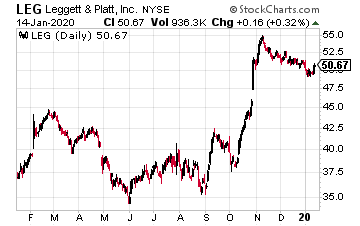

Leggett & Platt Inc. (LEG) is a diversified manufacturer that designs and produces a wide variety of engineered components and products found in most homes and automobiles.

The 136-year-old company is comprised of 15 business units, 23,000 employee-partners, and 145 manufacturing facilities located in 18 countries.

Products include bedding components, automotive seat and lumbar systems, private label beds, furniture components, and adjustable beds. Management’s target is to produce total shareholder return in the top one-third of the S&P 500. The LEG dividend has increased for 40 consecutive years, with an average 10-year 5% dividend growth rate. The current yield is 3.2%.

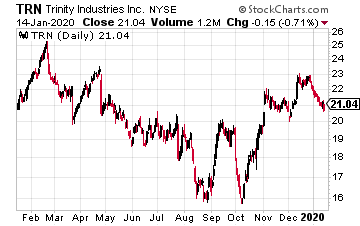

Trinity Industries Inc. (TRN) is a leading provider of railcar products and services in North America. The company operates an integrated platform designed to optimize the ownership and usage of railcars.

Trinity also owns a highway products manufacturing business and a logistics business.

The company has paid a dividend for 222 consecutive quarters and has increased the dividend ten years straight.

Dividend growth has been at a double-digit rate for the last decade. TRN yields 3.6%.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more