This Is The Dip

The excuse du jour for the current pullback/correction/sloppy period is clearly the Coronavirus. But in reality, it could have been anything. As I've been saying, stocks had become overbought and investors over believed in the bullish, theme. You know, the idea that we were revisiting 2013 and 2017's one-way market, where the only decision one had to make was what to buy next.

As is usually the case in these types of markets, something then came out of the woodwork to stir things up a bit and create some fear. Traders then all moved to a risk-off position at the same time and on Friday feared what the weekend headlines might bring. As a result, stocks whooshed lower.

The bearish talking points also included the yield curve inverting again and a not-so-hot report from the popular Chicago Business Barometer. In case you haven't been paying attention, the manufacturing sector isn't in great shape as this particular indicator confirmed last week by remaining in contraction territory for the seventh straight month.

The good news is that the beleaguered manufacturing sector seems to be taking a turn for the better as the other five regional factory activity indices all rose last week and three of the six are now in expansion territory. And since the consumer is really the driver of the U.S. economy, the uptick in manufacturing should be viewed as icing on the economy's cake.

The questions of the day, of course, include, how low will the current pullback go and will this bout of selling wind up in the "garden variety" category?

With the S&P 500 having fallen -3.1% from the recent high as of Friday's close, the extent of the decline certainly falls in the "normal" zone for pullbacks - and a move to the -5% area should be a big surprise. Thus, the jury is still out on whether Friday's low was "the low" for the current move.

Since this appears to be a news-driven event, the bulls would like to see the number of cases of the Coronavirus start to stabilize. And given that the virus has an incubation period of something like 14 days, seeing the number of cases not get significantly worse this week would be considered a win for the market.

In other words, the market doesn't need this thing to go away. It just needs to stop getting worse.

There can be little argument that the Coronavirus will impact the Chinese economy. As such, the drop of more than 7% overnight in Shanghai makes some sense.

But so far at least, it is hard to see how this outbreak will impact the U.S. economy to any great degree. In turn, the earnings picture shouldn't take a hit. And from my seat, this is really the driver at this point in time.

To be sure, nasty days like Friday aren't any fun and can test one's upbeat view of the market. But I think it is important to remember that there is no such thing as a "healthy" correction while it is occurring. No, pullbacks seem to always get ugly and scare the bejeebers out of you.

However, so far at least, this pullback seems to be keeping to the overbought/over the believed script and appears to be offering up the opportunity to "get in" that so many were looking for a couple of weeks back.

My guess is that the downside exploration may continue for a while in order to test the bulls' resolve (and the 50-day moving averages). Yet, I remain firmly in the "buy the dips" camp. At least for now.

Weekly Market Model Review

Since it's the start of a new week, it's now time to put aside my subjective view of the action and to review the "state" of our indicator boards. Each week we do a disciplined, deep dive into our key market indicators and models. The overall goal of this exercise is to (a) remove emotion from the investment process, (b) stay "in tune" with the primary market cycles, and (c) remain cognizant of the risk/reward environment.

The Major Market Models

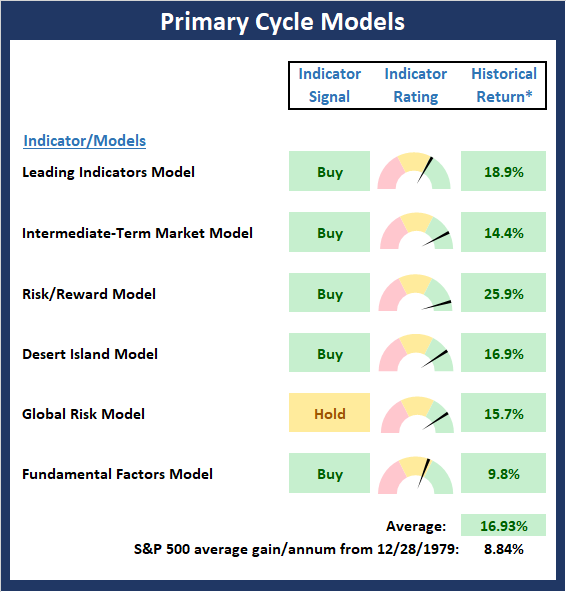

We start with six of our favorite long-term market models. These models are designed to help determine the "state" of the overall market.

There is one change to report on the Primary Cycle board this week as the Global Risk model downticked to neutral from positive. It is also worth noting that both the Leading Indicators and Fundamental models currently sit just above their respective neutral zones. However, with the board continuing to sport a lot of green, the bulls should be given the benefit of the doubt during this corrective phase.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

The State of the Fundamental Backdrop

Next, we review the market's fundamental factors in the areas of interest rates, the economy, inflation, and valuations.

The Fundamental Factors board is unchanged this week. With two models sporting buy signals, two on "hold", and only one negative reading, my take is the board remains moderately positive. This tells me to view the current growth scare with a skeptical eye and to be ready to put money to work into the "dip." But as I mentioned last week, pullbacks/corrections never "feel" good when they are happening in real-time.

