The Travelers Companies: Why This Dow Stock Is A Sell

The Travelers Companies (TRV) is the result of many decades of operating history and countless mergers and acquisitions.

The company was founded in 1864 by two local businessmen. The original business model was a response to a need for accident insurance in the U.S.

From this humble beginning was born one of the largest insurers in the world with 30,000 employees, 13,000+ independent agencies, and leadership positions in several categories of insurance.

The stock trades with a market capitalization of $39 billion and is a member of the closely-watched Dow Jones Industrial Average.

Travelers’ shares have already experienced a very strong move higher in 2019, gaining more than 30% since the start of the year. Given this, we see Travelers as somewhat overpriced and as such, we are cautious on the stock’s total return outlook.

Travelers has many positive points, including very high levels of capital returns, but in total, we rate the stock a sell due to the valuation after the big run in the share price.

Business Overview

Travelers operates in three segments: Personal Insurance, Business Insurance, and Bond & Specialty Insurance. Net written premiums, which is the company’s primary source of revenue, was split 37%, 54%, and 9%, respectively, among the three business lines last year.

Travelers has built a very diversified stream of revenue through the types of policies it underwrites, and that diversification has served it well over its history.

(Click on image to enlarge)

Source: Investor presentation, page 3

Today, Travelers is in an enviable position in terms of market share in a variety of categories, including top 5 positions in six major product lines. Travelers has relationships with 100,000 producers, making its scale absolutely massive. As the company has grown larger over the years, its diversification has helped produce a steady stream of profits it has used to feed back into more underwritten premiums.

Travelers reported Q1 earnings on 4/16/19 and results were once again quite strong. Total revenue was up 5%, primarily attributable to a 3% boost in net written premiums. Strength was seen across all of the company’s segments. Gross written premiums rose 6% during Q1 to a new record of $7.8 billion.

Lower catastrophe losses and stronger underwriting principles helped with margins as well, as the company’s underlying combined ratio was 91.6% in Q1, down 80bps from the 92.4% showing in the comparable period last year. That, combined with the revenue gain and a 3% lower share count, helped send core income per diluted share to $2.83, a 15% gain year-over-year. Investors would do well to remember that last year’s Q1 experienced higher-than-normal losses, so this simply represents a rebound to more normalized levels of earnings.

As an insurer, net investment income is a significant portion of the company’s revenue, and while Q1 was somewhat weak on that front, the company still produced $496 million during the quarter. The lower year-over-year total was due to lower private equity income, which can be volatile, but we aren’t concerned about long-term impairment of Travelers’ ability to generate income from its cash balances. Indeed, fluctuations in this source of revenue are typical.

Book value is up to $93 per share, having increased 7% in the past year. Travelers has been able to consistently and meaningfully increase its book value over time, but we note that the current share price is about 165% of book value, so on this measure as well, the valuation is being stretched. Indeed, 165% of book value is the highest valuation the stock has seen by that measure for at least 16 years.

The company returned $625 million to shareholders in Q1, continuing its very long history of returning a lot of capital to shareholders. The company’s dividend was also increased from 77 cents quarterly to 82 cents, a 6.5% increase.

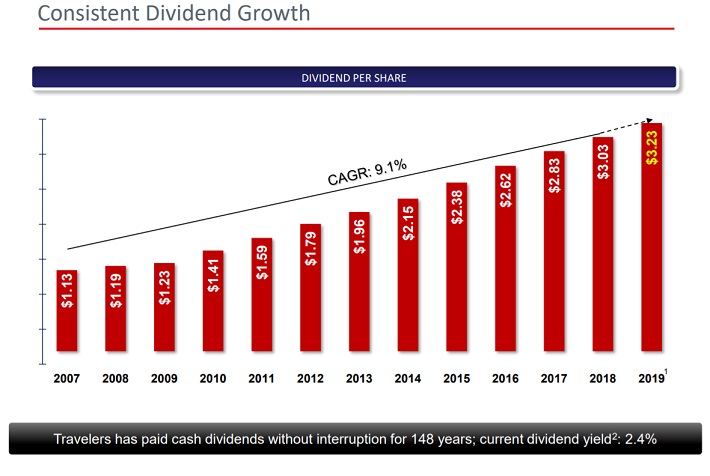

Travelers is certainly no stranger to dividend growth.

(Click on image to enlarge)

Source: Investor presentation, page 11

Indeed, this slide shows that since 2007, Travelers has managed to compound its dividend at an annual rate of 9.1%. In addition, the company has paid uninterrupted cash dividends to shareholders for a staggering 148 consecutive years. That puts Travelers in a league of its own in terms of dividend history, and we see the company’s track record, as well as a current appetite for returning cash to shareholders as a sizable positive for owning the stock.

After what was a favorable Q1 report, our estimate for this year’s earnings-per-share is unchanged at $11.00. While this would represent a 23% gain against 2018, unusually high losses in 2017 and 2018 compressed earnings.

We expect Travelers to generate EPS of $11 this year as simply a rebound to more normalized earnings, and 20%+ gains in earnings will not be the norm moving forward.

