These Two 8%+ Yield Income Stocks Are Still A Bargain

Unless you subscribe to the “greater fool” theory, it is hard to pick up shares of most stocks at current prices. While much of the U.S. economy remains throttled by the pandemic, the major stock indexes and popular tech stocks continue to set new record high prices. While the popular stocks and sectors appear extremely overvalued, many stocks that pay dividends remain well below pre-pandemic levels. You can still buy income stocks with very attractive yields plus appreciation potential.

On my recommendations, many piled into the Dividend Hunter stocks last spring and summer. Share prices were way down due to pandemic fears. In hindsight, the middle months of 2020 look like one of those once-in-a-decade stock market buying opportunities

Now I am getting questions from my Dividend Hunter readers about where to put new money to work. Share prices are up so much from where subscribers earlier invested; it doesn’t feel right to add shares at prices that are 70%, 100%, or even 300% higher than the prices in effect eight to ten months ago.

Currently, much of my subscriber communication involves a discussion about changing mindsets about share prices. While prices are up a lot, values by longer-term historical standards remain very attractive. This situation is especially true in the high-yield sectors.

Here are two examples to illustrate my point.

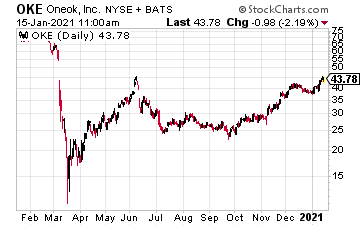

ONEOK, Inc. (OKE) is an energy midstream company that provides natural gas and natural gas liquids (NGLs) gathering, processing, and transport services. OKE has paid steady and growing dividends for more than 20 years and has never cut its dividend rate.

During the pandemic-triggered stock market crash, ONEOK fell from almost $80 per share to less than $15. The price remained below $30 until mid-October 2020. For investors that loaded up in the $20s, the current $45 share price seems too high for additional investments. Even at $45, ONEOK yields 8.6%.

Comparing the current price to the pre-crash high of $77 and the typical historical yield of 5%, you can see there remains plenty of upside for ONEOK as energy sector prices continue to recover. Even if you initially bought ONEOK at $25, buying at $45 is still a very attractive investment.

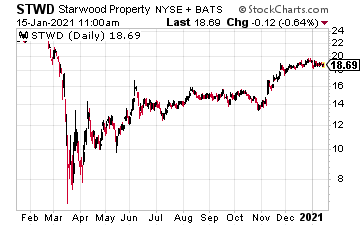

Also during the pandemic market crash, the share price of Starwood Property Trust (STWD) dropped from $26 to a low of around $10. The Starwood share price remained in the low teens until early November. Now the stock is close to $19.00, and the price “feels” high to investors who bought for less than 15.

However, the historical long term yield for Starwood is a stable 8%. The current yield is well over 10%. Starwood remains an excellent opportunity to lock in a double-digit yield for the long term.

My point is that if you bought income stocks in mid-2020, you made some great investments. Now share prices are much higher than during the summer of 2020, but if you look at the longer-term picture, these stocks are still undervalued.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more