The Top 3 Fashion Stocks For Growth & Dividends

The fashion industry is in a state of flux. Fashion trends are constantly changing and companies in this industry must adapt to the needs of consumers. Otherwise, they risk falling behind.

In addition, traditional brick-and-mortar retail stores face a separate threat in the form of Amazon (AMZN) and others in the online shopping arena. The rise in e-commerce has made it difficult for mall-based retail stores to compete.

However, the top fashion stocks have been able to withstand changing consumer habits, and continue to grow earnings-per-share, even in a very difficult environment for retail.

Investors looking for exposure to the major fashion stocks should consider the following three stocks, all of which pay dividends. You can see the entire list of consumer-cyclical dividend stocks here.

Click here to instantly download your free list of 674 dividend-paying consumer cyclical stocks, along with important investing metrics like price-to-earnings ratios and dividend yields.

This article will discuss three of the top fashion stocks, including clothing retailers and fashion product manufacturers. The analysis will focus on the business models, growth outlooks, and total expected returns of the top fashion stocks.

Fashion Stock #3: The Gap Inc. (GPS)

Gap Inc. is a clothing and accessories retailer with operations around the world.

The company operates 6 distinct business segments: Gap, Banana Republic, Old Navy, Intermix, Hill City and Athleta. The Gap was founded in 1982 and has a market cap of $9.8 billion, with annual revenue of nearly $17 billion.

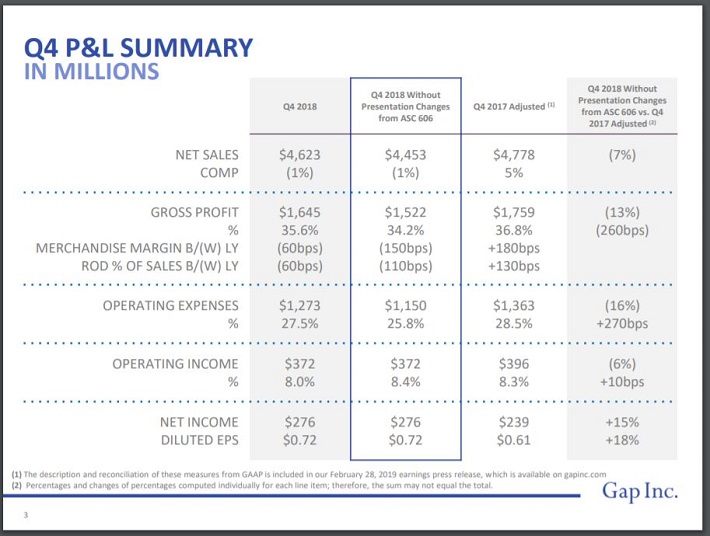

The Gap released fourth quarter and fiscal 2018 financial results on 2/28/2019.

Source: Earnings Slides

The company earned $0.72 per share for the fourth quarter, $0.03 per share above analyst estimates and an increase of 18% from the same quarter the previous year. Revenue declined 3.2% to $4.62 billion and missed analyst estimates by $66 million.

Comparable sales in the fourth quarter were down 1% overall and faced a difficult comparison. The prior-year period saw a 5% increase. Comparable sales for Old Navy were flat while Gap Global declined 5%. Comparable sales for the Banana Republic declined 1%.

Comparable sales were also flat for the year. In 2018, Old Navy increased comparable sales by 3%, while the Banana Republic saw a 1% increase. However, Gap posted a 5% comparable sales decline for the year.

For 2018, earnings-per-share improved 21% to $2.59 and revenue grew 4.6% to $16.6 billion. The Gap expects earnings-per-share to decline 3.1% to $2.51 in fiscal 2019.

The company will be spinning off its Old Navy brand, which accounts for 40% of sales, into a standalone entity. The Gap also expects to close nearly 230 stores over the next two years, which will reduce annual sales by $625 million and result in pretax expenses of at least $250 million.

The Gap’s earnings-per-share history has been quite erratic and the company has had difficulty sustaining growth from year to year over the last decade. Still, earnings-per-share increased an annual rate of 5.1% from 2009 to 2018.

Much of this growth can be attributed to the reduction in share count. In fact, The Gap has reduced its share count by 5.7% per year over the last decade.

While The Gap still plans to buy back $200 million in shares in the fiscal year 2019, this likely won’t be enough to help post positive earnings-per-share growth for the upcoming year.

Taking into account a lower reduction in share count, the Old Navy spin-off and the cost of stores, we expect that The Gap will achieve earnings-per-share growth of just 1.4% annually through 2024.

