The Top 3 Furniture Stocks You Can Invest In Right Now

The U.S. housing industry is one of the most important sectors of the economy, because of its impact on many other industries, and also because the health of the housing market is often seen as an indicator for the broader economy.

One sub-sector of the very large home industry that investors should pay attention to is the furniture industry, which offers some promising companies that investors can put their money into.

These companies are less cyclical compared to home builders, as furnishings and fixtures are not only needed for newly built houses but also in already existing homes.

New furniture is purchased as replacements when buildings are sold to new owners. Even when there is no sale of the property, owners, and renters regularly upgrade their furniture.

This results in strong profits and cash flow for the top furniture stocks, which return cash to shareholders in the form of dividends.

You can see the entire list of consumer-cyclical dividend stocks here.

The furniture industry is not a high-growth industry, but the following three companies could offer attractive total returns through earnings growth, dividends, and low valuations.

Furniture Stock #1: Leggett & Platt (LEG)

Leggett & Platt is an engineered products company whose product portfolio includes furniture and bedding components, as well as other products such as store fixtures.

Leggett & Platt has been founded in 1883, and due to raising its dividend annually for 47 years in a row the company is a Dividend Aristocrat.

Leggett & Platt is currently trading with a market capitalization of $5.7 billion. Leggett & Platt increased its exposure to the bedding components industry by acquiring Elite Comfort Solutions (ECS) in January 2019 for $1.25 billion.

(Click on image to enlarge)

Source: Leggett & Platt presentation

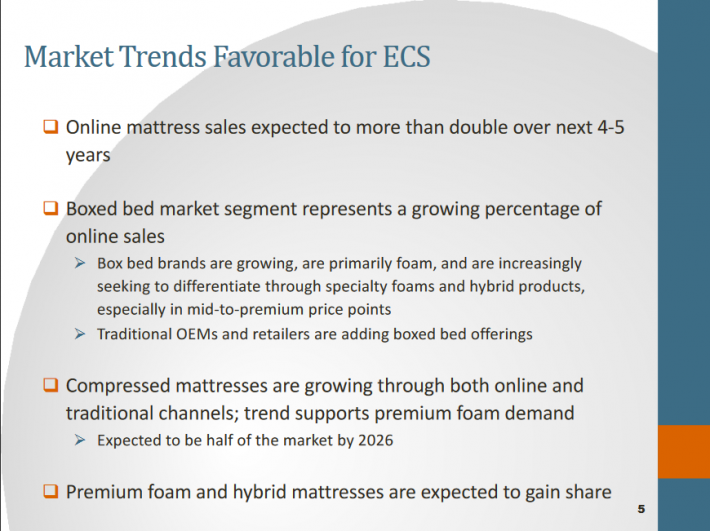

Elite Comfort Solutions is a premium bedding and bedding components company that will benefit from rising spending on premium mattresses over the coming years.

The deal will significantly expand Leggett & Platt’s exposure to specialty foam and other hybrid bed products. The acquisition is expected to be accretive to earnings starting in 2020.

The ECS acquisition is the primary reason for Leggett & Platt’s high forecasted revenue growth rate of 16% to 19% for fiscal 2019. Synergies and cost savings that will be captured over the coming years will positively impact Leggett & Platt’s bottom line going forward as well.

Leggett & Platt scores well across many safety metrics. It has a strong balance sheet, with a trailing debt-to-adjusted EBITDA ratio of 2.3x, which indicates a manageable level of debt.

And, Leggett & Platt has durable competitive advantages, which add to its safety. The company has more than 125 manufacturing facilities around the world, which provides valuable economies of scale.

Leggett & Platt also has an expansive intellectual property portfolio, consisting of 1,500 issued patents and nearly 1,000 registered trademarks.

Leggett & Platt forecasts earnings-per-share of $2.55 for fiscal 2019, which means that shares are trading at roughly 17 times this year’s net profits right now.

This represents a discount relative to how Leggett & Platt used to be valued, but not a very large one – multiple expansion towards an 18 times earnings multiple would still add about 1% to the company’s total returns annually over the coming five years.

