This Wall Street Data Provider Is Set To Rally In 2020

So the President gets impeached and Wall Street treats it like one giant snoozefest. If someone told you a year ago that Brexit would finally get done and President Trump would be impeached, you’d probably assume that the markets would be going bonkers.

It hasn’t. Instead, the stock market’s as calm as ever.

Let’s look at some numbers. On Monday, the S&P 500 completed a string of eight up sessions in nine days. The only loser was a teeny tiny loss of 0.04%. In other words, we came close to having a nine-day winning streak, and that happened through the U.K. election and the impeachment vote.

How did this happen? That’s easy.

One of the big mistakes investors make is confusing financial markets with voting booths. Markets have rallied under both parties, and markets have dropped under both parties. Sometimes stocks just have a mind of their own. It’s just how it is and to be an investor, you need to know the rules. To quote Hyman Roth, “this is the business we’ve chosen.”

In the long run, stocks are all about earnings and valuation. But that takes time. It looks like the S&P 500 is about to wrap up another solid year. The index is currently up close to 30% for the year. The S&P 500 has made 32 record highs this year, and it’s made 21 record highs in the last 40 trading days.

But what comes next?

Let’s look at how well the market has done historically after +20% years. Not so bad, actually. Since 1950, it’s happened 18 times, and in 15 of those years, the stock market has made a profit the following year. The average gain is 11.2%.

That’s not all. If the S&P 500 closes above 3,248.87 on December 31, then this would be the best year for stocks since 1997.

The New Mood on Wall Street

The mood has shifted, and investors are more confident than they were over the summer. Remember in August when the two-year Treasury yield jumped above the 10-year yield for about half an hour? The great “inversion” scare was good for about a week, as market commentators talked about “being very concerned.”

Well, here we are a few months later, and the yield curve is back to normal. In fact, the 2/10 spread is now the steepest it’s been in over a year.

There’s been more good news about the economy. For example, Fannie Mae significantly boosted its housing forecast for next year. According to Fannie, “growth in single-family housing starts will accelerate to 10% during 2020 and top one million new homes in 2021.” Last month, mortgage applications to buy new homes were up 27% from last year.

Housing demand is very high, especially at the lower end of the market, and that’s exactly where builders have been least active. Earlier this week, the new-homes sales report showed the best three-month run in the last 12 years.

In the last year, new-home sales are up 17%. The recent report from the National Association of Home Builders showed homebuilder confidence is at a 20-year high. It’s even higher than it was during the housing bubble.

Last week, we saw a nice rebound in the report in industrial production. This data hasn’t been very strong in recent years. Some of the recovery is due to the end of the GM strike, but that doesn’t explain all of it.

I’ve also noticed that credit spreads are tightening. In plain English, that means that lenders are willing to take on more risk. That’s actually good news, at first, since it means more borrowers have access to capital. This can eventually become a problem when too many folks find themselves in too much debt. For now, it’s good news and suggests that a recession isn’t imminent.

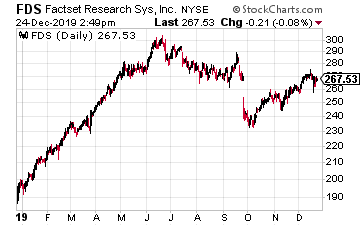

FactSet Creamed Wall Street’s Earnings Forecast

Stocks are like a good place to be. I’ll give you an example. Recently, FactSet (FDS) reported fiscal Q1 earnings of $2.58 per share. That was a 9.8% increase over last year, and it easily beat Wall Street’s estimate of $2.42 per share.

If you’re not familiar with FactSet, they provide Wall Street with all the data and numbers that we love to play with. It’s a good business to be in. A few months ago, FDS alarmed some investors when it gave unimpressive guidance for this fiscal year. The stock took a big hit.

Let’s look at some numbers. For their fiscal Q1, which ends in November, organic revenue grew 4.2% to $367.9 million. I like that FactSet’s operating margin improved to 33.9%, compared with 31.5% last year. At the end of the quarter, FactSet’s client count stood at 5,601. The company now has 126,785 users and 9,865 employees.

Even though FDS had a solid quarter, the company didn’t alter its conservative guidance. I suppose changing the numbers after one quarter might be too soon. For what it’s worth, FactSet still expects full-year earnings to range between $9.85 and $10.15 per share, and revenue between $1.49 and $1.50 billion.

I expect that sometime in early 2020, FactSet will raise its guidance and the shares will rally. FactSet is a solid stock to own for 2020.