These "Most Crowded Stocks" Face The Greatest Risk Of Wipe Out

Two months ago, BofA appeared to stumble (with a five year delay after this website did) upon the holy grail of investment strategies: as we reported at the time, the bank's analysts echoed what we first said in 2013, when we presented what we then viewed (and still view) as the best trading strategy of the New Abnormal period, when we said that buying the most shorted names while shorting the names that have the highest hedge fund and institutional ownership is the surest way to generate alpha, to wit:

... in a world in which nothing has changed from a year ago, and where fundamentals still don't matter, what is one to do to generate an outside market return? Simple: more of the same and punish those who still believe in an efficient, capital-allocating marketplace and keep bidding up the most shorted names.

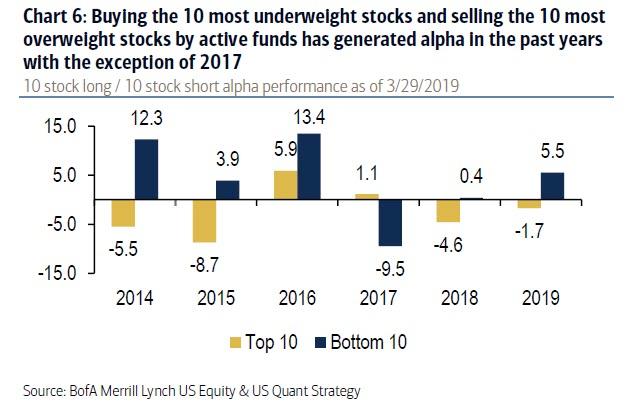

Fast forward to April, when Bank of America confirmed once again that with just one exception, the historically un-volatile 2017, this strategy has continued to be consistently profitable, as "over the last several years, buying the most underweight stocks by large cap active funds and selling the most overweight stocks by large cap active funds has consistently generated alpha."

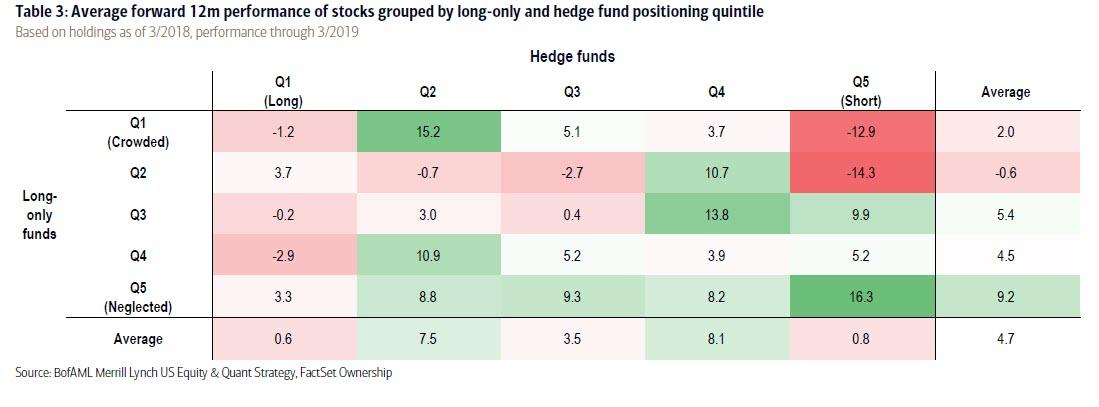

Then, in an attempt to drill down on how this highly contrarian strategy generates its returns, Bank of America strategists broke down the universe of most disliked stocks by both hedge funds and long long only funds. Next, when analyzing the returns of the "most shorted" basket of stocks by hedge funds, BofA found that those stocks which also have high crowding risk among long-only funds lagged the market significantly (-12.9% vs. +4.7% for the equal-weighted S&P 500).

However, when looking at the most shorted by hedge fund basket, that quintile of stocks neglected by long-only funds outperformed the universe by a big margin, tripling the return of the broader market (+16% vs. +4.7%). Similarly, within the most neglected basket of stocks by long-only funds, hedge funds’ overweights have generated a modest, 3.3% return, underperforming the universe by 1.4% - and "surprisingly" their underweights (“shorts”) by 13%.

This, to Bank of America suggested that "Long Onlies" and hedge fund positioning data could complement each other as alpha signals.

Alternatively, one could have simply done what we said back in 2013, and go long the most shorted stocks (by the entire market, including hedge funds and mutual funds) while shorting the most crowded positions, and generate an average annual alpha of 6.6% (i.e., return on top of the market) in the past six years without doing anything labor intensive but merely rebalancing the trade basket every quarter based on publicly available information.

