This Auto Parts Play Should Bounce

One of our greatest recommendations was Autozone (AZO). A few months ago, at nearly $180 we were asked about a competitor, Advance Auto Parts (AAP) and we said it was not the time. The stock has now dropped 30 points, and we think it will find some support here. We expect to be able to pick up a few points on this play quite easily.

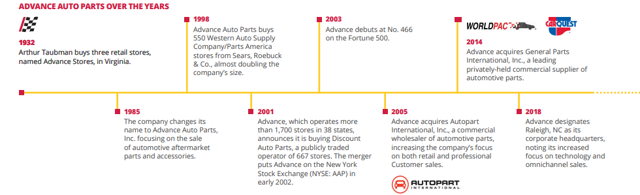

The company has been around for a very long time. The company was founded in April 1932, when Arthur Taubman purchased three stores in Virginia from Pep Boys. Growing organically over the next 50 years, Advance Auto Parts was operating more than 150 stores by 1989, eventually reaching 649 stores in 10 states by 1996. In 1998, Advance doubled in size when the company acquired Western Auto Supply Company. Significant growth continued in the new millennium as Advance became a publicly traded company on the New York Stock Exchange. In 2014, Advance acquired General Parts International, Inc., a leading privately-held distributor and supplier of original equipment and aftermarket replacement products for commercial markets operating under the Carquest and Worldpac brands.

Image source: Advance Auto Parts Website

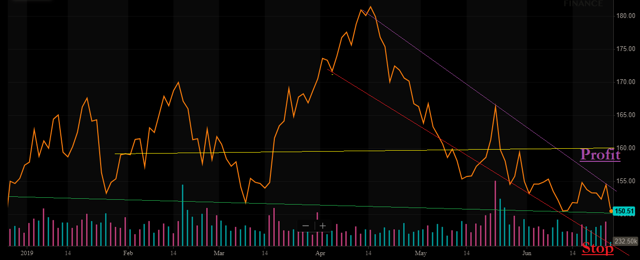

The stock had seen some solid growth but has fallen off of late. We believe there is opportunity here. Here is the recent 6 month chart:

Image source: BAD BEAT Investing Chartist

We like the support we are seeing at $150 and suggest a buy at this level. We will keep a tight stop on this one and look to scalp some gains. If you opt to play options here I would either sell puts to raise some cash or do a simple deep in the money longer dated call, given the somewhat tight range of the stock.

The play

Current price: $150.19

Target entry: $148-$151

Stop loss: $143

Target exit: $159-$163

Estimated time frame: 4-6 weeks

Preferred option: Sep 2019 $130 call (deep in the money) for $23.50-$24.00

Discussion

The company continues to deliver. Let us talk abut performance, as the most recent quarter continued to demonstrate impressive sales. Net sales in Q1 were $3.0 billion, a 2.7% increase from last year. Comparable store sales for the first quarter of 2019 increased 2.7%. This is a key indicator and it remains strong. This continues a strong 2018.

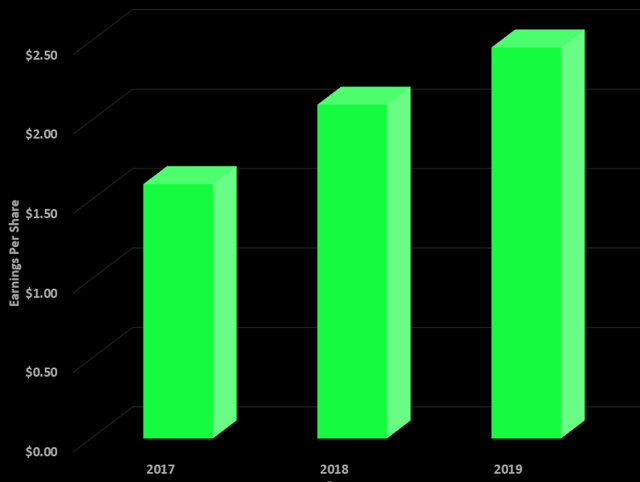

Image source: Advance Auto Parts Annual Report 2018

Adjusted gross profit margin in Q1 was 44.6% of net sales, a 37 basis point increase from Q1 2018. The increase was primarily driven by favorable product margin and improved inventory management. Things are moving in the right direction. Adjusted SG&A was 36.4% net sales, an improvement of 8 basis points as compared to last year. These improvements were driven by leveraging store labor and lower insurance and claims expenses. Adjusted operating income was $243.6 million, an increase of 8.7% versus the first quarter of the prior year. Adjusted operating income margin improved to 8.3%, an increase of 46 basis points compared to the prior year. Adjusted Diluted EPS was $2.46 for the first quarter of 2019, an increase of 17.1% compared to the first quarter of the prior year. Continuing strong Q1 growth:

Image source: BAD BEAT Investing Chartist

Operating cash flow was also up substantially to $204.5 million versus $154.0 million in the prior year, an increase of 32.8%. Free cash flow was $143.2 million, an increase of 19.9% compared to the same period of the prior year.

But what can we expect going forward? Is there potential here? Well we anticipate sales of $9.7-$9.8 billion in 2019 with comparable sales growth of 1.5%-2.5%. That is solid. With operating margins of over 8%, and not even counting share repurchases, we believe adjusted EPS will approximate $8.25-$8.50. Thus, at the low end of this EPS guidance, we are trading at 18X forward EPS. That is historically heavily discounted for this stock. We like it.

We are talking about scalping a few points on a trade, but what if you invest and hold on to this stock?

If we forecast out AAP's expected earnings growth over the next 3 years and hold the P/E level constant, then we can expect the price, including dividends, to rise to $247. So that's our estimated gain. Estimating the price decline from there is a little tricky. AAP did not experience an earnings decline during the last recession, which is great. But it did experience one in 2016/17 of about -31%. Additionally, AAP's P/E ratio during the heart of the recession was 11.2 That amounts to a potential -30% decline from where we are today. If we have a recession within the next three years, it's unlikely to be as severe as the one in 2008. That said, we think expecting a P/E contraction to a 15 multiple is reasonable, which would be an ~12-13% decline. While earnings did grow during the last downturn, we think it's reasonable to surmise we might see them fall a little bit since we didn't even have a recession in 2016/17 and they fell. As such, we think the risk reward is pretty compelling right now under $150. While we have applied a tight stop, feel free to adjust.

The one item we would like from Advance is a better dividend. That would have us even more bullish here, but we believe the stock bounces in the short-term, and runs over the next year. This is especially going to be helped by a buyback. Last year the company authorized a $600 million share repurchase program. Under this program, the company repurchased 0.8 million shares of its common stock for $127.2 million during the first quarter. At the end of the first quarter of 2019, the company had $200 million remaining under the share repurchase program. We expect it to be used and expect a new authorization.

In summation, we believe the stock is a solid buy for a bounce.

Disclosure: This piece first appeared last week at BAD BEAT Investing. We are long AAP, AZO