The Top 4 Stocks To Start Your Retirement Portfolio

Retirees have a different set of challenges in their investment planning, than other groups of investors. Investors in or nearing retirement might have to consider income replacement as a key component of their investment decisions. After all, retirees no longer have a regular paycheck from working to rely on.

In addition to traditional sources of retirement income such as pensions and/or Social Security, retirees can boost their income with dividend stocks. These are companies that pay shareholders regular income for owning the stock. Not all stocks pay dividends. But the consistent payments from dividend stocks can be a valuable source of income for retirees.

Image source: Pexels

High-Yield Stocks Overview

High dividend stocks are especially interesting right now, in the climate of record high stock prices and historically low interest rates. For example, the average yield of the S&P 500 Index is just 1.5% currently, a fairly unimpressive yield for investors who want to generate income from their stock portfolio.

Unfortunately, not all stocks with high dividend yields should be purchased. Some stocks have high dividend yields not because the company has increased the dividend payout, but rather because the stock price has plunged. Stock prices and dividend yields move in opposite direction–as a stock price declines, the dividend yield rises (and vice-versa).

Therefore, companies in distressed financial condition whose share prices are declining rapidly, will have a high dividend yield. But in some cases, an extremely high dividend yield is a precursor to a dividend cut or suspension, which is a bad outcome that investors want to avoid as much as possible.

The following 4 stocks to not necessary have the highest dividend yields; instead, they have a combination of high yield plus dividend safety, a strong balance sheet, and a sustainable payout. As a result, they appeal to income investors looking for quality high-yield stocks. The 4 stocks are listed below according to dividend yield, from lowest to highest.

High-Yield Retirement Stock #4: S.L. Green Realty (SLG)

- Dividend Yield: 5.1%

SL Green is an integrated Real Estate Investment Trust, otherwise known as a REIT, that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. It is Manhattan’s largest office landlord, and currently owns 96 buildings totaling 41 million square feet.

Source: Investor Presentation

In late January, SLG reported (1/27/2021) financial results for the fourth quarter of fiscal 2020. Its same-store net operating income decreased -5.9% over the prior year’s quarter and its occupancy rate dipped from 94.2% at the end of the previous quarter to 93.4%. As a result, its funds from operations (FFO) per share decreased -11% over the prior year’s quarter, from$1.75 to $1.56. In the full year, the REIT collected 97.9% of total billings for office, 80.8% of billings for retail and 94.8% of total billings.

SLG has been significantly affected by the coronavirus crisis, which has caused a recession and thus has hurt several tenants. However, SLG benefits from reliable growth in rental rates in one of the most popular commercial areas in the world, Manhattan. The REIT pursues growth by acquiring attractive properties and raising rental rates in its existing properties. It also signs multi-year contracts (7-15 years) with its tenants in order to secure reliable cash flows.

Due to the effect of the pandemic on its business, funds from operations have stumbled this year but they have remained fairly resilient. We expect SLG to grow its funds from operations per share at a 3.0% average annual rate over the next five years. This should be enough growth to sustain the dividend payout.

Thanks to its financial strength, the REIT can endure the ongoing crisis and emerge stronger whenever the pandemic subsides. It can also maintain its dividend, which is well-covered with a healthy payout ratio of 51% expected for 2020. As an example of its operational strength, SLG recently raised its dividend by 2.8%, and also announced a special dividend of $1.6967 per share due to its asset dispositions in 2020.

High-Yield Retirement Stock #3: AT&T Inc. (T)

- Dividend Yield: 7.1%

AT&T is the largest communications company in the world, operating in four distinct business units: AT&T Communications (providing mobile, broadband and video to 100 million U.S. consumers and 3 million businesses), WarnerMedia (including Turner, HBO and Warner Bros.), AT&T Latin America (offering pay-TV and wireless service to 11 countries) and Xandr (providing advertising).

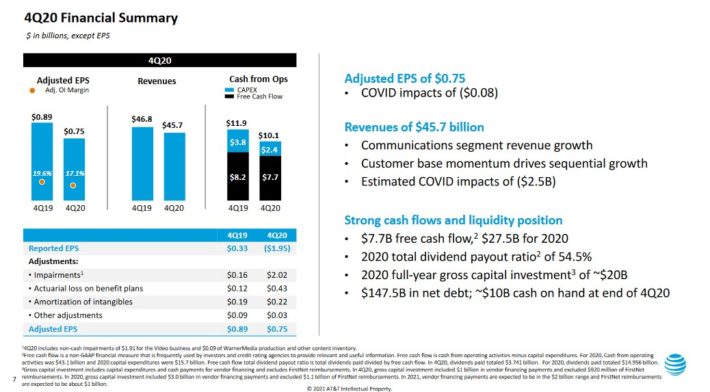

On January 27th, 2021 AT&T reported Q4 and full-year 2020 results. For the quarter, the company generated $45.7 billion in revenue, down from $46.8 billion in Q4 2019, as the COVID-19 pandemic continues to weigh on results. Reported net income equaled a loss of -$13.9 billion or -$1.95 per share due to non-cash charges. On an adjusted basis, earnings-per-share equaled $0.75 compared to $0.89 in the year-ago quarter. The $0.75 figure does not adjust for -$0.08 in COVID-19 impacts.

