The Top 3 Major Book Publishing Stocks Today

The book publishing industry is undergoing rapid changes: The business model that remained relatively unchanged for decades is moving towards new technologies such as e-books rapidly.

Not only is the nature of the products is changing, but distribution channels are also shifting: Traditional book stores are increasingly closing down, whereas sales of books via e-commerce platforms are growing. Amazon, which started out as an online book store and expanded into many other product categories since, is the biggest online book seller. Amazon is not only selling books; the company has also moved into publishing books itself – for Amazon this is a relatively small business, but it infringes on the traditional business of publishers like Random House.

Despite these factors the publishing industry is not troubled beyond relief. There are still several positives: NPD reports that physical book sales rose by 1.9% during 2017, so even in this segment there is some growth that publishers can benefit from. The global book publishing market is also forecasted to continue to grow over the next couple of years, supposedly hitting $123 billion by 2020.

In this article we will look at the three biggest publicly traded book publishing companies: Scholastic (SCHL), John Wiley & Sons (JW.A), and Pearson plc (PSO), the parent company of Random House.

They are ranked by estimated total returns over the coming five years in this article, and more data on each company is available through the Sure Analysis research database.

Book Publishing Stock #3: Scholastic (SCHL)

Scholastic is the smallest company among the three we will look at in this article; its market capitalization is $1.5 billion. Scholastic, which publishes children’s books, teaching material and magazines, was founded in 1920 and is headquartered in New York, NY.

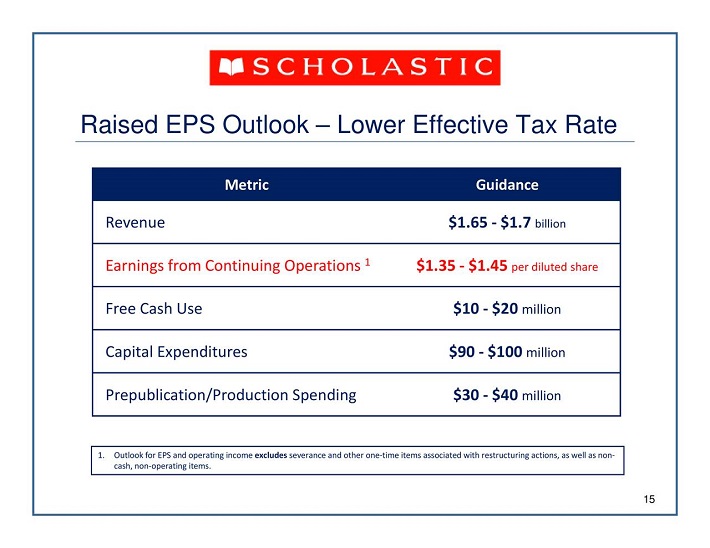

Scholastic has been able to grow its revenues at a low-single digits pace in recent quarters (sales were up by 3% in the last reported quarter), but Scholastic was not profitable during all of these quarters. Due to the high amount of children book sales (which make up ~60% of the company’s revenues) total revenues are relatively seasonal throughout the year, depending on holidays in the quarter, and they are also impacted by the timing of new book releases from its most attractive series. During the most recent quarter Scholastic had to report a small net loss ($0.30 per share), but the company is nevertheless forecasting relatively solid profitability for the whole year.

Source: Scholastic Investor Presentation

Scholastic forecasts profits of $1.40 per share for the current fiscal year, which would mean a decline from $1.83 in 2017. Scholastic’s profitability has seen ups and downs throughout the last decade, in total profits are currently slightly higher than they were in 2009 (earnings of $1.24 per share).

We forecast that profitability will increase substantially over the coming years, though, due to several positives: The first one is the strong line-up of brands & content in the children’s book segment, where Scholastic arguably holds the number one franchise, Harry Potter. The original series has finished about ten years ago, but new stories in the franchise, such as Harry Potter And The Cursed Child or Fantastic Beasts & Where To Find Them will continue to drive sales for Scholastic. Scholastic also publishes other successful series such as I Survived and Dog Man.

Scholastic’s Education segment has generated low-single digits revenue growth in recent quarters, which should be possible in future years as well, the company recently has invested into its salesforce to keep its positive sales momentum intact and to capitalize on market opportunities. Scholastic’s International segment has produced the highest growth rates in the recent past, during the last quarter sales increased by 8%. This is not surprising, as the overall book market is growing at higher rates in many of the countries Scholastic targets compared to the US. Due to strong growth rates primarily in Asia the International segment could be turned around, producing a small operating profit during the most recent quarter, compared to operating losses in the previous year’s quarter.

