This Has Been The Best Month Ever

Another New Record: Stocks Can Never Fall Again

The S&P 500 rose 17 basis points on Thursday, August 27. Tech stocks fell and the banks rallied. No matter which stocks do well on the day, the index almost always goes up. The Nasdaq was down 34 basis points and the Russell 2000 was up 28 basis points.

The VIX was up 1.2 to 24.47, which is unusual when you consider that the market hit a record high. The CNN fear and greed index rose 2 points to 76, which represents extreme greed.

As you can see from the chart below, the S&P 500 has increased 83.3% of the days in August, which is the most ever. There are only two days left and it looks like stocks will rise on Friday, August 28, based on the futures market. Furthermore, the stock market has almost always risen on Mondays this summer. This will go down as the best month for stocks.

Fund Managers Love This Market

Fund managers love this stock market, which is crazy when you consider how badly the economy is doing. Yes, it has improved, but without more stimulus, the consumer might sag again. We need the Abbott (ABT) rapid test to work to properly eliminate COVID-19.

Thursday was a bad day for COVID-19, as the seven-day average for both new cases and new deaths rose slightly. It was wrong to predict the seven-day average of deaths to fall to 800 by the end of August. Deaths have seemingly declined very slowly.

Despite that negativity, fund managers are levered long stocks which is a sign of euphoria. As you can see from the chart above, the NAAIM index rose to 106.56, which is its fourth highest reading ever. More importantly, this is the third straight reading above 100 and the seventh straight reading above 90.

Another instance in which it was above 100 for three straight weeks was back in October 2017. The S&P 500 rose 13% after that and then crashed early in 2018. This rally likely won’t last another three months. A crash will be worse than early 2018 because now we have retail investors involved with their stimulus money. Popular stocks with hedge funds and retail traders are about to take a nosedive.

Thursday’s Market (Tesla Passes JNJ)

Tesla (TSLA) stock rose 4% as it hit a record high. There was a crash mid-day where it fell 5.3%, but it rebounded near the high. Tesla’s 14-day relative strength index is at 81.3. With Thursday’s rally, it likely got above 80. Even Apple (AAPL) fell after getting above 80 on Monday, August 24.

Tesla’s stock is up 62.9% since it announced its split. With a market cap of $418.6 billion, Tesla has surpassed Johnson and Johnson (JNJ) to become the eighth biggest company in America. Next stop is Visa (V), which is at $449.2 billion.

We don’t know if the hype surrounding battery day on September 22 can get Tesla above Visa. Financial press would go crazy if Tesla passes Berkshire Hathaway (BRK-A; BRK-B), which is next on the list with a market cap of $518 billion. It’s tough to gauge Tesla because the stock will rally the most at the end of its bubble, but we don’t know when the end is. If it has another two weeks left, there might be a lot of gains to be had.

It was correct to predict that Tesla would rally without Apple, which was correct as Apple is only up 0.5% this week. Wednesday was an amazing day for the cloud stocks and Thursday was a great day for bank stocks.

The regional bank ETF (IAT) was up 2% and the small cap value index was up 0.8%. Since this has been the best month in terms of the number of up days, we can say for certain September won’t be better. Investors are worried about election risk, and are even more concerned with the tech bubble.

Everyone already knows the election is coming. It would be interesting if hedges didn't help traders when the tech stocks fall, because the rest of the market rallies. That would be double the trouble.

The put to call ratio is 0.38. This was the second day in a row it was below 0.4, making this the second time in the past 15 years it has done so. The first time was April 2010. Recovery stocks rallied on Thursday, as Live Nation (LYV) was up 8.8% and Royal Caribbean (RCL) was up 6%.

The worst sector was communication services, which fell 1.3% as Facebook (FB) fell 3.5%. The best sector was the financials (up 1.7%), as the yield curve steepened. Wells Fargo (WFC) was up 2.3%.

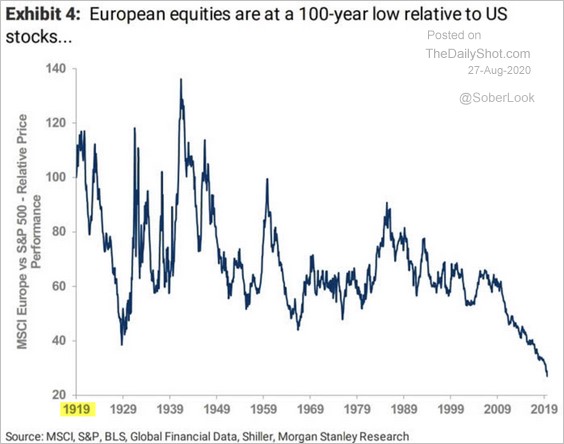

European Equities Low Versus America

As you can see from the chart below, European equities have done the worst versus American stocks in over 100 years. Divergence is even wider than the troughs in 1929 and 1999. That’s because U.S. tech stocks are in a comparable sized bubble to the 1920's and 1990's.

Everyone thinks European stocks are bad businesses. Their indexes don’t have a lot of tech stocks. However, that thesis has played itself out. These businesses aren’t as good, but they still have value. This relationship will normalize as American tech stocks will crash. European stocks might only rise modestly.

Conclusion

August 2020 will be remembered as having the most up days in a month ever. Many of us will be referring to this historic month for the rest of our investing lives. This has been an amazing summer as cloud stocks have exploded. Salesforce (CRM) was added to the Dow, Apple reached over $2 trillion, Tesla became the eighth largest company in America without being in the S&P 500.

Such a feat has never occurred before. Active managers are leveraged long on average. There are no bears left unless you look at the AAII investor sentiment poll.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more