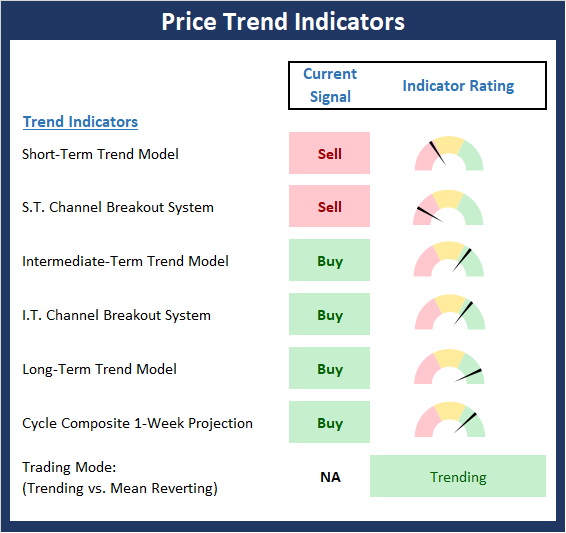

The State of the Trend

After looking at the big-picture models and the fundamental backdrop, I like to look at the state of the trend. This board of indicators is designed to tell us about the overall technical health of the current trend.

The current pullback, which has reached -3.1% for the S&P 500, -2.8% for the DJIA, -2.9% for the NASDAQ 100, -3.0% for Midcaps, and -3.55% for Smallcaps, has put some stress on our Trend board. However, for now at least, the board - and the market's intermediate-term trend - appears to be merely "bending" and not "breaking." We'll be watching support at Friday's lows as a "tell" about the near-term price movement.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

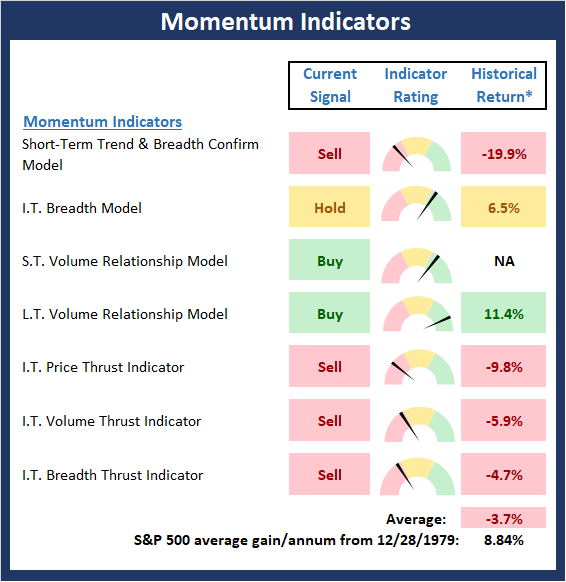

The State of Internal Momentum

Next, we analyze the "oomph" behind the current trend via our group of market momentum indicators/models.

The Momentum board deteriorated further this week. This is a bit worrisome as I would have expected to see the board put up more of a fight into a short-term pullback. I'll be paying particular attention to the Intermediate Term Breadth model. If this model were to go negative, it would suggest to me that the bears may have a leg to stand on and that further downside exploration would be in order.

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

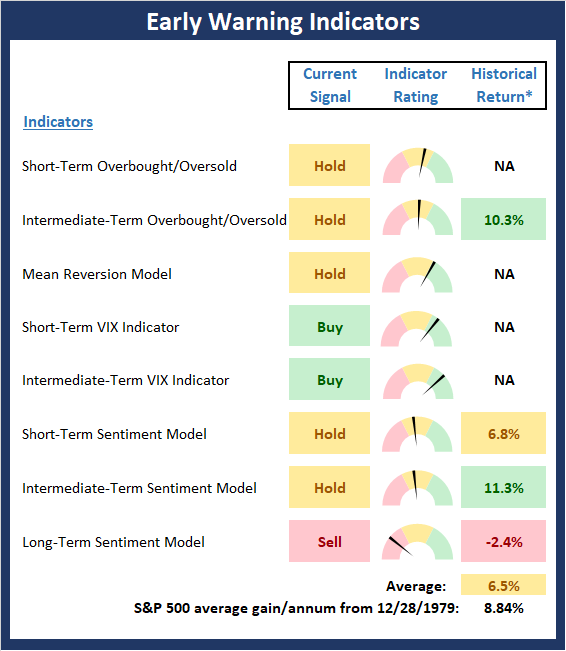

Early Warning Signals

Once we have identified the current environment, the state of the trend, and the degree of momentum behind the move, we then review the potential for a counter-trend move to begin. This batch of indicators is designed to suggest when the table is set for the trend to "go the other way."

The biggest changes this week are seen on the Early Warning board. Recall that this board did a nice job alerting us to the fact that the table had been set up for the bears to enjoy some time in the spotlight well before the selling began. As usual, something (in this case, it was the Coronavirus) came out of the woodwork to allow traders to "go the other way." However, the board is now starting to shift. While the board is not in a "table pounding" position at this time and is often early (hence the name), I believe it does suggest that traders should "get ready to buy."

* Source: Ned Davis Research (NDR) as of the date of publication. Historical returns are hypothetical average annual performances calculated by NDR. Past performances do not guarantee future results or profitability - NOT INDIVIDUAL INVESTMENT ADVICE.

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more