Which begs a parallel question: is extreme crowding in select positions during times of market stress an additional, and under-appreciated, source of downside risk?

Apparently the answer is yes, because in an exercise conducted by Goldman's chief equity strategist, which was clearly plagiarized from Bank of America's April report, David Kostin writes that Goldman's famous hedge fund VIP and mutual fund overweight baskets each underperformed the S&P 500 on Friday, demonstrating once again the risk to popular positions during risk-off events, and confirming that just as popular positions take the escalator up, they then take the elevator down as one after another hedge fund liquidate their positions in a rush to frontrun other panicking sellers.

Of course, this is a mirror image of what is seen on the way up, and so far the highest conviction fund positions have still out performed the S&P YTD.

According to Kostin, "our Hedge Fund VIP basket, which tracks the most popular long positions (GSTHHVIP), has outperformed the S&P 500 and our basket of short positions by 120 bp and 715 bp YTD, respectively. Similarly, the most overweight mutual fund positions (GSTHMFOW) have outperformed the S&P 500 and most underweight stocks by 240 bp and 140 bp so far this year."

Of course, what goes up must come down. Yet is it inevitable that the most crowded positions will eventually suffer a greater crash than the average S&P stock as violent mean reversion is re-stablished? For now, days of extreme market stress such as Friday indicate that the answer is yes. That said, Kostin's answer is somewhat more nuanced:

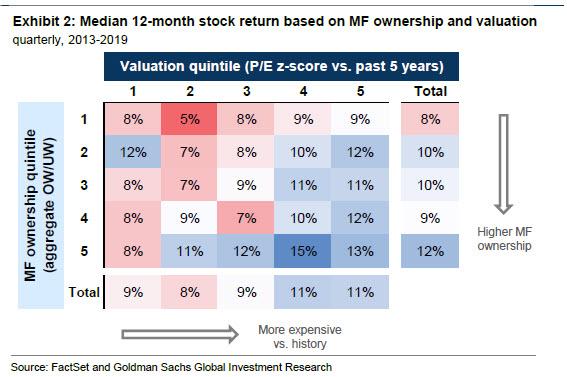

Despite posing a tactical risk, concentrated ownership has generally been a positive signal for subsequent stock returns. Investors often ask us to include fund positioning in stock screens, expressing concern about stocks that are already extremely popular. However, empirically, the top 20% of stocks based on number of hedge fund owners have outperformed the least popular quintile in 65% of quarters since 2009, with an average excess return of 90 bp during the three months between filings. We also found that the signal is particularly strong when combining popularity and valuation: popular, high valuation stocks have posted a median 12-month return of +13% return vs. +8% for unpopular, low valuation stocks.

A similar observation emerges for mutual fund holdings, where an analysis reveals that the most popular quintile has outperformed by an average excess return of 67 bp during the three months between quarterly filings. As with hedge funds, including valuation improves the signal: a median 12-month return of +13% return for most overweight, high valuation stocks vs. +8% for most underweight, low valuation stocks, as shown in the chart below which bears an eerie similarity to the BofA chart presented 2 months ago.

