These Stocks Give You Twice The Yield Of The Dividend Aristocrats

ith the near term potential of an economic recession at the front of investor’s minds, I see more and more recommendations to invest in “Dividend Aristocrat” types of stocks.

These are companies that have paid growing dividends for years and give investors faith that their stock market investments will emerge relatively unscathed after the stock market passes through the next big market downturn. For buy-and-hold investors, a dividend growth-focused strategy is a proven winner.

The challenge with the widely recognized and held dividend aristocrat type stocks is just that. They are popular, and with the market near all-time highs, carry low current dividend yields. These stocks typically carry yields ranging from the high one percent range up to around 3%. We live in a low-interest rate world, so it’s easy to understand how investors who follow the usual financial news outlets would believe that 2% to 2.5% yields on their “safe” income stocks are acceptable.

I blame a lot on the mainstream financial news. One bad trait is that the focus is always on a small number of well know, or recent IPO stocks. There are hundreds if not thousands of stocks that get little or no attention from the financial news outlets. My colleague Eddy Elfenbein just launched a newsletter focused on them.

One other point to consider is that historically, across major stock market indexes, between 30% and 95% of the long-term total return from stocks can be attributed to dividend income and reinvested dividends. The range of dividend portion of total returns depends on the period you pick. It’s important that dividend income plays a big role in the overall return you will earn during a lifetime of stock market investing.

With that as our background, I would like to suggest that investing in stocks with a higher yield than the 2% to 2.5% average of the well-known blue-chips will likely produce superior returns compared to a portfolio of dividend aristocrats. For some examples, here are three dividend growth stocks with current yields well above the yields we have discussed so far. I am looking for yields that are double the blue-chip average.

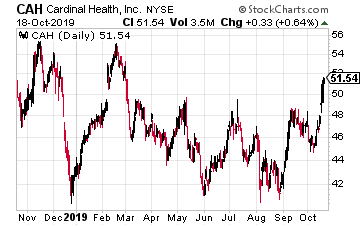

Cardinal Health, Inc. (CAH) is a global, integrated healthcare services and products company. The company provides medical products and pharmaceuticals and cost-effective solutions that enhance supply chain efficiency from hospital to home.

The business is divided into four sectors: Logistics Solutions, Product Solutions, Business Solutions, and Patient Solutions. For investors, Cardinal Health has increased its dividend rate for 23 straight years. Dividend growth has averaged 9.8% for the last five years and 17.2% for the last 10.

The recent slowing of dividend increases is the likely reason for the current attractive 3.9% yield. An increase back to double-digit dividend growth would cause this CAH share price to skyrocket.

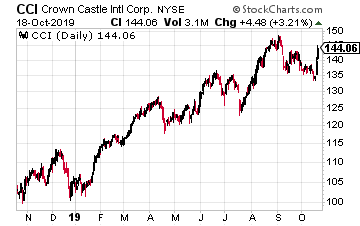

Crown Castle International Corp. (CCI) is a real estate investment trust (REIT) that owns cell towers and small cell nodes. The portfolio of cell phone towers now exceeds 40,000. Small cell nodes are the infrastructure required for shorter range, but very fast 5G mobile phone and data service.

Crown Castle is the market leader in small cell technology, controlling over 65,000 nodes. The REIT’s dividend has been increased for six straight years, averaging high-single-digit annual growth. The dividend was just increased this month by 6.7%.

CCI is a great play on the coming 5G revolution, and the shares currently yield an above-average 3.6%.

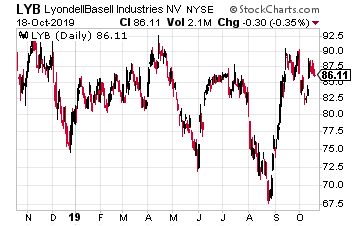

LyondellBasell Industries N.V. (LYB) is one of the largest plastics, chemicals, and refining companies in the world. They are the world’s largest licensor of polyolefin and polypropylene technologies in the world. The company owns and operates refineries and processing plants around the world.

The LYB dividend has been growing since 2012, with a 9.6% five-year average annual growth rate. Energy and industrial sector stocks are out of favor, which makes this stock a very attractive dividend growth investment.

The current yield is 4.8%, with the next dividend increase due to be announced in May next year.

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more