This Specialty Oil Play Is Unique And Is Poised To Move Higher

We believe HollyFrontier Corporation (HFC) shares are undervalued, and have been buying in a pyramid style fashion on the way down, while also owning some protective puts which have given profit. We think the stock could trade well over $100 by 2020, provided the macroeconomic outlook remains similar to the present situation and our near-term expectations for energy to trade in a range bound fashion hold.

There are several key reasons we believe investors need to consider this name. The first is that we project the price of oil to start to stabilize into 2019. While our initial expectations for the price of crude have been revised lower given the recent glut, what matters is the crack spreads. The spreads between what the company pays for its input, raw oil, and the costs for what is sells its products for, is projected to remain wide (if not widen).

Source: HollyFrontier

We also believe it is key to point out that the company's refiner down times it had experienced were temporary, and while turnaround is costly, they are a long-term benefit to help boost capacity which is extremely limited for base III oils with so few companies in the space. Coupled with rising demand for base III oils in several industries, the demand/capacity picture is attractive. We will add that a possible rollback of fuel standards, and further RIN credits (required costly) biofuel additives could reduce expenditures longer-term.

The recent purchases of Red Giant Oil and Sonneborn, are underappreciated. There is a great dividend, now approaching 2.5%, and the company is pretty liquid, with modest debt, allowing it to easily fund the appropriate opportunity to inorganically grow. Finally, on several rudimentary valuation metrics, the stock has upside based on our moderately bullish expectations for future earnings, but also suggests upside remains even if we are off significantly.

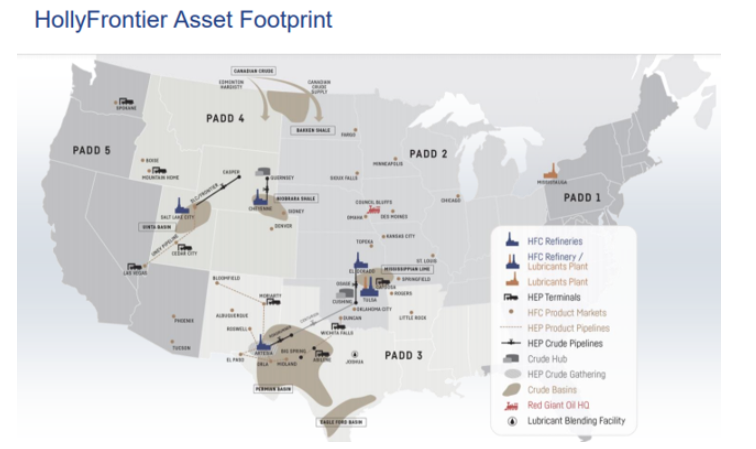

If you do not recall our first overview of the name, this is a specialty oil company that has a large presence in much of the energy rich areas of the United States:

Source: HollyFrontier September presentation

So what does it do? Holly is a base oil and lubricant company, primarily. It has been quietly in growth mode for several quarters, though the stock has taken a breather in recent months with oil, and we believe there is opportunity here as the company is making acquisitions to expand its footprint, setting up for long-term success in its operating sector.

What is up with Lubricants and Specialty Products?

The lubrication and specialty oils market is a really interesting niche market in the oil industry. It is pretty small and it is involved in the utilization of different processes and expertise than commodity petroleum products. While not world-scale, lubes and specialty products are high-margin, yet not an easy field to enter. The operational decision to group the lubes operation of the Tulsa refinery with the Mississauga operation can be expected to improve efficiency. The company made several recent acquisitions to REALLY boost its dominance in this space. What are we talking about here?

Great acquisitions

The first recent purchase of note was of Red Giant Oil. This is a lubricants company and is one of the largest suppliers of engine oil for locomotives in North America. This will expand the company's footprint in Idaho, Utah and Wyoming, along with bringing in a blending and packaging facility in Texas. Red Giant Oil is expected to generate approximately $7.5 million in annual forecasted EBITDA for HollyFrontier. We think that number is too conservative on management's part and believe that it can approach $10 million additional EBITDA in coming years depending on oil pricing and margins, but also is factoring in growth in demand as well as limited capacity for additional production in the Americas for specialty lubricants.

As the next few quarters advance, we expect immediate synergies from this acquisition, and suspect based on EBITDA contributions it could add $0.06 in earnings. The second major purchase was recent, and was of Sonneborn for $655 million, including working capital with an estimated value of $72 million. This deal will likely close in 2019. The company expects to fund the transaction with cash on hand, and anticipates the acquisition will be immediately accretive to HollyFrontier’s earnings per share, cash flow and EBITDA margins.