Growth Prospects

We forecast 6% annual earnings-per-share growth on a long-term basis for Travelers following the rebound in earnings for 2019. Should Travelers hit our estimate of $11 in earnings-per-share for this year, its compound annual growth rate for the past decade will be just under 6%.

As mentioned, 2017 and 2018 were extraordinary years for losses, so that has unusually crimped the company’s earnings. We see a return to more normalized growth coming.

Growth will accrue primarily from higher underwritten premiums, which will then drive a small measure of margin expansion, as well as buyback activity. We expect revenue growth in a range of the low to mid-single digits annually, as it was in Q1 with a 3% gain in net underwritten premiums. This is fairly standard for Travelers and we have no reason to think this won’t continue.

Margins will be subject to losses on the company’s policies, as well as its net investment income. Catastrophe losses, as mentioned, caused sizable declines in profitability in 2017 and 2018 relative to “normal” years and that, unfortunately, can happen at any time for an insurer.

This is a risk that must be accounted for in the valuation given that earnings can experience significant volatility without warning, and we feel that risk is not priced in today.

Finally, the buyback should continue to provide a low single-digit tailwind to total returns, as it has for so many years.

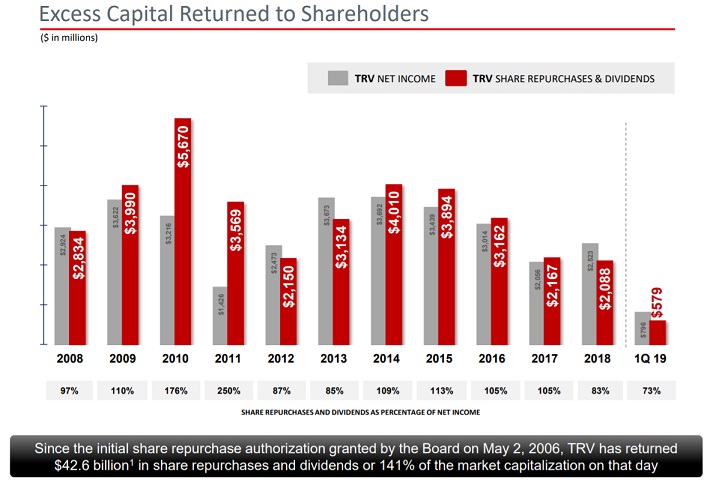

(Click on image to enlarge)

Source: Investor presentation, page 9

Travelers has a very long history of returning capital to shareholders via dividends and buybacks, and it has reduced its float by half in the past decade. Very few companies have achieved share repurchase success like Travelers has over the years.

As the company continues to allocate cash towards share repurchases, we expect that will continue. We note, however, that buybacks made at 165% of book value and ~125% of our fair value estimate based upon earnings likely aren’t the best use of capital.

We expect the dividend to continue to rise in the high single digits moving forward, improving upon the current yield that is just over 2%.

Valuation & Expected Returns

The current share price of $153 is 13.9 times our estimate of $11 in earnings-per-share for this year. That is well in excess of historical valuations for Travelers, as this was bested only by earnings multiples in 2017 and 2018, which were the result of depressed earnings.

We think fair value is 11 times earnings, implying a meaningful 4% to 5% headwind to total annual returns in the coming years from a valuation that looks more than full. Indeed, the stock’s price-to-earnings ratio and price-to-book-value both suggest Travelers is quite overvalued today.

The valuation headwind will be more than offset by 6% earnings growth and the current ~2% dividend yield, but overall, we see just 3% to 4% total annual returns in the coming years. This puts Travelers near the bottom of our coverage universe in terms of projected total returns, and we are unable to recommend it at this time due to this.

Despite the fact that we see low projected total returns, Travelers is relatively recession-resistant. Its earnings-per-share before, during and after the Great Recession are below:

- 2007 earnings-per-share of $6.72

- 2008 earnings-per-share of $5.24 (22% decrease)

- 2009 earnings-per-share of $6.32 (21% increase)

- 2010 earnings-per-share of $6.31 (flat)

Travelers’ earnings are more dependent upon losses rather than economic conditions, although we note that during times of recession, the company’s net investment income is likely to suffer materially. Still, insurance companies are relatively defensive and Travelers is no different. We think the company’s earnings will hold up pretty well during the next downturn.

Final Thoughts

Travelers appears to be getting back on track in terms of earnings-per-share production this year after two down years. While we see a sizable rebound in earnings this year, the stock has already made a massive run in 2019 that we don’t feel is justified. The valuation of the stock has us very cautious on the company’s total returns given modest growth prospects in front of it.

We like the company’s relative recession resistance, as well as its massive capital returns. However, we note that buybacks performed at sky-high valuations are generally capital-destructive. In addition, Travelers used to be a strong-yielding income stock, but its dividend yield has been reduced to just over 2% today thanks to the higher share price.

Given all of this, we rate Travelers a sell. The company’s valuation has moved far out of our comfort zone and we don’t see how the company can grow into it. Interested investors should wait for a much lower price before initiating a position.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more