Source: Investor Presentation

For the year AT&T generated $171.8 billion in revenue, down from $181.2 billion in 2019. The pandemic impacted revenue across all businesses particularly, WarnerMedia and domestic wireless service revenues. On an adjusted basis earnings-per-share equaled $3.18 for 2020, versus $3.57 in 2019. This figure does not adjust for -$0.43 in COVID-19 impacts. AT&T ended the quarter with a net debt-to-EBITDA ratio of 2.70x. Recent news that AT&T may soon sell a large minority stake in DirecTV could generate additional cash to pay down debt.

AT&T also provided a full year 2021 outlook. For this year, the company anticipates 1% revenue growth, adjusted earnings-per-share to be stable with 2020 and a dividend payout ratio in the high-50% range.

Two individual growth catalysts for AT&T are 5G rollout and its recently-launched HBO Max service. AT&T continues to expand 5G to more cities around the country. AT&T’s 5G service now covers more than 120 million people.

Last year, AT&T launched streaming platform HBO Max, and has steadily grown its subscriber count. At the end of 2020, AT&T had 41 million combined HBO Max and HBO subscribers in the United States. The company recently announced it will expand HBO Max to 39 territories in Latin America in June 2021. The new platform is a critical step for AT&T to keep up in the streaming wars.

AT&T is optimistic about generating reasonable growth and the payout ratio had been falling, resulting in excess funds to divert toward paying down debt. With a long history of increasing dividends each year (AT&T is a Dividend Aristocrat) we expect the company’s dividend payout to remain secure, even in a recession.

High-Yield Retirement Stock #2: Altria Group (MO)

- Dividend Yield: 7.6%

Altria Group is a tobacco products giant. Its core tobacco business holds the flagship Marlboro cigarette brand. Altria also has non-smokable brands Skoal and Copenhagen chewing tobacco, Ste. Michelle wine, and owns a 10% investment stake in global beer giant Anheuser Busch Inbev (BUD).

Altria is a legendary dividend stock, because of its impressive history of steady increases. Altria has raised its dividend for 50 consecutive years, placing it on the very exclusive list of Dividend Kings.

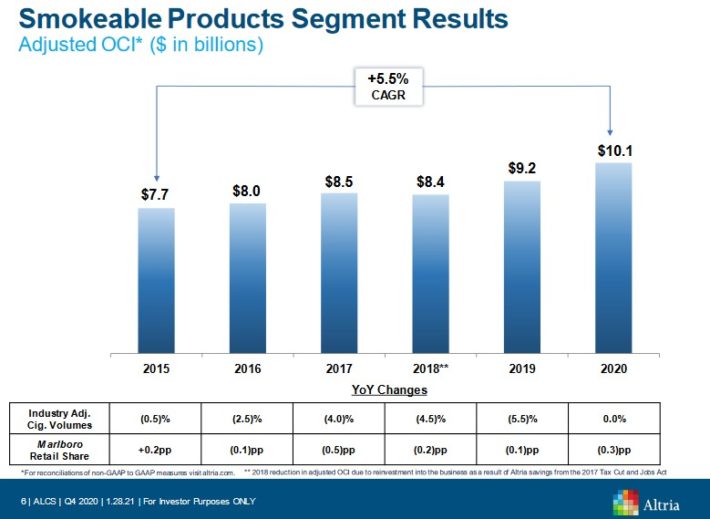

On January 28th, Altria reported financial results for the fourth quarter and full year. Revenue (net of excise taxes) of $5.05 billion increased 5.3% year-over-year. Cigarette volumes surprisingly increased 3.1% for the quarter, reversing many quarters of volume declines. Adjusted earnings-per-share declined 2% for the fourth quarter.

For the full year, revenue net of excise taxes increased 5.3% to $20.84 billion, while adjusted earnings-per-share increased 3.6% to $4.36 for 2020. The core smokeable products segment grew operating income by 10% for the year.

Source: Investor Presentation

For 2021, Altria expects adjusted diluted EPS in a range of $4.49 to $4.62, representing a growth rate of 3% to 6% from 2020.

Altria’s key challenge going forward will be to generate growth in an era of falling smoking rates. Consumers are increasingly giving up traditional cigarettes, which on the surface poses an existential threat to tobacco manufacturers.