In total revenues should grow by a low- to mid-single digits pace annually going forward, but earnings will likely grow even faster, thanks to the impact of cost controls (the company targets paper & printing spend, freight costs, etc.) that should help make the company profitable on a consistent basis. On top of that Scholastic buys back about 3% of its shares annually at the current pace of repurchases, which boosts earnings per share growth by ~3% as well.

Scholastic has a very strong balance sheet, debt totals just $8 million, whereas the company holds about $360 million in cash and equivalents. The high net-cash position (relative to the company’s size) will allow Scholastic to continue with investments into technology while also keeping shareholder returns via dividends and share repurchases at a high level. Due to its exposure to consumer spending (thanks to a high portion of children’s book sales) Scholastic was hurt during the last financial crisis, profits were roughly cut in half. In a major recession the impact on Scholastic would most likely be severe, again.

Scholastic’s shares are, unfortunately, trading at a very high valuation: Despite profits declining during 2018, shares have risen more than 30% from their 52-week low, at a share price of $44 shares trade at ~31 times this year’s earnings. This is a huge premium over the broad market’s valuation as well as relative to Scholastic’s valuation in the past. Multiple normalization (we forecast that shares will trade at 19 times earnings by 2023) will be a major headwind for total returns over the coming years.

Through a combination of earnings per share growth (13%-14% annually), price-to-earnings ratio compression (-10% annual impact on total returns) and a dividend that yields 1.4%, we forecast annual total returns of 4%-5% for Scholastic through 2023.

Book Publishing Stock #2: Pearson plc (PSO)

Pearson plc is the biggest book publishing company in the world, with annual sales of ~$6 billion and a market capitalization of $8.9 billion. Pearson is headquartered in London, United Kingdom, the company was founded in 1944. Pearson is active in consumer publishing, education content and business information markets.

Like those of many other British companies, Pearson’s quarterly updates do not contain as much information as what we are used to from US based companies, but Pearson stated that its revenues grew by 1% during the first quarter, and the company had previously issued guidance for earnings of $0.65 to $0.70 per share during 2018.

Source: Pearson Investor Presentation

When we look at Pearson’s results during 2017, we see that most things moved into the wrong direction – underlying revenues were down slightly, operating profits and earnings per share declined by close to 10%, each. Strong cash generation and lower debt levels were positives, but declining profits – a trend that has been intact since 2011 – remain the main problem for Pearson.

Pearson’s performance will likely improve through the coming years, though, as the company’s sales performance is improving and since Pearson is tackling costs at the same time. Q1’s trading update, which included a sales increase of 1%, is not overwhelming at first sight, but when we take a closer look we see that the company is moving into the right direction. Sales in North America were up by 3%, sales in the Core segment (UK, Australia, and Italy) grew by an even better 6% year over year.

The Growth segment, was the only one with a negative performance (sales were down by 12% year over year), which can be explained by an unusually large order from the South African educational system during Q1 2017. Adjusted for that, the Growth segment would have generated positive top line growth as well. It therefore looks like Pearson is on a good way to generate positive revenue growth rates in the future, although the pace will likely remain in the low-single digits.

In order to stop its profits from declining further Pearson is targeting costs and has set aggressive goals: During 2018-2020 Pearson wants to cut expenses by almost $400 million, all else equal this would result in a 40% boost to Pearson’s operating income. Since there are other factors at play, though, such as inflation and lower trading profits, we forecast that profits will grow at a substantially lower pace (past cost saving programs and restructurings were less impactful than one would have guessed at first sight).

Nevertheless the cost savings program, combined with a solid revenue growth outlook, will most likely bring Pearson back on growth track in 2019, which is a major positive for shareholders, after earnings per share declined by ~40% between 2010 and 2017.

The company has cut its dividend twice throughout the last two years, which has brought down Pearson’s dividend yield to 2.0%, which, in combination with the unconvincing dividend track record, makes Pearson an unattractive income investment.

Pearson has paid down a significant amount of debt through 2017, lowering its long term debt position from $1.4 billion to $600 million. This is an opportune move during times of rising interest rates, and the lower interest expenses Pearson will endure going forward will be a positive for its profitability in the long run.

