Things Change, But Do They Last?

2021 is nothing like 2020. The change started in early November following the election and the vaccine data. The change accelerated after the Dems won the Senate in January and the vaccine distribution went well after a tough initial launch in December. Sentiment has dramatically shifted since late October. The momentum stocks are now banks and energy. That probably sounds hard to believe for some readers.

The most popular new trend is to bet on the reopening. Critics of this trend say it has gone too far because it’s a one-time event. The market has never shied away from pricing in a short term benefit as if it is a long term game changer. That’s why stocks cratered in March and software stocks exploded in the summer.

Everyone knows the market can act unpredictably in the short term, but the recent moves in stocks in the past 15 months have been extraordinary. It is common to see stocks triple and quadruple when they become part of trend. The FOMO trade even tempts the most hardened long term buy and hold investors. It’s also turning the bears even more bearish than ever before. Many acknowledged that value stocks were cheap last year, but now bears see little opportunity at all and are calling for a massive crash.

Part of the sentiment shift has been the steepening of the yield curve which has been supported by the selloff in the long bond and the Fed’s refusal to discuss hiking rates. We will get an update on monetary policy this week. We aren’t holding our breath that a hike is coming. A steepening curve is now the consensus trade. As you can see from the chart below, Goldman expects further steepening by the end of this year.

📈 Goldmans expects a further steepening in US yield curve pic.twitter.com/wCTOg9CWv6

— PiQ (@PriapusIQ) March 12, 2021

We Have To Discuss It

Whenever there is a short term cyclical move, there are always calls for it to extend indefinitely. As we just mentioned, last year investors thought software would grow indefinitely and this year investors think the boost in vacation spending will go on for years. The same was the case for oil. More investors like oil stocks now than they did when it went negative last spring. These are the caveats for when we discuss the potential for sustained higher rates and higher inflation for the long run.

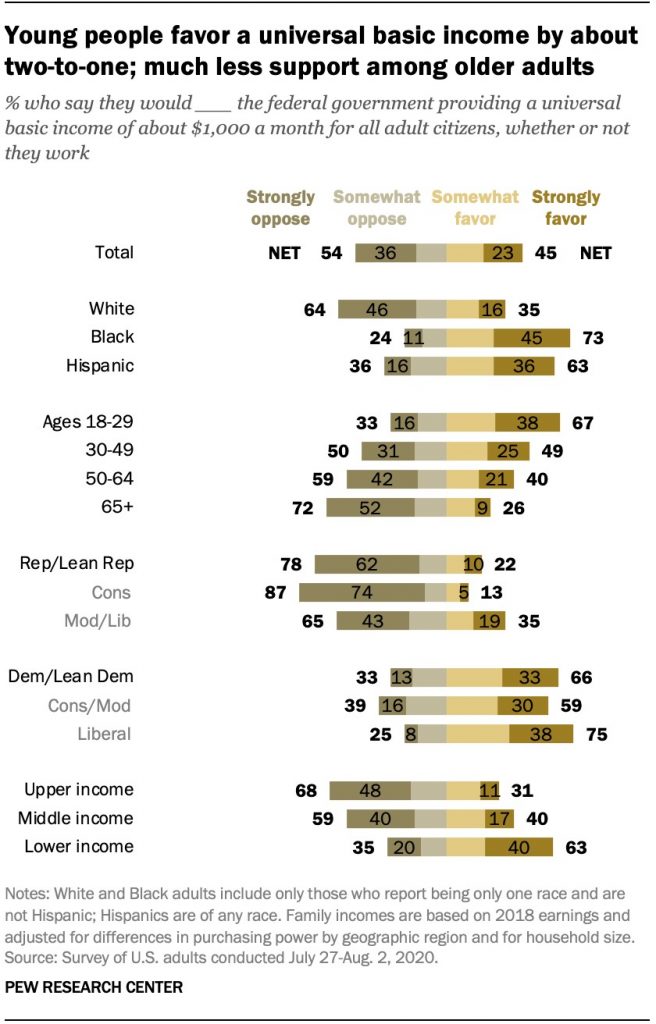

However, we have good reason to discuss this. There has been a massive shift in the Overton window when it comes to fiscal policy. There is virtually no fear of inflation or deficits. The Democrat’s $1.9 trillion stimulus plan looks more like a universal basic income than anything before. As you can see from the chart above, young people favor UBI. As they become a more powerful voting bloc, it will gain support if they don’t change their minds.