The combination of forecasted multiple expansion expected earnings growth of 6% annually and the 3.5% dividend yield, total expected returns could exceed 10% per year over the next five years.

Furniture Stock #2: HNI Corporation (HNI)

HNI Corporation was founded in 1944, since then the furniture manufacturer has turned into a company that is valued at $1.6 billion and that generates more than $2 billion in annual revenues.

HNI Corporation is primarily active in the hearth products market and in the office furniture market.

(Click on image to enlarge)

Source: HNI presentation

HNI management states that the outlook for the office furniture segment, which provides the majority of the company’s revenues, is positive due to rising employment and shortening refresh cycles for existing office furniture.

The long-term outlook is also positive for the company’s hearth products segment, which benefits from rising spending on remodeling existing homes.

HNI generated revenue of $600 million during the most recent quarter, up 2.4% year over year. Earnings-per-share more than doubled during Q4, compared to the prior year’s quarter.

We forecast that HNI Corporation will earn $2.70 on a per-share basis during fiscal 2019, which would represent a growth rate of 12% from fiscal 2018.

HNI stock trades at roughly 14 times this year’s expected net profits right now. This is a rather low valuation compared to how HNI’s historical average, which should result in some multiple expansion over the coming years.

If HNI’s earnings multiple expands to 18, this would add about 5% to its annual returns over the coming five years.

Together with a 3.1% dividend yield and our earnings-per-share growth rate estimate of 6% annually, we get to a total return estimate of roughly 14% annually going forward, which we deem to be highly attractive.

Furniture Stock #3: Ethan Allen Interiors (ETH)

Ethan Allen Interiors is an interior design and home furnishings company that was founded in 1932.

Ethan Allen is the smallest company of the three furnishing companies in this article, as it is valued at only $520 million right now.

(Click on image to enlarge)

Source: Ethan Allen presentation

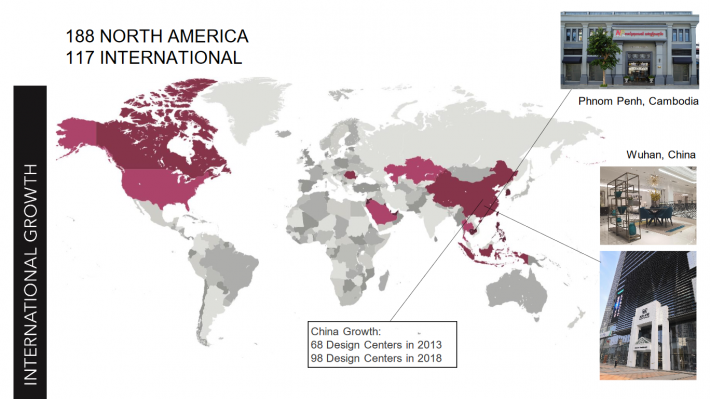

Ethan Allen generates the majority of its revenues in the U.S., but the company is growing its international business continuously. Over the last five years, it has increased its design center count by almost 50% in China, for example.

Growth prospects in countries such as China, the UAE, as well as several other Asian countries are promising, as rising disposable incomes and a growing middle class allow for growing consumer spending on higher-priced goods such as furniture.

Ethan Allen recently announced that its orders during the fiscal third quarter were up 5.5% year over year, which bodes well for the upcoming earnings results that will be announced at the end of April.

Analysts are currently forecasting earnings-per-share of $1.45 for fiscal 2019, which ends at the end of June 2019. This would represent a growth rate of roughly 7% versus 2018’s earnings-per-share of $1.35.

Ethan Allen stock is valued at 14 times this year’s expected earnings per share. Some multiple expansion towards a price to earnings multiple of 16 seems possible, which would add about 3% to the company’s annual total returns through 2024.

The stock also has a 3.9% dividend yield. With an earnings-per-share growth rate of 9% annually according to consensus analyst estimates, Ethan Allen could produce total returns of ~16% annually going forward. This gives Ethan Allen the highest expected returns among the three major furniture stocks.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more