Pearson’s valuation is significantly lower than that of Scholastic, Pearson trades at ~17 times this year’s expected earnings. Relative to its historic valuation this is a small premium, but the headwind to total returns will be a lot less severe than what we have seen at Scholastic.

Through a combination of annual earnings per share growth of 5%-6%, multiple compression (that will negatively affect Pearson’s total returns by 1%-2% annually) and a dividend that yields 2.0% Pearson’s shares will deliver total returns of ~6% annually through the next five years.

Book Publishing Stock #1: John Wiley & Sons (JW.A)

John Wiley & Sons is a publishing company with a strong focus on the professional & scientific community, its products include research journals (scientific, technical, medical & scholarly), reference books, manuals, databases, scientific and education books, test preparation services, etc.

The company also offers services such as development and assessment services for businesses and services for higher education institutions. John Wiley & Sons was founded in 1807, the Hoboken-based company is currently valued at $3.7 billion.

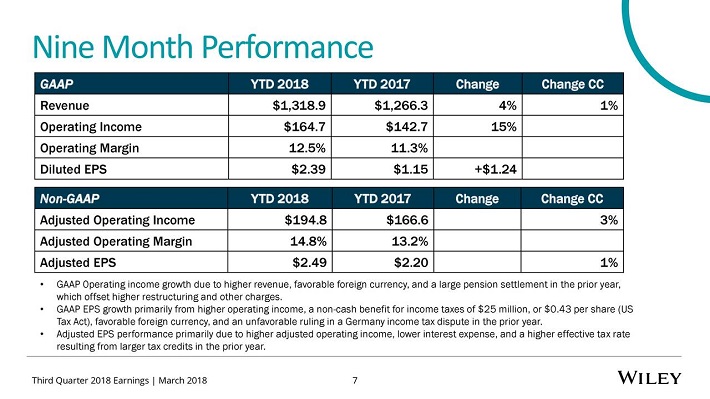

Source: John-Wiley & Sons Investor Presentation

The company recorded solid revenue growth during the first three quarters of fiscal 2018, with revenues, operating earnings and earnings per share growing at a solid pace. John-Wiley & Sons’ results were positively impacted by currency rate changes, though, at constant forex rates its results would have been weaker.

Nevertheless John Wiley & Sons has the best growth track record of the book publishers featured in this article, its earnings per share have grown by 8% annually over the last three years, and profitability is substantially higher than it was ten years ago.

John Wiley & Sons’ business model – offering publishing and other services to the professional and scientific community – is less cyclical, less seasonal and less vulnerable to competition than the more consumer-oriented business models of Pearson & Scholastic. John Wiley & Sons generates a significant portion of its revenues from journal subscriptions, which means that about 40% of John Wiley & Sons’ top line comes from recurring revenues.

John Wiley & Sons delivers about 70% of its products in digital form, the company therefore is among the leaders in reshaping its business model towards the digital age. With most of the transformation completed, investments into digitalization will slow down in the future, which bodes well for John Wiley & Sons’ margins. Through a combination of revenue growth, incremental margin improvement and some share repurchases John Wiley & Sons should be able to grow its earnings per share at a relatively attractive pace of 6%-7% annually going forward.

John Wiley & Sons pays a dividend that yields 2.0%, the dividend was grown by 10% annually throughout the last decade. More recently the dividend growth rate has slowed down, though, as John Wiley & Sons has been investing heavily into digitalization. Going forward the dividend will likely grow relatively in line with the company’s earnings.

John Wiley & Sons’ balance sheet looks healthy, despite a liabilities to assets ratio of ~60% the company has strong interest coverage, earning 14 times its annual interest expenses during 2017.

Shares of the company are trading at roughly 18 times this year’s earnings, which is not a high valuation per se, but slightly more than John Wiley & Sons’ historic valuation. We see the company’s multiple decline to 17 over the coming years, which results in a small headwind to total returns going forward.

We forecast that shares of the company will provide the highest total returns among the three companies covered in this article, at ~7% annually, through a combination of earnings per share growth (6%-7%), dividends (2%), partially offset by multiple contraction (~1.5% annual headwind).

Due to offering the highest total returns, combined with the best growth track record and the lowest cyclicality, John Wiley & Sons looks like the best publishing company right now.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more