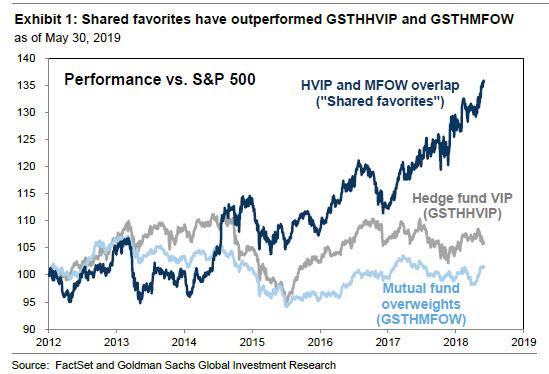

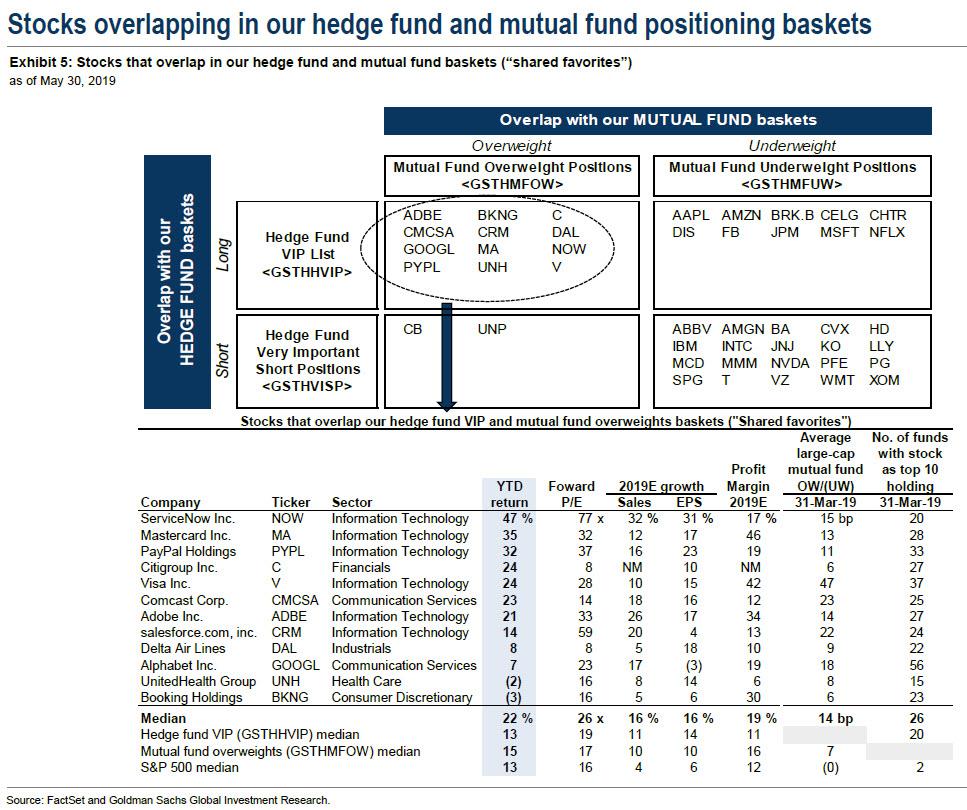

Putting this together, Goldman notes that stocks popular among mutual funds and hedge funds (“shared favorites”) have generated an annualized return of +19% since 2013, higher than hedge fund VIPs (+14%), mutual fund overweights (+14%), and S&P 500 (+13%).

"An equal-weighted list of shared favorites has outpaced the S&P 500 in 66% of months compared with 55% for both hedge fund VIPs and mutual fund overweights. Shared favorites have also delivered a modestly higher total return/volatility ratio (1.1) than GSTHHVIP (0.9) and GSTHMFOW (1.0) during this period as seen in the chart below. "

Of course, all the above suggests is that reflexivity is alive and kicking, and as a rising market take popular stocks higher, by the simple fact that they are "popular", they tend to rise even more.

The problem is what happens on the way down, and as Kostin admits here, "intuitively, crowded positions have tended to underperform in falling equity markets" adding that "since 2013, our list of shared favorites outperformed in 60% of weeks where S&P 500 posted a positive return, but just 44% of weeks where S&P 500 posted a negative return."

So while Goldman will certainly not tell its top clients to short the stocks they are all long - even though everyone knows that it is those stocks that would suffer the most if were about to enter another bout of extreme volatility - the bank is "kind enough" to show 12 stocks which screen as the most popular holdings for hedge funds and mutual funds. The "shared favorites", which "wink wink" may be most at risk of crowded position unwinds, this quarter are: ADBE, BKNG, C, CMCSA, CRM, DAL, GOOGL, MA, NOW, PYPL, UNH, and V.

And, as Kostin further notes, 11 of the 12 stocks that overlap in our Hedge Fund VIP and Mutual Fund Overweights baskets were also shared favorites last quarter. Citigroup was the only stock to enter the shared favorites list while EA and TMUS dropped out. "GOOGL is the only stock that has been a shared favorite in every quarter during the past five years," which probably means that GOOGL will be crushed during any real mean-reversion episode.

While the shared favorites above (up +18% YTD) have outperformed both Goldman's hedge fund VIP (+13%) and mutual fund overweight baskets (+15%), the median stock trades at a higher P/E (26x) than the median S&P 500 stock (16x), hedge fund VIP (19x) and mutual fund overweight (17x). It also means that any event that triggers a widespread multiple collapse - such as a trade war escalation-driven market crash - will have the most adverse impact on those companies, whose PEs are almost 100% above the market average.

And now that investors know which stocks will suffer the biggest drop due to their high beta on both the way up and way down, the only question is what will catalyze such a drop. Conveniently, president Trump lately has been providing numerous triggers for just such a drop, and one of these days the market - unable to infinitely digest the endless barrage of Trump tweets - will finally break.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more