The Gap has paid its shareholders a dividend every year since 1989. The company did pause its dividend growth in 2016 and 2017 but has a 10-year CAGR of 11%.

Based on expected dividends-per-share of $0.97 and our earnings-per-share projections for 2019, the current payout ratio is 39%. The stock currently yields 3.8%, well above the 1.9% average yield of the S&P 500.

From a valuation perspective, using our expected earnings-per-share for 2019 of $2.51, the price-to-earnings ratio is 10.3. This is roughly half the average price-to-earnings ratio of 21.7 for the S&P 500.

Due to the volatility in growth over the last decade and the spin-off of Old Navy, we expect shares of The Gap to trade at 11x earnings-per-share, below its historical valuation of 12.7x earnings-per-share, sometime in the next five years.

If the valuation were to expand to meet this target by 2024, then investors would see an additional 1.3% added to total expected returns over this time period.

In total, we estimate that The Gap can offer a total annual return of 6.5% over the next five years. This is a modest, albeit unspectacular, expected rate of return.

The Gap is a satisfactory holding for income investors due to its high dividend yield, but the total returns are not likely to impress.

Fashion Stock #2: Foot Locker Inc. (FL)

Foot Locker, which was originally part of the now-defunct FW Woolworth Company, became an independent company in 1988.

Foot Locker is an athletic apparel retailer which operates more than 3,200 stores in more than two dozen countries. The stock has a market capitalization of $7 billion, with company sales approaching $8 billion each year.

Unlike many other mall-based retailers, Foot Locker has performed relatively well over the past five years.

It has continued to generate impressive comparable sales growth in recent years, even with the onslaught of Amazon and other e-commerce competitors.

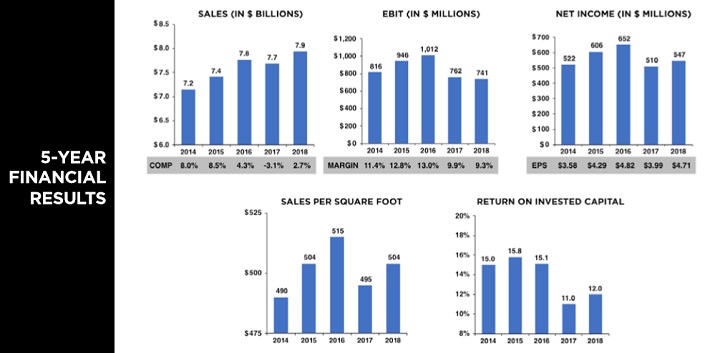

(Click on image to enlarge)

Source: Investor Presentation

Foot Locker released fourth quarter and full year results on 3/1/2019. For the quarter, earnings-per-share improved 24% to $1.56 per share. This was $0.16 ahead of estimates.

Revenue grew 2.8% to $2.3 billion, topping expectations by $93 million. Fourth-quarter comparable sales increased 9.7%, a very strong growth rate.

Earnings-per-share for the company’s fiscal year increased 18% to $4.71. Revenue grew 2% to $7.9 billion, a record since Foot Locker became an independent company. Full-year comparable sales were higher by 2.7%.

We expect Foot Locker to earn $4.95 per share in fiscal 2019, which would be a 5.1% increase from the previous year.

Foot Locker’s history has been very stable over the last decade. Only once in the last 10 years has the company failed to improve its yearly earnings-per-share total (2017). Foot Locker has improved it earnings-per-share by an average of 24% per year during this time.

Much of the company’s earnings-per-share growth is due to a 25% reduction in the share count from 2009 to 2018. Foot Locker’s net profit margin has improved from ~2% to ~7% during this time. We feel that the company can reasonably be expected to grow earnings-per-share at a rate of 5.6% per year over the next five years.

Foot Locker has increased its dividend for nine consecutive years. With one more annual increase, Foot Locker will become a member of the Dividend Achievers. You can see all of the Dividend Achievers here.

There is a very good chance the company will continue to raise its dividend. With a current per-share dividend payout of $1.38, Foot Locker has an expected dividend payout ratio of just 28% for fiscal 2019. This leaves plenty of room for future dividend hikes.

Foot Locker shares also appear to be modestly undervalued. Using expected earnings-per-share of $4.95 for the current year, the stock has a price-to-earnings ratio of 12.5.

Over the last 10 years, the company’s stock has had an average price-to-earnings ratio of 14. If shares were to be valued at this level by 2024, then shareholders would see an additional 2.3% added to annual returns over this time.

