Third Point Reveals New Stake In Snowflake

With both old and new Wall Street flooding into the recently IPOed cloud darling Snowflake, which among other investors also sported none other than Berkshire Hathaway (although in light of Warren Buffet's aversion to IPOs, it has been widely speculated that Berkshire's $250MM investment in SNOW was the work of Buffett's two lieutenants Todd Combs and Ted Weschler), it will probably not come as a surprise that even venerable hedge fund managers are rushing into the latest tech superstar.

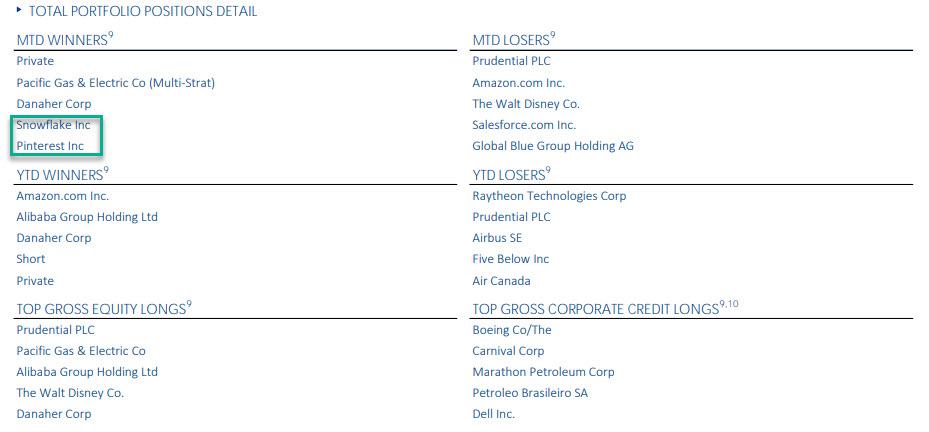

While we still have about a month to go until Dan Loeb releases his monthly quarterly commentary, today the billionaire activist investor published the latest holdings for his Third Point hedge fund, which had a $13.7 billion firm AUM as of Sept 30. It revealed new positions in both online marketplace Pinterest PINS (Third Point previously briefly held a position in Pinterest last year), as well as Snowflake, whose post-IPO surge prompted many to caution about dot-com era forth. The two names appeared in the list of the fund's top 5 MTD winners, which also included Danaher DHR, PG&E PCG as well as a private company. Monthly losers included Prudential PRU, as well as Amazon.com AMZN, Walt Disney Co. DIS, Salesforce.com CRM, and Global Blue Group Holding AG GB, which went public in August through a merger with a blank-check company sponsored by Third Point. The biggest YTD winners are Amazon AMZN, Alibaba BABA, and Danaher (as well as an unnamed short), offset by YTD losers Raytheon RTX, Prudential, and Airbus.

(Click on image to enlarge)

According to Bloomberg, both Pinterest and Snowflake are passive investments.