For this reason, Altria has made significant investments in new categories, highlighted by the $13 billion purchase of a 35% stake in e-vapor giant JUUL. This acquisition gives Altria exposure to a high-growth category that is actively contributing to the decline in traditional cigarettes. The long-term future is cloudy for cigarette manufacturers such as Altria, which is why the company has invested heavily in adjacent categories to fuel its future growth.

Altria also recently announced a $1.8 billion investment in Canadian marijuana producer Cronos Group. Altria purchased a 45% equity stake in the company, as well as a warrant to acquire an additional 10% ownership interest in Cronos Group at a price of C$19.00 per share, exercisable over four years from the closing date.

Altria enjoys significant competitive advantages. It operates in a highly regulated industry, which significantly reduces the threat of new competitors entering the market. And, Altria’s products enjoy tremendous brand loyalty, as Marlboro controls more than 40% of U.S. retail market share.

Altria is also highly resistant to recessions. Cigarette and alcohol sales fare very well during recessions, which keeps Altria’s strong profitability and dividend growth intact. With a target dividend payout of 80%, Altria’s dividend is secure.

High-Yield Retirement Stock #1: Enterprise Products Partners (EPD)

- Distribution Yield: 8.2%

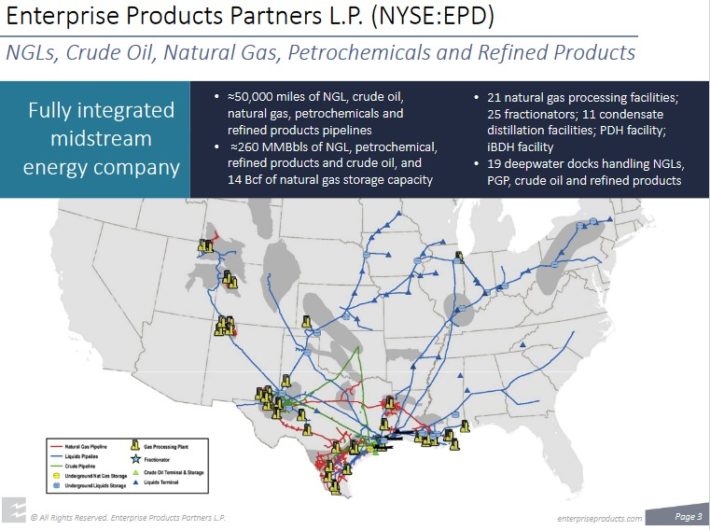

Enterprise Products Partners is a midstream Master Limited Partnership, otherwise known as an MLP. Enterprise Products has a tremendous asset base which consists of nearly 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines. It also has storage capacity of more than 250 million barrels.

These assets collect fees based on materials transported and stored.

Source: Investor Presentation

In early February (2/3/21), Enterprise Products reported fourth-quarter and full-year 2020 financial results. Fourth-quarter EBITDA increased by 1.8% year-over-year and distributable cash flow remained flat year-over-year. For the full year, adjusted EBITDA declined by 0.8% to $0.85 billion, while distributable cash flow of $6.4 billion was a 3% decline from the prior year. Enterprise Products retained $2.5 billion of excess distributable cash flow in 2020, which can be used for growth investment or to pay down debt.

Despite the weak performance in the first quarter, we believe Enterprise Products still has positive long-term growth potential moving forward, thanks to new projects and exports. Enterprise Products has benefited from higher cash flows associated with the completion of two NGL fractionators that began service during 2020.

In 2021 and 2022, Enterprise Products sees growth capital expenditures of $1.6 billion and $800 million, respectively.

In terms of safety, Enterprise Products Partners is one of the strongest midstream MLPs. It has credit ratings of BBB+ from Standard & Poor’s and Baa1 from Moody’s, which are higher ratings than most MLPs. It also had a high distribution coverage ratio of 1.7x in the third quarter.

Another attractive aspect of Enterprise Products is that it is a recession-resistant company. Enterprise Products’ high-quality assets generate strong cash flow, even in recessions. As a result, Enterprise Products has been able to raise its distribution to unitholders for 22 consecutive years.

Enterprise Products has a high credit rating of BBB+ which separates it from most other MLPs. In addition, it has world-class assets and a very long history of distribution increases.

Final Thoughts

High yield stocks are attractive for investors, particularly retirees, due to their higher income payouts. But investors need to research each individual stock before buying, to make sure the dividend payout is sustainable. This is especially true in an uncertain economic climate. Many high-yield stocks cut or suspended their dividends in 2020 due to the coronavirus pandemic.

The 4 stocks in this article all have leadership positions in their respective industries, along with durable competitive advantages. They also have strong earnings to support their hefty dividends, which will help secure the dividend even in an economic downturn. As a result, these are top stocks for investors to start their retirement portfolios.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more