We forecast that shares of Foot Locker can provide investors with an attractive total annual return of 10.1% over the next five years.

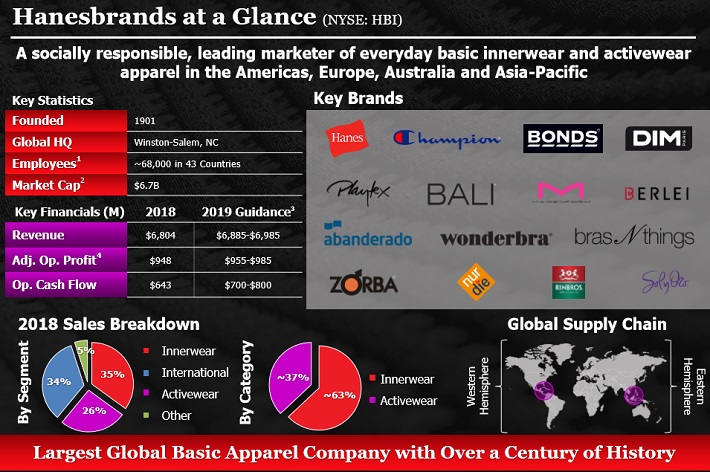

Fashion Stock #1: Hanesbrands (HBI)

Unlike the first two companies on this list, Hanesbrands does not have a physical store presence. Instead, Hanesbrands is a leading manufacturer of everyday basic innerwear and active wear. The company’s well-known brands include Hanes and Champion.

Hanesbrands sells its products in the U.S., Europe, Australia, and the Asia-Pacific region. The stock has a market cap of $6.7 billion, with annual sales of almost $7 billion.

(Click on image to enlarge)

Source: Investor Presentation

Hanesbrands reported fourth quarter and full-year results on 2/7/2019.

The company earned $0.48 per share, a 7.7% decline from the same quarter the previous year. Much of this decline was due to a higher tax rate during the most recent quarter. Revenue grew 7.5% to $1.8 billion, which was $60 million higher than expected.

Hanesbrands had 6% constant currency organic sales growth during the quarter, largely due to the activewear and international segments. Sales for the Champion brand improved 36% year-over-year.

Operating margin for the entire company improved 630 bps due in part to lower SG&A costs. Acquisitions, which Hanesbrands has spent almost $3 billion on over the past seven years, also contributed to margin expansion.

For the year, earnings-per-share declined 11.4% to $1.71 while revenue increased 5.1% to $6.8 billion. Hanesbrands is forecasted to earn $1.78 per share in 2019, which would be a 4.1% increase from the previous year.

Outside of 2018, Hanesbrands has increased its earnings-per-share every year since 2009. The company has a 10-year average earnings growth rate of 15.1% during this time.

Much of this growth occurred at the beginning of this time frame, as the average growth rate has fallen to just 3.8% since 2014. Erring on the side of caution, we believe the company can grow earnings-per-share at a rate of 3% annual through 2024.

Hanesbrands has only paid a dividend since 2013 and, up until 2018, had increased it every year. The company has maintained its current quarterly payout of $0.15 per share since the 3/7/2017 payment. Prior to this, the annual payment had quadrupled to $0.60 by 2017.

We assume no dividend increase in 2019. Using our expected earnings-per-share, the company has a dividend payout ratio of 34%. The stock currently yields 3.2%.

In addition to a solid dividend yield, Hanesbrands appears to be an undervalued stock. With expected EPS of $1.78 for fiscal 2019, the stock has a price-to-earnings multiple of 10.4.

The 10-year average price-to-earnings ratio of the stock is 12.9, which represents our estimate of fair value. Shareholders would see an additional 4.4% added to annual returns if the stock returns to its historical valuation by 2024.

In total, we believe Hanesbrands can offer annual returns of 10.6% over the next half decade, which makes it an attractive fashion stock.

Final Thoughts

While retail can be a challenging space, especially with the rise of e-commerce, the top fashion stocks can continue to thrive. The Gap, Foot Locker, and Hanesbrands offer at least a solid expected rate of return over the next five years.

Those looking for income should note that each company discussed in the article all yield above the average yield of the S&P 500. Value investors could also be enticed by the low valuations of each company.

Though earnings growth is muted for each company, total expected returns are satisfactory when factoring in dividends and positive returns through expanding valuation multiples.

As a result, each company is considered a top fashion stock.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more