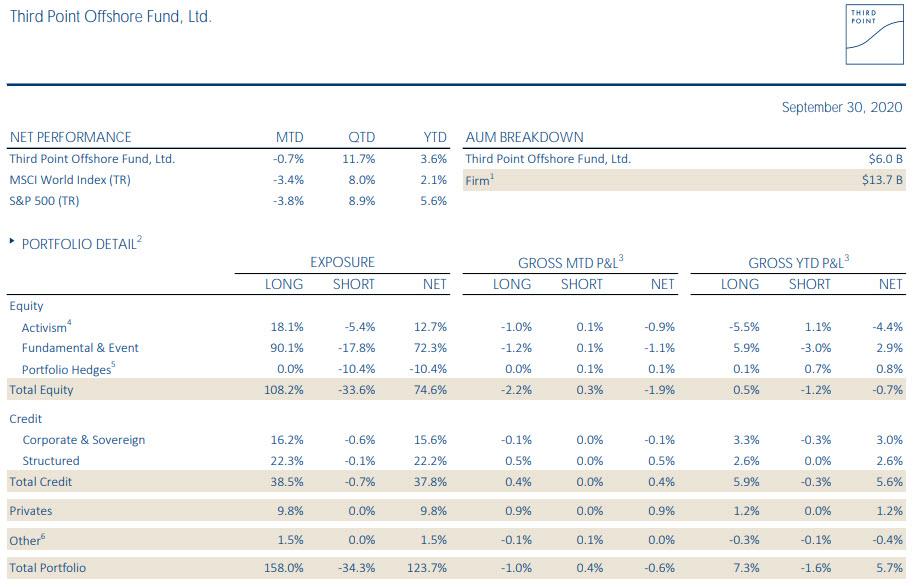

Despite the outperformance of the two stocks, Third Point reported a 0.7% loss for the month of September, which however was dwarfed by the fund's 11.7% return in Q3. For 2020, Third Point is up a modest 3.6%, modestly lagging the S&P500. The report also revealed a Gross long exposure of 158%, and net exposure of 123.7% net of 34.3% in short holdings, mostly in various equities.

(Click on image to enlarge)

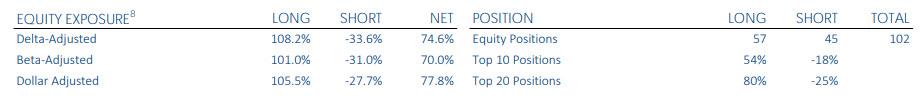

A breakdown by sector exposure showed Third Point is focused on Media/Internet (net 22.5%), Financial (net 19.2%), and the Enterprise Technology (11.0%) sectors. Size-wise, the fund is mostly exposed to mega-cap companies with 54.9% in net exposure. Third Point also appears to be hedging single names mostly with index shorts which accounted for more than half, or 19.4%, of the fund total equity short of -33.6%

(Click on image to enlarge)

Within equities, gross exposure was 108.2% and 74.6% net of 33.6% in shorts.

(Click on image to enlarge)

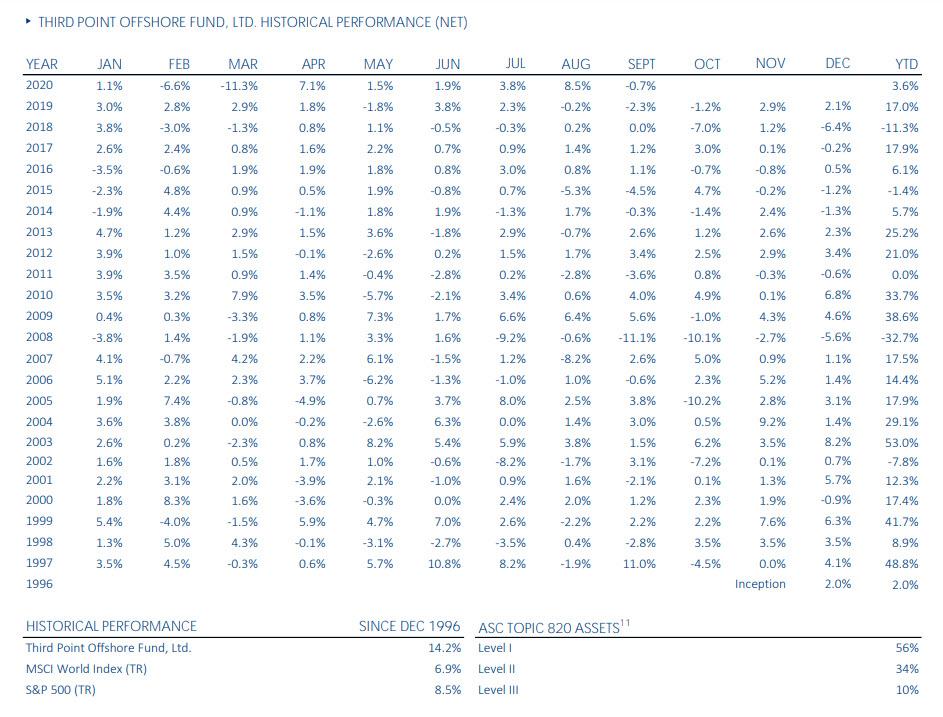

A full breakdown of Third Point's Offshore fund since inception is shown below. It shows that the fund has suffered just four down years in its entire history: 2002, 2008, 2015 and 2018, and has returned a CAGR of 14.2% since Dec 1996, nearly double the S&P's compounded 8.5% return over the same period.

(Click on image to enlarge)

Disclosure: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more