It’s certainly possible to have fiscal restraint with UBI by cutting other programs. However, cuts make it less palatable. Plus, the proponents of UBI are the same politicians and economists who don’t worry about inflation. If such policy leads to more government spending, it could lead to higher inflation. It’s extremely difficult to gauge what level of government spending is appropriate. The goal is higher incomes for the lower and middle class. The first test will be how much inflation the $1.9 trillion stimulus brings.

Very Large Shift In Emerging Markets

There are positive and negatives to following the markets every day. One positive is you can take advantage of opportunities. Sometimes intraday selloffs get severe because of a lack of liquidity. If you buy at those points you get better prices.

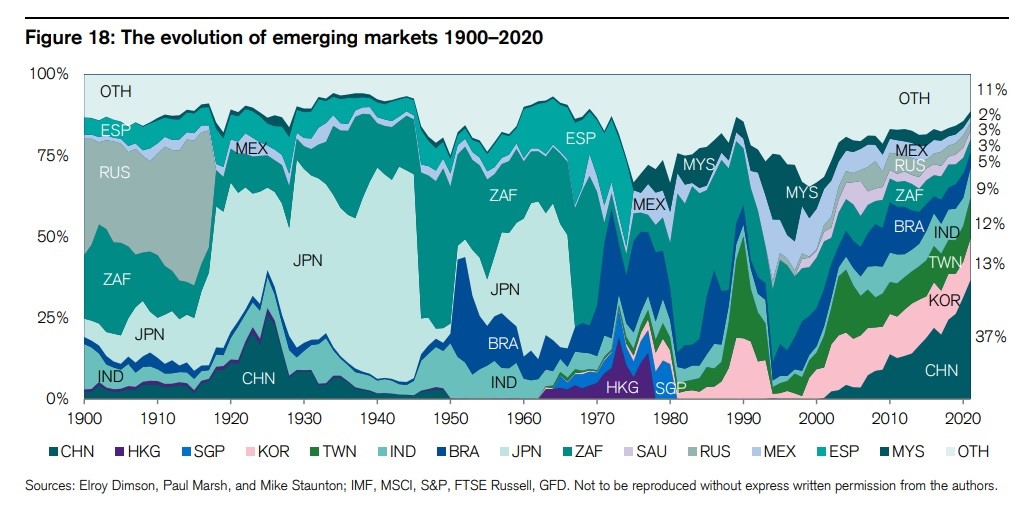

The negative is you can get too focused with the short term and miss out on long term changes. The market is always changing, but if you are glued to your screen all day, two months can feel like an eternity. When you step back and look at the past few decades you see massive shifts. Since most of us plan to invest for decades, it’s valuable to do that. Just look at the rise and fall of multiple countries within the emerging markets index in the past 120 years. If you’re lucky, you will be investing in a period of about half of this chart. Politics, wars, and economic policy shifts have major consequences. The change is even more severe when you look at individual companies.

(Click on image to enlarge)

What Is Old, Is New Again

FAANG stocks were once the darlings of the market, but they have transitioned into GARP stocks. It’s up to you to determine how reasonable the price is. As you can see from the chart below, Netflix is now in the middle of the pack in terms of 2024 PE ratios. You can either say Netflix is very cheap based on its higher growth rate than the rest of the group or that Netflix only looks cheap because analysts are anticipating high growth in the next few years which might not be reached.

choose your fighter after you stop laughing pic.twitter.com/VXwdHtXOOe

— modest proposal (@modestproposal1) March 15, 2021

Either way, it’s still weird to see Netflix trading at a similar multiple to legacy entertainment companies like ViacomCBS. The stock of ViacomCBS is up 214% in the past 6 months. This speaks to the point the bears have made which is even many value stocks are expensive. A 20.1 2024 PE multiple is extremely high for a company with 0% expected EBITDA growth. Clearly, investors think growth will be higher than analysts project. Investor optimism stems from their new streaming platform. Of course, the competition is fierce and the space is now crowded. That could suppress the entire group’s multiple.

Conclusion

The yield curve shifted. The new trend is to bet on reopening stocks. The banks and energy are now momentum names. The software and online retail stocks aren’t nearly as beaten down as the cyclical stocks were at the end of October. That explains why the market is at a new record high. The support for UBI among young people implies higher government spending could be here to stay. That could boost inflation. Markets shift wildly if you step back from the screens and look at the big picture. The streaming industry is becoming more competitive, yet each new player gets a huge valuation boost after they announce a new service. ViacomCBS stock is rallying quicker than it did in the late 1990s.

Disclaimer: The content in this article is for general informational and entertainment purposes only and should not be construed as financial advice. You agree that any decision you make will be ...

more