Why is this one good to consider. Sonneborn has been setting global industry standards by offering specialty products as one of the world’s largest dedicated suppliers of white oils and waxes. Many of the largest personal care, cosmetic, pharmaceutical and food processing companies use Sonneborn’s products. Sonneborn is a leading specialty hydrocarbon producer that offers this global reach combined with expertise and depth of experience. With the addition of Sonneborn, HollyFrontier, itself, will become a leading global supplier of specialty products.

Fiscally it looks good. Sonneborn has generated approximately $66 million of EBITDA over the 12-month period ended July 2018, representing an EBITDA margin of 18%. This acquisition will advance HollyFrontier’s downward integration strategy into high margin specialty products and significantly grow the Rack Forward business segment.

More on The Crack Spread

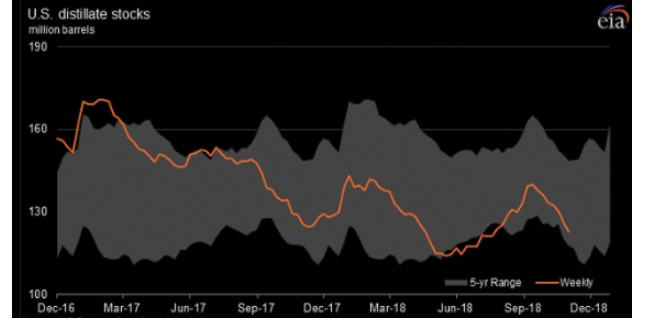

Distillate stocks are near the low end of their five year range.

Source: Data from EIA, graphics by BAD BEAT Investing

The trend in the 3-2-1 crack spread, a measure of refining profitability, is shown about $15/barrel. The specific crude used for this calculation is WTI-Cushing. However, as we detailed before, companies like HollyFrontier are able to use less expensive crude, and often will net larger profitability. So even though oil prices are heading lower, the spread is what matters and it remains strong. Further, because HollyFrontier’s product contains more distillates than the typical refiner and because distillates are more in demand with a higher price, HollyFrontier is also in a better competitive position with its product slate. So it is WINNING.

No impact of new regulations

One concern that we previously had when we first looked at the name in detail was potential legislation to improve/clean fuels. We want to point out that the The International Maritime Organization’s standard to reduce the sulfur content of marine fuel from 3.5% by weight to 0.5% by weight goes into effect January 1, 2020.

Source: International Maritime Organization

How big of an impact is this? Well, the global residual fuel oil market is 7.5 million barrels per day, and half of this is marine fuel will be hit by this new rule in 2020. What is important to note is that unlike some competitors inside and especially outside the U.S., HollyFrontier’s refineries will require no new capital investment to meet the new fuel specifications. This gives it a leg up on competition.

HollyFrontier’s Competitive Position

There is no doubt that the refining sector in the United States is tough. There's always so many moving parts and it requires large, fixed capital assets, siting for new refineries is typically environmentally prohibitive, feedstock costs are volatile, and products are highly regulated. This is just the nature of the beast when investing here. It is difficult. Holly is a growing market share of the total U.S. refining capacity. Right now it is under 19 million barrels per day Marathon Petroleum (MPC), the largest refiner, is 16%, and Valero (VLO) is 14%. There are a few more companies sprinkled in between, and we get to HollyFrontier’s share, which is 2.7%.

Aside from MPC and VLO, major competitors include BP (BP), PBF Energy (PBF), and Phillips66 (PSX). Other refiners with smaller regional market shares in the mid contientent include CVR Energy (CVRR), Chevron (CVX), and ExxonMobil (XOM).

In PADD III, which includes Texas, Louisiana, and New Mexico, the company has more dominance. We believe much of the growth will be here, and this continues to benefit the spreads as we mentioned above.

For base III oils, HollyFrontier is one of the only producers. The Petro-Canada Lubricants plant is the largest producer of base oils in Canada with 15,600 barrels per day of lubricant production capacity, and until 2017 it was the only North American producer of Group III base oils. It remains unclear at this time whether other companies will step into the realm of producing these oils, which could impact the capacity versus demand charts.

Our research suggests that demand will grow in the auto industry, but at this time few companies have expressed interest moving in this direction. The only one we have identified has having produced base III oils are Calument. At the 13th ICIS Pan American Base Oil conference, base II oil producer Motiva announced it will produce Group III base oils commercially at its Port Arthur, Louisiana base oil facility. With the limited number of players in the space, HollyFrontier enjoys an advantage.

Source: Quad 7 Capital, photo taken on site visit June 2018

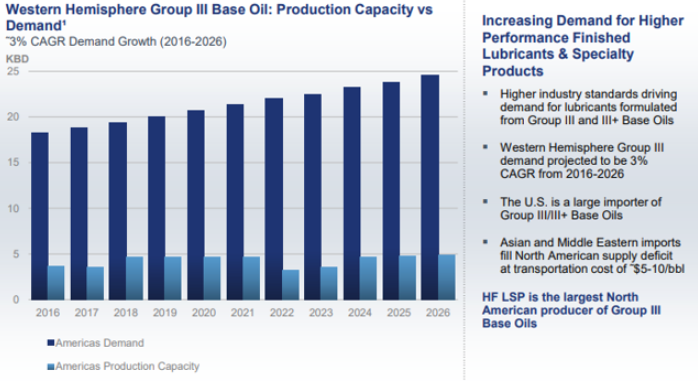

Demand versus capacity projections.

As we look to the start of a new decade, our longer-term oriented followers will be pleased with projections for the demand for base oil production versus production capacity:

Source: Holly Frontier September presentation

These projections are key, and our review of current performance and industry trends leads us to believe the demand curve is accurate. While production capacity can get a little sticky to project with precision given that we do not know the state of producers years ahead, the key takeaway here is that we expect no meaningful increases in the ability to produce more base oil.

We believe that the fact that the demand for higher performance lubricants and specialty products coupled with the limited production capacity projections is wildly bullish in our estimation. While pricing will fluctuate quarter to quarter on energy exchanges, the fact is that there will be increasing demand for higher performance finished lubricants and specialty products moving forward, while capacity is flat to down. As HollyFrontier is the largest producer in North America, we view this as bullish, and believe investors still have the opportunity to capture alpha from this divergence.

Valuation

HollyFrontier’s market capitalization is over $10 billion today. It currently trades at $58 per share. Consensus targets are currently around $74, a nice premium. While oil prices could drag the price lower toward the bottom of the 52-week price range of $42.42-$83.28 per share, we are confident in building a position to hold into the new decade. This is a fantastic company, and the value proposition is strong.

Source: AZ Quotes

We alluded to this earlier, but the company's dividend of $1.32, which we see as being increased. As shares pull back the yield is growing and right now at $58 the stock's yield is 2.27% relative to the current stock price. The company is also buying back its stock and could repurchase $1 billion in 2019. That is going to really boost EPS potential. Those building a position will be paid to wait.

Now at $58 per share, we should look at valuation. We see HollyFrontier’s 2018 EPS coming in around $6.90-$7.00. This puts shares at just 8.3 times 2018 earnings. That is pretty cheap. Looking ahead to 2019, we see EPS in the range of $7.60 to $8.00, so this is double-digit growth projected. At the high end, we have a stock trading at just 7.25 times forward earnings.

Is the balance sheet ok? Let us look at that. At September 30, 2018, the company had $4.9 billion in liabilities and $11.5 billion in assets giving HollyFrontier pretty low leverage. Its ratio of current assets divided by current liabilities is 2.4, which we view as safe. Its cash and cash equivalents at the end of the third quarter were $1.1 billion, providing substantial liquidity.

Source: BAD BEAT Investing

With an enterprise value of $11.8 billion, its EV/EBITDA ratio is 5.2, so the company is attractively valued here. We continue to like the growth prospects here.

Risks

Despite relying on the spread, which is secure, refiners tend to go down in value with oil prices, even if the correlation is not always appropriate. We are using this to our advantage, and buying on the way down. Still you should consider oil price expectations as part of an investment thesis. However, we think that the company's niche area is secure, but a risk would be major refiners moving more into base 3 oils. Keep an eye on that.

Take home

Profitability remains strong, offline operations are coming back on line, and the oil glut is only temporary. We know management has investors' best interests at heart and is a proven team. Recent acquisitions are smart. Refining capacity versus demand is favorable. We are looking for EPS growth of at least 10% in 2019. Couple this with rudimentary valuation, a 2.25% dividend, a big $1 billion share repurchase program, and a healthy balance sheet, and we think we have a strong case for building a position here.

Disclosure: Quad 7 Capital is long HFC in the BAD BEAT investing portfolio